The coming week is shaping up to be busy for the financial-economic calendar, with several key events taking place. Crypto market volatility is likely to return, and bears are in the driving seat at the moment.

On September 25, macroeconomics outlet The Kobeissi Letter listed this week’s key events. The one to watch for is the Federal Reserve chair’s speech on September 28.

A Week of Economic Events

On September 26, a new data report for US building permits and new home sales will be released. The numbers have been forecast to dip a little, suggesting slightly weaker real estate markets, but it should not impact crypto markets.

Also on Tuesday are the month’s US consumer confidence index figures, which are reflective of the broader economy. They are expected to remain subdued at August levels, suggesting the economy remains sluggish.

This would be bearish for crypto markets since there is less appetite for high-risk asset investments.

The second quarterly GDP (gross domestic product) figures are expected to be released on September 28. The median forecast is a rise from 2.1% to 2.3%.

Moreover, there will be two Fed speakers on Thursday, Fed Governor Lisa Cook and Chair Jerome Powell. However, neither is expected to have much impact on digital asset markets as Powell will hold a town hall meeting for educators.

Last week, the Fed decided to leave rates unchanged at 5.25%-5.5%, as widely expected by the markets.

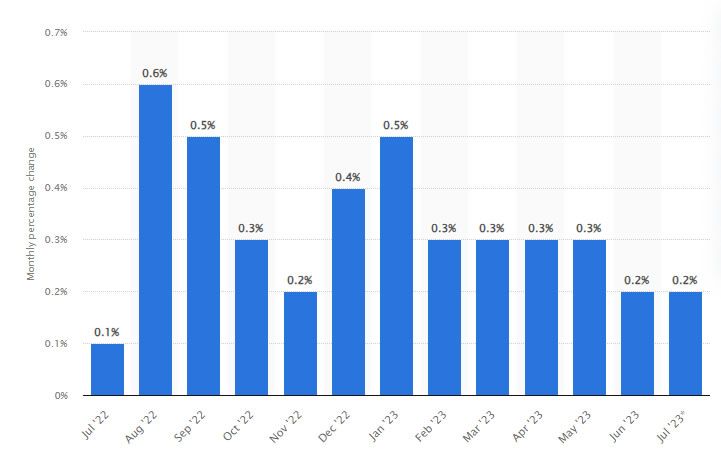

Friday will see new figures for the Personal Consumption Expenditures (PCE) index. The Core PCE inflation is also known informally as the Federal Reserve’s preferred inflation gauge. Core PCE year-on-year is expected to fall from 4.2% to 4.0%.

Speaking on financial markets, Kobeissi noted,

“The return of volatility is fantastic news for traders.” It added, “More Fed uncertainty is back and we are ready for it.”

Crypto Market Outlook

Crypto markets remain deep in bear territory, so it is unlikely that this week’s economic events will rouse the bulls.

Total capitalization has fallen by around $10 billion over the weekend. As a result, it currently stands at $1.08 trillion, where it has been for the past fortnight.

BTC dropped sharply during the Monday morning Asian trading session, shedding 2.4%. The asset fell to $26,000 which served as support for a slight rebound to $26,106.

However, a fall below this level is expected this week as sentiment slides. Additionally, October is usually very bearish for stock and crypto markets, and it is just around the corner.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.