Bitcoin (BTC) price started September negatively, swinging below $26,000 again on Friday. However, a critical on-chain indicator reveals growing bullish pressure from US-based whale investors.

The US Federal Reserve is set to announce fresh Interest Rates on September 19. With the crucial monetary policy meeting now barely 10 days away, US-based institutional firms appear to be making last-minute Bitcoin (BTC) accumulation. Will this trigger a Bitcoin price rally in the coming days?

Wall Street Whales are Piling Buying Pressure on Coinbase

With the next Fed meeting fast approaching, a vital on-chain indicator shows US institutional investors have been piling up buy pressure. CryptoQuant’s Coinbase Premium Index shows the percentage difference between Bitcoin prices on Coinbase Pro and Binance spot markets.

While Binance dominates the retail spot market globally, Coinbase Pro is largely dominated by US-based institutional firms and high-net-worth traders. Hence, positive values of the Premium Index values indicate an uptick in US investors’ buying pressure on Coinbase.

The chart above shows that on Sept 7, the Coinbase Premium Index broke into positive values for the first time this month. But curiously, the last time the Coinbase index broke above 0.80 was around March 2023. And that was instantly followed by a price rally toward $30,500, a 2023 peak at the time.

It remains to be seen if the Coinbase Premium Index will continue rising. If that happens, it could shore up retail investors’ confidence and trigger a price rally ahead of the next Fed meeting.

Rising BTC Markets Liquidity Suggests Impending Trend Reversal

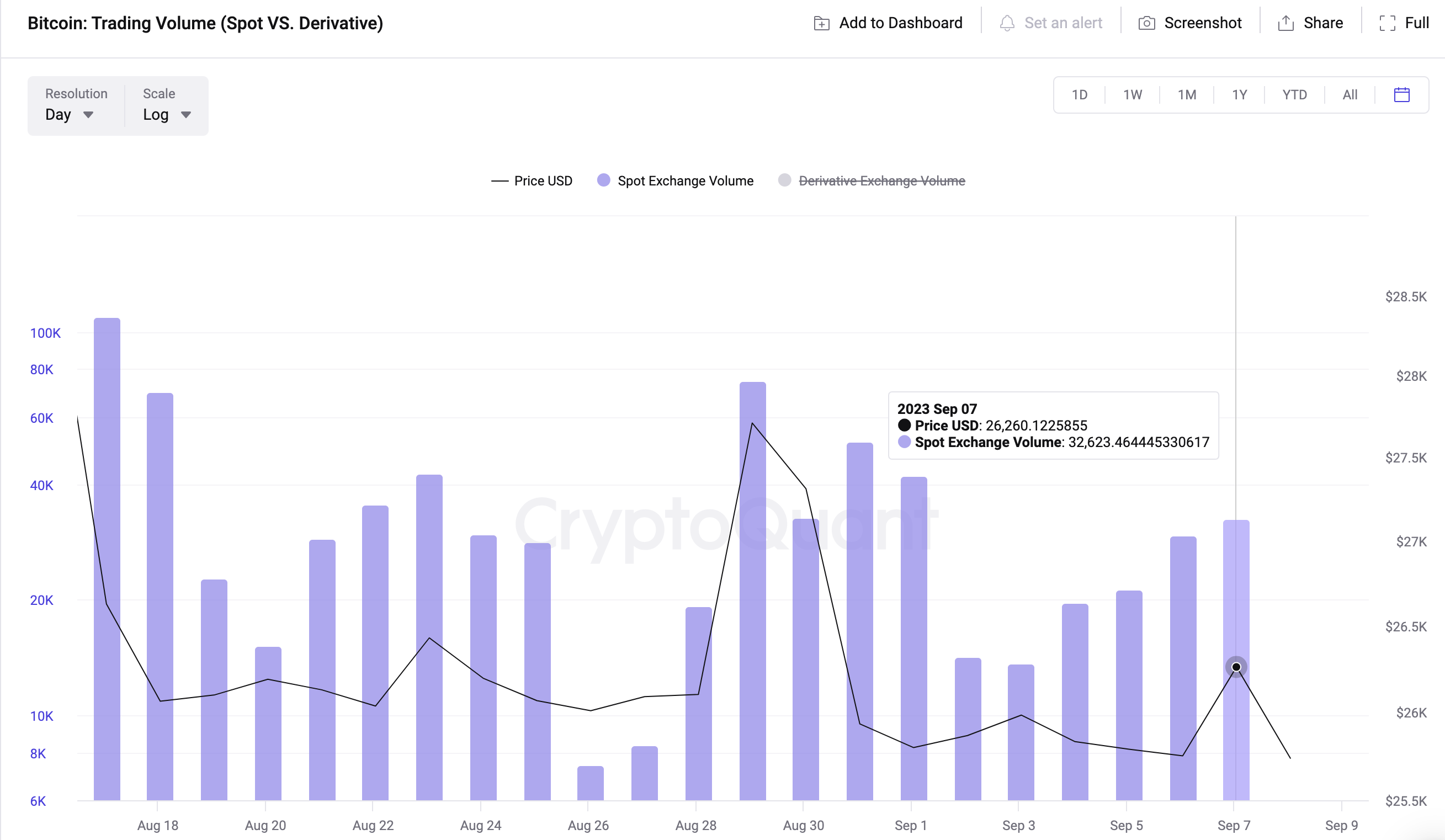

This optimistic stance is further reinforced by the liquidity pouring into Bitcoin spot markets this week. According to Cryptoquant, Bitcoin Spot Trading Volume has been rising persistently since Sept 2, nearly doubling.

In numerical terms, BTC Spot Trading Volume for Sept 2, stood at 14,230 BTC. At the close of Sept 7, an aggregate of 32,632 BTC were traded across various crypto exchanges. This represents a 130% spike in Spot Market volumes within a week.

Typically, Spot Trading volumes decrease in bear markets as beleaguered investors close their positions. Hence, rising BTC spot volumes during the current flat price action imply that liquidity and investor interest are returning to the market. This increased liquidity could help Bitcoin traders execute orders efficiently in the coming days while keeping prices stable.

Also, historical data trends show that recent Bitcoin price rallies have often been preceded by a spike in BTC Spot trading volumes.

In conclusion, the buying pressure from US-based whales and the BTC Spot trade volume spike could combine to trigger a Bitcoin price rally.

BTC Price Prediction: $28,000 is a Viable Target

From an on-chain perspective, the US-based whales could trigger a Bitcoin price rally toward $28,000 in the coming days, This bullish stance is also validated by the In/Out of Money Around Price data, which depicts the purchase price distribution of current Bitcoin holders.

It shows that if BTC scales the $26,500 obstacle, the bulls could gain momentum to push for $28,000.

As shown below, the 2.31 million addresses bought 740 BTC at the maximum price of $26,560 currently pose a major resistance. But if the US whales’ optimism intensifies, the Bitcoin price rally could hit $28,000.

Conversely, the bears could seize control if BTC price drops below $24,500. However, as shown below, 654,000 addresses had bought 253,000 BTC at the minimum price of $25,000. They could offer considerable support by making spirited attempts to cover their positions.

But if that support level caves in, then BTC price could eventually drop toward $24,000.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.