The Ripple (XRP) price is looking to rise over the next couple of days owing to the support it receives from large wallet holders.

The asset’s target is to recover the losses noted recently, which would warrant a rise to $0.54.

Ripple Finds Massive Support

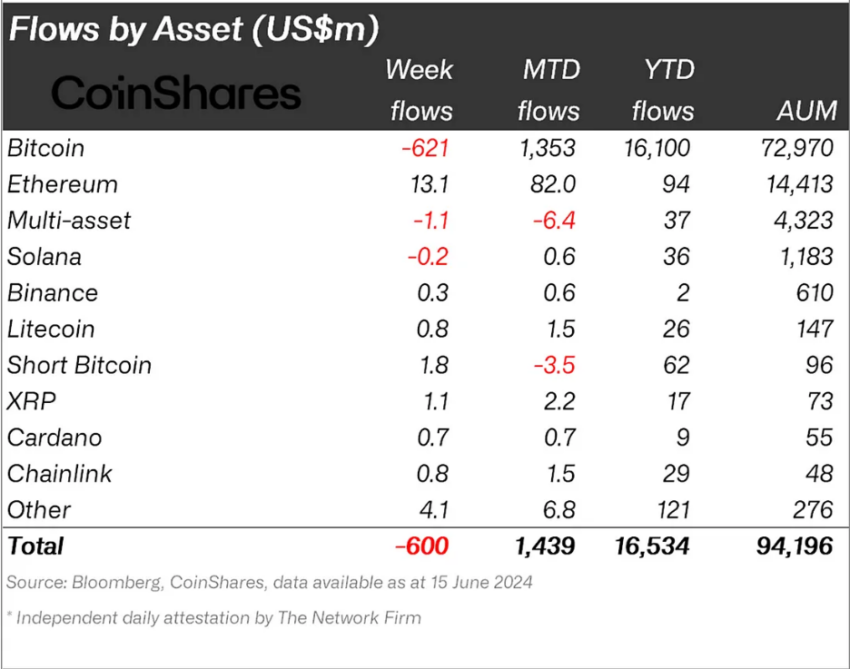

Ripple’s price rise is largely due to institutional investors. These investors have demonstrated strong confidence in XRP, pouring over $1.1 million into the cryptocurrency. This substantial investment comes even as the Federal Open Market Committee (FOMC) maintains a hawkish stance on monetary policy.

XRP noted the highest influx of funds from institutional investors, which underscores a significant vote of confidence in the altcoin’s potential. Other major tokens, such as Litecoin and Chainlink, observed inflows worth $0.8 million, with Solana noting outflows of $0.2 million.

Secondly, the Relative Strength Index (RSI) is currently positioned in the bullish zone, indicating positive momentum. The RSI, a critical technical indicator, suggests that the buying pressure outweighs the selling pressure, pointing towards a favorable outlook for XRP.

The bullish RSI reflects growing investor sentiment and suggests that the recent institutional investments may be well-placed.

Securing the neutral line at 50.0 as support would further confirm a bullish trajectory for XRP. If the indicator maintains support above this line, it would signify sustained buying interest and a potential continuation of the upward trend.

Read More: How To Buy XRP and Everything You Need To Know

This technical confirmation would bolster the confidence of both retail and institutional investors in XRP’s bullish prospects.

XRP Price Prediction: Bouncing Back From Losses

XRP price, trading at $0.51 at the time of writing, is at the cusp of breaching the 23.6% Fibonacci Retracement. This line is also known as the bear market support floor, and flipping it into support could provide XRP with some relief from further declines.

While the altcoin is on the path of recovering its recent losses, it would need to chart a rise to $0.54 in order to do so.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

But if the breach fails, it would not be surprising to see the XRP price fall back down below $0.50. The potential drawdown will also send the token down to test the support at $0.47, which will invalidate the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.