Ripple (XRP) bulls have fiercely defended the $0.45 price support territory despite the industry-wide contraction in the altcoin markets. But can they consolidate into a bullish price reversal in the coming days?

After taking profits in late March and early April, Ripple’s large institutional investors appear to be making a U-turn. If other investors also interpret the negative market sentiment as a bullish signal to buy the dip, could XRP price break above $0.60?

XRP Whales Are Buying the Dip

XRP price lost the crucial $0.50 support last week. But, behind the scenes, a cluster of large investors holding 1 million to 10 million XRP coins have been buying the dip. According to on-chain data from Santiment, this price-savvy whale cohort has added 80 million coins to their wallet balances within the last two weeks.

At a current market price of $0.46, the newly added XRP coins are worth $36 million. This positive divergence between price and buying trends among whales could be a crucial indicator of an impending price rebound.

Generally, when whales keep buying during a price correction, it reaffirms confidence in the underlying technology and products built on the network. Also, considering how this specific group of whales has successfully timed price rallies in the past, it is only a matter of time before XRP enters another bullish push in price.

Ripple Market Sentiment Approaches 2-Month Low

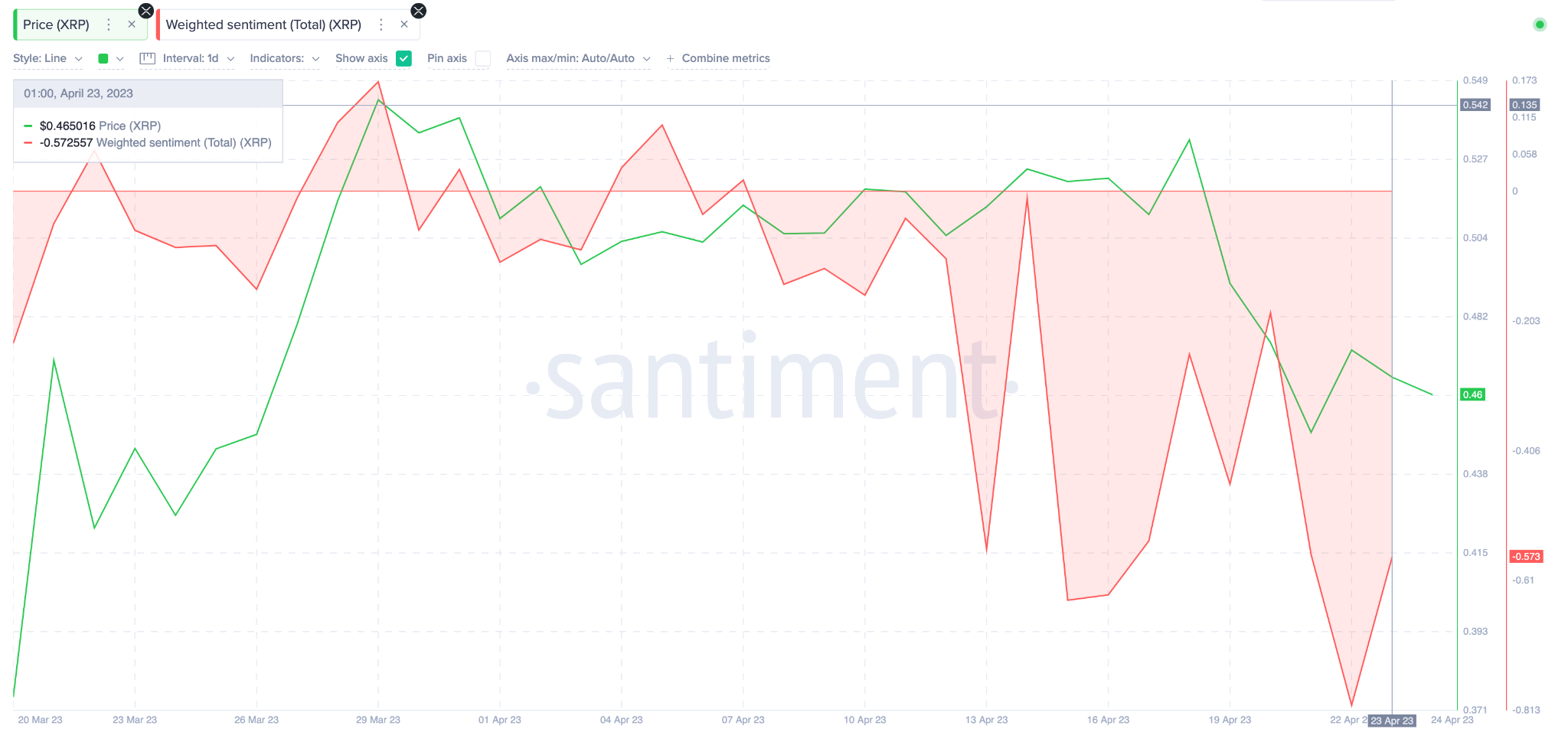

The Ripple (XRP) ecosystem devolved into euphoria in late March when news broke about a potential victory in the infamous SEC lawsuit. On-chain indicators now show that the market euphoria may be over. As of Apr. 24, XRP Weighted Sentiment sits at -0.57, after hitting its lowest low since Feb 2.

Generally, Weighted Sentiment tracks the market perception of a particular asset by comparing the ratio of positive social media mentions to negative ones. When Weighted Sentiment declines to a new local low, it typically signals an impending reversal of an ongoing bearish trend.

XRP Price Prediction: A Rebound Above $0.50 is Likely

Over the past week, bullish XRP holders have defended the $0.45 support level. But, according to on-chain data, 2022 was the last time the XRP’s Market-Value to Realized-Value (MVRV) ratio declined to the current levels. And it was promptly followed by 12% price gains in November and December 2022. Hence, this signals that an XRP price rebound may now be on the cards.

Yet, the bears could still flip the narrative if XRP price drops below $0.45. But historically, XRP investors have typically avoided incurring losses below the 10% range. Hence, their fierce bullish support could be counted on at this level.

But, should the $0.45 support level fail, XRP could further decline toward the 18% loss range at $0.41. But if this scenario plays out, the majority of the holders may stop selling and inadvertently trigger a rebound.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.