Another day in the rapidly expanding world of decentralized finance brings another player to the scene, attracting yield farmers seeking big gains. Yearn Finance is the latest DeFi darling and its YFI token is gaining serious traction.

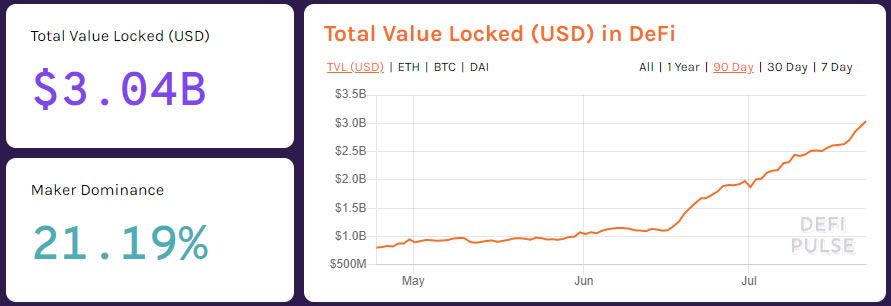

DeFi markets have hit the $3 billion in total value locked milestone. This achievement came a lot quicker than most expected, as many in the crypto industry were predicting it would only reach $2 billion in 2020.

The rapid release of new liquidity mining tokens and DeFi platforms has created a tsunami of collateral flooding into these protocols. It seems that not a day has gone by in recent weeks without a new DeFi token going parabolic, or a platform hitting a new high in terms of collateral lockup.

Even the amount of Ethereum locked in DeFi has surged to an all-time high of 3.9 million ETH, which equates to almost 3.5% of the total supply. Today’s DeFi darling is Yearn Finance as its ‘valueless’ token has been reeling in the yield farmers.

YFI Yields Hit Four-Figure APY

The latest DeFi governance token to hit the scene is Yearn’s YFI, which the issuers themselves have labeled as ‘valueless.’ To sum up the state of the embryonic industry, prices surged from the outset and $150 million in deposits were reaped. The platform describes itself as a yield aggregator for lending platforms that rebalances for the highest yield during contract interaction. Yearn Finance issued the governance token a few days ago, stating that it was used for managing the platform, and those that are ‘not interested in managing the platform should stay away’ from it. Yearn added that it has released the zero value-token to further relinquish control of the platform;We re-iterate, it has 0 financial value. There is no pre-mine, there is no sale, you cannot buy it, no, it won’t be on Uniswap, no, there won’t be an auction. We don’t have any of it.That wasn’t enough to prevent a digital gold rush as farmers loading up on the governance token, presumably to earn voting rights, but more likely to access gains of up to 1,000% per year in interest. According to Camila Russo’s latest Defiant newsletter, YFI is distributed among those who deposit funds to yEarn pools. Just like other DeFi tokens, its purpose is to encourage liquidity providers:

Three days after the token distribution started, this is exactly what they did: deposits soared by more than $150M to over $280M.

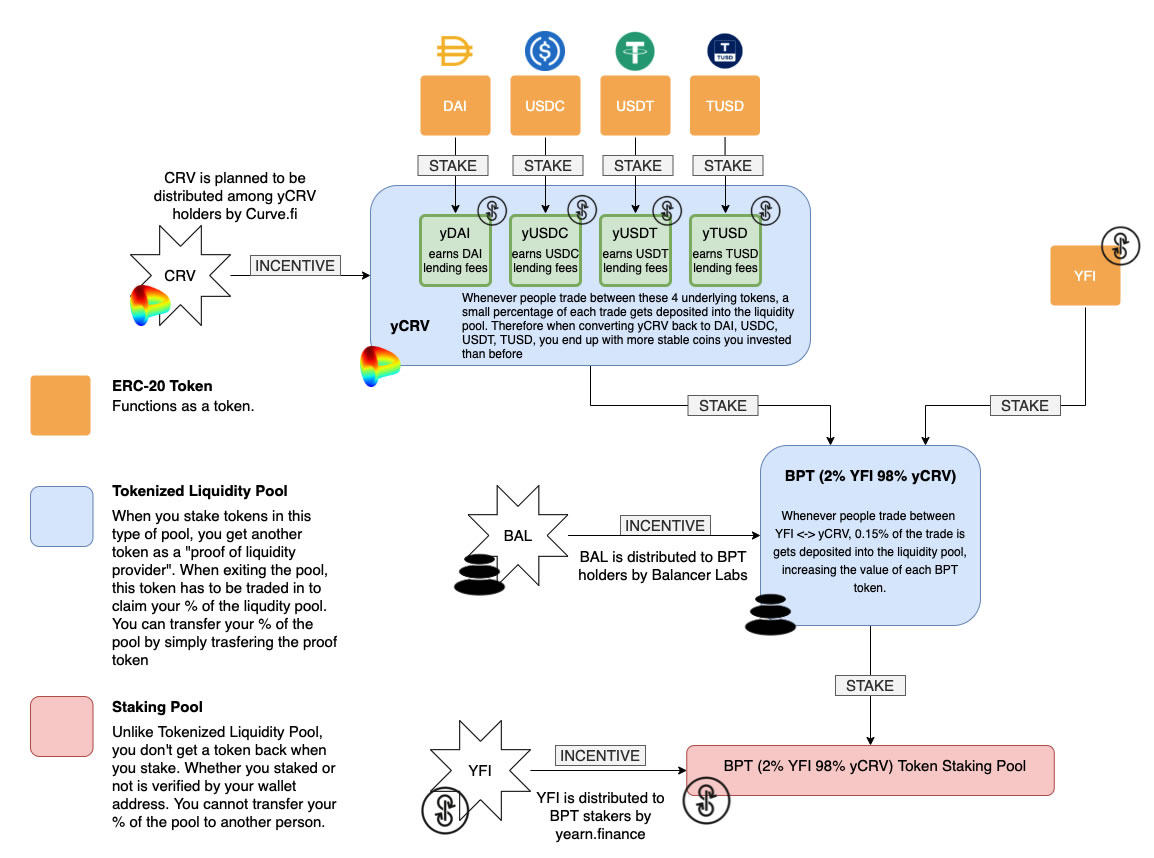

Avoiding a DeFi Disaster

In the Defiant article, penned by Cooper Turley, he pointed out that Ethereum community members were quick to point out that the control of YFI issuance still rested in the hands of yEarn founder Andre Cronje. Theoretically, using simple Solidity code, Cronje could have minted millions of tokens to drain the DAI/YFI pool which contained around $60 million at the time. Collateral on the Curve Finance protocol soon skyrocketed to over $100 million on smart contracts that underpinned YFI. This could have led to another massive DeFi exploitation if the intentions were malignant—fortunately, they were not. Yesterday, this potential fiasco was addressed by putting control of YFI tokens in a multi-signature wallet, which requires 6 out of 9 participants to agree on changes. This still appears somewhat centralized, however, with so few voters required to access the wallet. Nevertheless, Cronje admitted that he was not one of the signatories. YFI can only be earned by using the yEarn platform, and it has a total supply of just 30,000 tokens which will be distributed to stakers using the liquidity pools. At the time of writing, prices $1,140 according to Uniswap. That is one monumental surge for a ‘valueless’ token. There are four pools in total at the moment working with Curve and Balancer, which recently passed its first three governance proposals, in order to generate rewards in YFI. This multifaceted image was posted in an attempt to explain how Yearn pools operate:

At its peak price of just over $2,000/YFI, LP’s were looking at APYs north of 1,000% on any of the aforementioned pools.He added that these were short-term returns from the spike in demand. A consistent APY of four figures would be unsustainable, however, yEarn has consistently delivered annual returns of about 10% for its Yearn Finance lending pool, which autonomously floats between Compound, Aave, and dYdX based on which has the highest return at the time. Turley elaborated on governance proposals in a medium post for the project, concluding;

In case you haven’t figured it out yet, YFI is entering unchartered territory. If you’ve made it this far, you’re one of the few individuals who have figured out how to navigate down the furthest DeFi rabbit hole to date.

How High Can DeFi Fly?

The latest $3 billion milestone for the rapidly inflating DeFi ecosystem has come just twenty days after it reached $2 billion in TVL. So far this year, the DeFi space has grown by a monumental 350% in terms of how much crypto has been locked up as collateral. Naturally, this TVL figure will increase if Ethereum prices go up as it is measured in the dollar equivalent.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Martin Young

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

READ FULL BIO

Sponsored

Sponsored