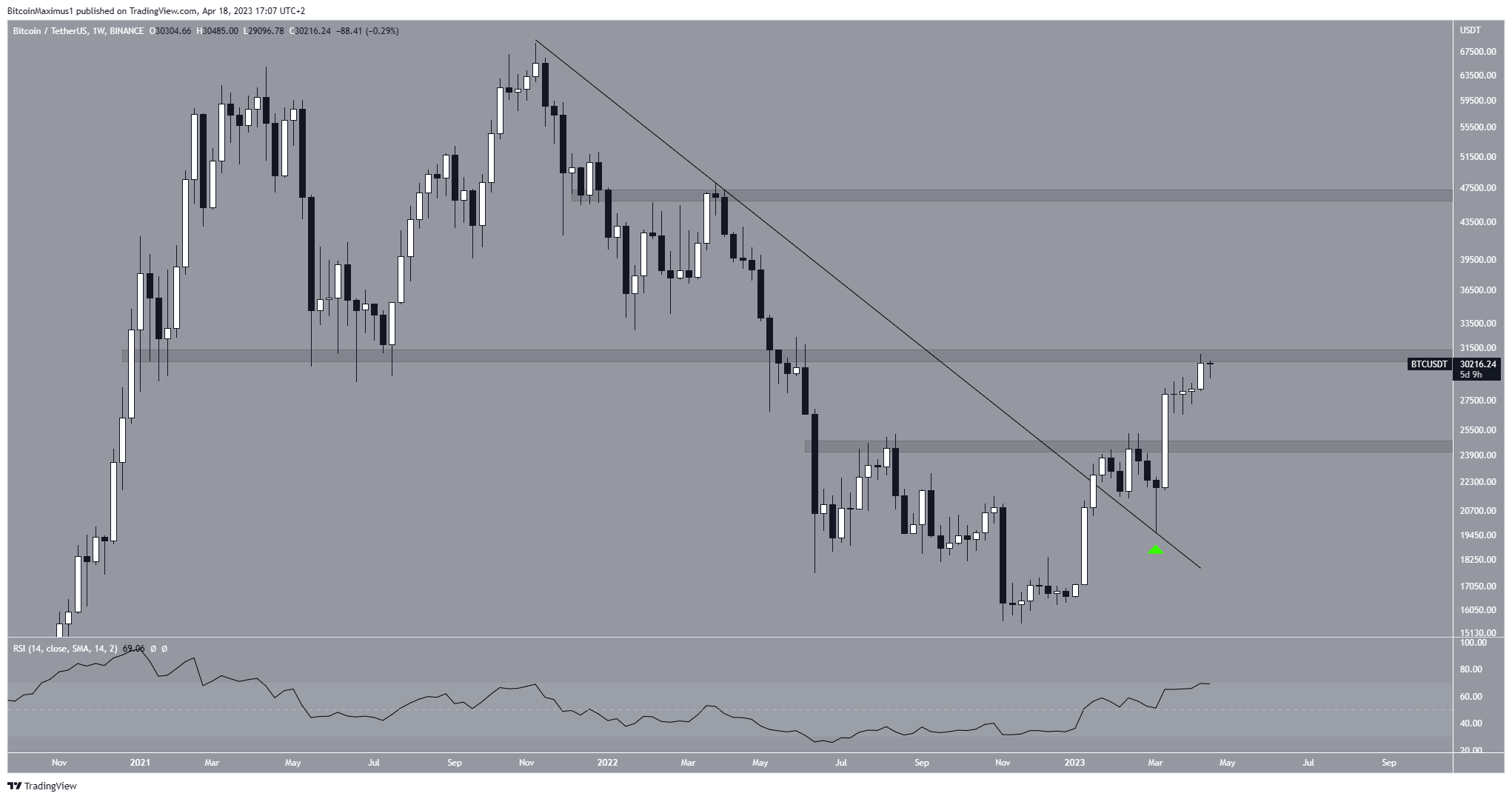

The Bitcoin (BTC) price has reached an important resistance area that had previously provided support since the beginning of 2021. Will bitcoin be able to break through this resistance or is it time for a correction?

The Bitcoin price has increased rapidly since validating its long-term resistance line as support in March. This created a long lower wick (green icon). Such wicks are considered bullish signs because sellers could not push the price down. Rather, buyers reclaimed momentum and caused the price to close higher than its weekly lows. As expected, the BTC price has increased rapidly since.

BTC Reaches Yearly High

The next week, BTC broke out from the $24,500 resistance area and has now reached the $31,000 horizontal resistance. This is a very important area since it had previously acted as support since the beginning of 2021.

The Relative Strength Index (RSI) is increasing and now sits above 50, indicating a bullish trend. The RSI is a momentum indicator used to determine overbought or oversold conditions. An upward trend and a reading above 50 suggest that bulls still have momentum.

This supports the possibility that the price will clear the $31,000 resistance area and validate it as support. If so, the next resistance would be at an average price of $46,000.

On the other hand, a rejection from the $31,000 resistance area could cause a drop to $24,500.

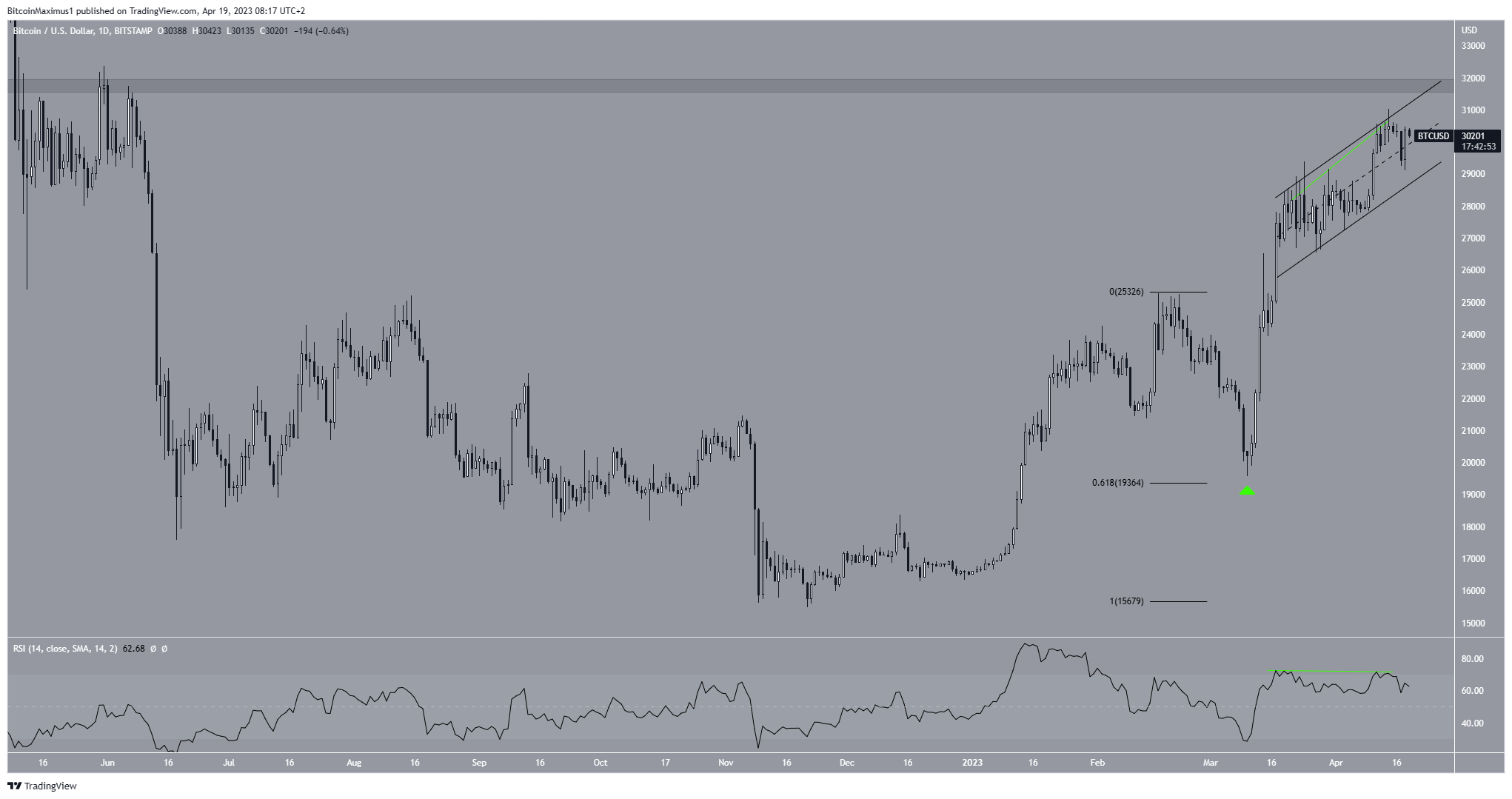

Bitcoin BTC Price Prediction: Will Price Clear $31,800?

The technical analysis from the daily time frame provides a bullish BTC price prediction. It shows that the rate of increase accelerated after the price bounced at the 0.618 Fib retracement support level on March 10 (green icon).

Fibonacci retracement levels work on the theory that after a big price move in one direction, the price will retrace or return part of the way back to a previous price level before resuming in the original direction.

Since March 16, the digital currency has traded inside an ascending parallel channel. These channels usually contain corrective structures, meaning that an eventual breakout from it would be likely. Furthermore, the daily RSI has generated bearish divergence (green line). A bearish divergence occurs when a price increase is not accompanied by a similar increase in the RSI. It signifies that momentum is waning and often precedes bearish trend reversals.

If the BTC price breaks out from the channel, it will invalidate the bearish divergence. Since that would also mean a breakout above the $31,000 resistance area, it would confirm the bull run in the process.

On April 18, BTC created a bullish engulfing candlestick. This is a type of candlestick in which the entire decrease from the previous day is negated the next day, and the price closes higher than yesterdays open. As a result, it supports the possibility that Bitcoin will break out and invalidate the bearish divergence in the process.

While a breakout from the channel could lead to the acceleration of the upward movement toward $46,000, a breakdown from it would invalidate the bullish hypothesis and could cause a drop to $24,500.

For BeInCrypto’s latest crypto market analysis, click here.