Like the rest of the cryptocurrency world, Bitcoin miners have had a rough year.

Some estimates state that, through November and December 2018, as many as 100,000 individual miners have shut down operations.

The most likely reason for this is Bitcoin’s price drop over the past 12 months. Starting at nearly $20,000 USD, Bitcoin fell below $4,000 USD by November 2018. Except for a few fleeting days in December and January when prices crept above $4,000, it has stayed below that number since.

Analyzing the difficulty

Low miner network participation is one of the unfortunate ramifications of Bitcoin prices dropping and staying in this low range for an extended period of time. It is not financially viable for miners to continue mining Bitcoin below a certain profitability level. A new analysis has come to light regarding this long-held theory, and it does not bode well for the current state of Bitcoin. According to some experts, the price at which Bitcoin miners will break even is exactly $4000. [bctt tweet=”The price at which Bitcoin miners will break even is exactly $4000. Even with difficulty adjustments, the fixed hardware costs represent a floor under which BTC cannot survive. ” username=”beincrypto”] For Bitcoin miners, one of the most genius features of the Bitcoin protocol is its difficulty adjustment capability. For the most part, periodic difficulty adjustments keep Bitcoin mining within reasonable limits. It will never be too easy to mine Bitcoin, nor will it be too difficult. Both mining time and the complication of mining a Bitcoin block are monitored and adapted as necessary through difficulty adjustments. The difficulty adjustment is usually made every 2016 blocks or approximately every two weeks. Bitcoin mining difficulty is adjusted to ensure that it takes about ten minutes to mine one block on the blockchain. Bitcoin miners operate with confidence that mining time will remain at a consistent difficulty point where the randomly selected cryptographic puzzle in each block is solved and all transactions are settled in about ten minutes. This process is officially referred to as Proof of Work.

How difficult should it be?

The difficulty is adjusted primarily based on the amount of miners working the network at any given time. If more mining is taking place, blocks are solved more quickly. This means that it takes less time for blocks to be solved. When this is the case, the difficulty algorithm adjusts the cryptographic puzzle so that blockchain mining difficulty increases. Conversely, if fewer miners are on the network, it will take longer for miners to solve each block. At this point, the algorithm will decrease difficulty, and it will be easier to solve these automatically generated cryptographic puzzles. Decreasing difficulty essentially means that a smaller number of possible solutions exist, making it easier for miners to guess the correct solution. It is sort of like moving from an Expert level to a Medium level Sudoku game. Sometimes, the difficulty adjustment needs to be extreme. For example, on Dec 3, 2018, mining difficulty dropped by 15.1 percent. This was the second largest drop in history. This drop was closely followed by a nine percent drop on Dec 18, 2018. It then adjusted upward on Dec 31, 2018, with a difficulty increase of ten percent. These are big numbers, and they represent big changes in the overall Bitcoin platform.

Profitability calculations

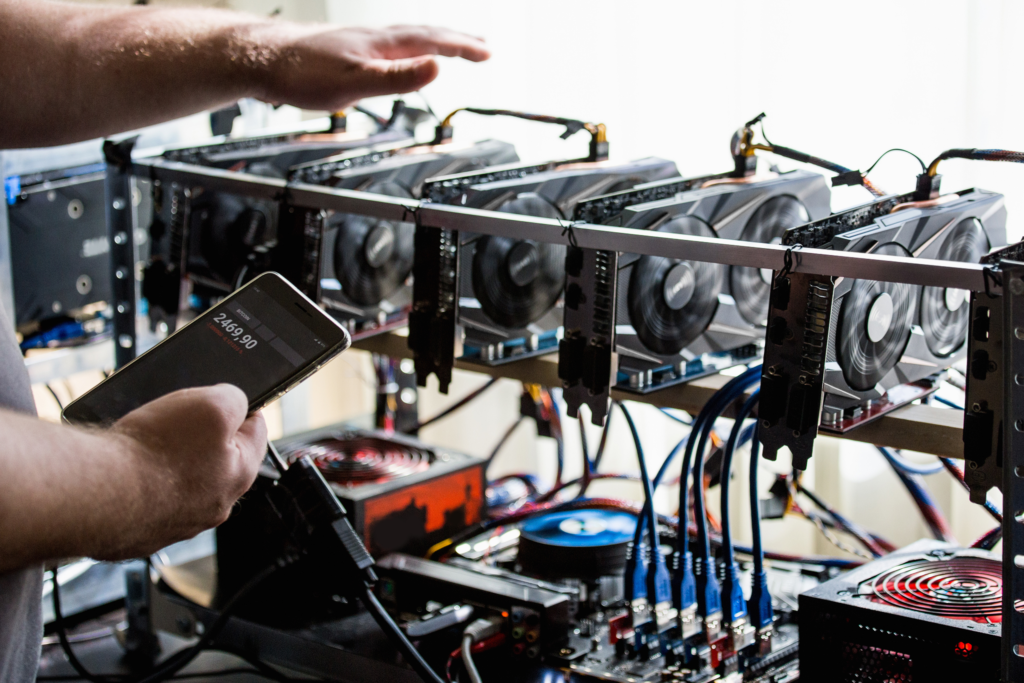

When looking at overall profitability, there are a few items that the difficulty adjustment algorithm doesn’t officially take into account. One major factor is the cost to mine Bitcoin. It takes a tremendous amount of energy to mine Bitcoin, even with ASIC hardware mining units. ASIC units are not inexpensive to maintain and replace. In fact, an often overlooked factor in the overall cost to mine Bitcoin is the ASIC unit supply chain itself. Bitcoin infrastructure engineer and blockchain experts have performed extensive analysis on the overall cost of mining Bitcoin. The conclusions reached are drawn from a thorough account of the total costs of a Bitcoin mining operation, including ASICs manufacturing costs and the entire ASIC supply chain. https://twitter.com/HassMcCook/status/1083134480708059136 The big picture of Bitcoin infrastructure provides a unique perspective on what Bitcoin is and how it relates to the world, in general, and factors into an accurate picture of ASIC supply chain costs on Bitcoin mining. Considering Bitcoin as simply another form of Energy in monetary form, the suggestion that everything on earth is Energy in one form or another leads to the conclusion that the energy required to operate a Bitcoin mining operation is synonymous with Bitcoin itself. Everything is interchangeable. Many analysts factor in the operational energy expenditure, or OPEX, of Bitcoin mining. It is impossible not to do so. ASIC mining hardware was developed to alleviate some of the energy burdens of simple CPU mining.Missing some numbers

The high energy costs of Bitcoin mining are so prohibitive that mining has long been relegated to geographic locales where electricity is cheap and there is little effect on local community utility infrastructure. What has not previously been factored in is the capital energy expenditure (CAPEX). It costs a lot of money to manufacture and ship ASIC hardware. From obtaining the basic materials to quality testing improvements to a laundry list of shipping needs, ASICs are pricey. Furthermore, ASIC hardware utility is finite. In fact, it frequently needs replacement. Every time it does, the entire process above resets. All the same metals and fossil fuels are required for production. Production costs remain the same.

True cost per bitcoin

Per this analysis, the true cost to produce a bitcoin is $4,000. This cost analysis includes the 100 megawatt hours of direct and indirect work toward producing said bitcoin. The reality that this price is in direct alignment with what the current market price of bitcoin is telling — but here is where this cost analysis model really gets interesting. The same cost model on Nov 8, 2018, right before the Bitcoin market tanked again, elicited an average mining cost of $6200. This was the market price on that date. The same model on Sep 9, 2018 yielded an average mining cost of $6450 — again, the market price of Bitcoin on that date last year. This level of consistency inspires confidence in Bitcoin’s ability to use the difficulty adjustment function to maintain itself — even during deep market downturns. It is exactly why Satoshi built difficulty algorithms into the system. The allure of decentralized, anonymous money drew some of Bitcoin’s most ardent evangelists in — but the level of comprehensive elegance found in a system like a difficulty adjustment protocol is what keeps them.

Evaluating the bottom

Based on these calculations, it seems apparent that Bitcoin has been essentially bouncing off the bottom of its price range for the past several months. While the price may have fluctuated, the ‘actual’ price with difficulty adjustments and additional costs calculated in is more or less the same for miners. Of course, the one factor that cannot fluctuate with difficulty adjustments is the hardware cost of ASIC units. This fixed cost provides a structural bottom to the market, below which the Bitcoin infrastructure would simply collapse. Think the difficulty adjustments are enough to keep Bitcoin markets moving? Or is there a potential for real systemic failure? Let us know in the comments below!

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Jon Buck

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

READ FULL BIO

Sponsored

Sponsored