This coming week is shaping up to be a busy one for financial events, some of which may impact crypto market movements. The largest event is the Federal Reserve meeting on Wednesday, when another interest rate decision will be made.

There are several key financial events this week, and the Fed’s interest rate decision is among them.

The Week’s Financial Events

On September 19, data will be released for housing starts and building permits. These provide an outlook into the current US housing market, which has been on rocky ground due to high interest rates.

Neither are predicted to move much from the previous month, and they have no impact on crypto markets.

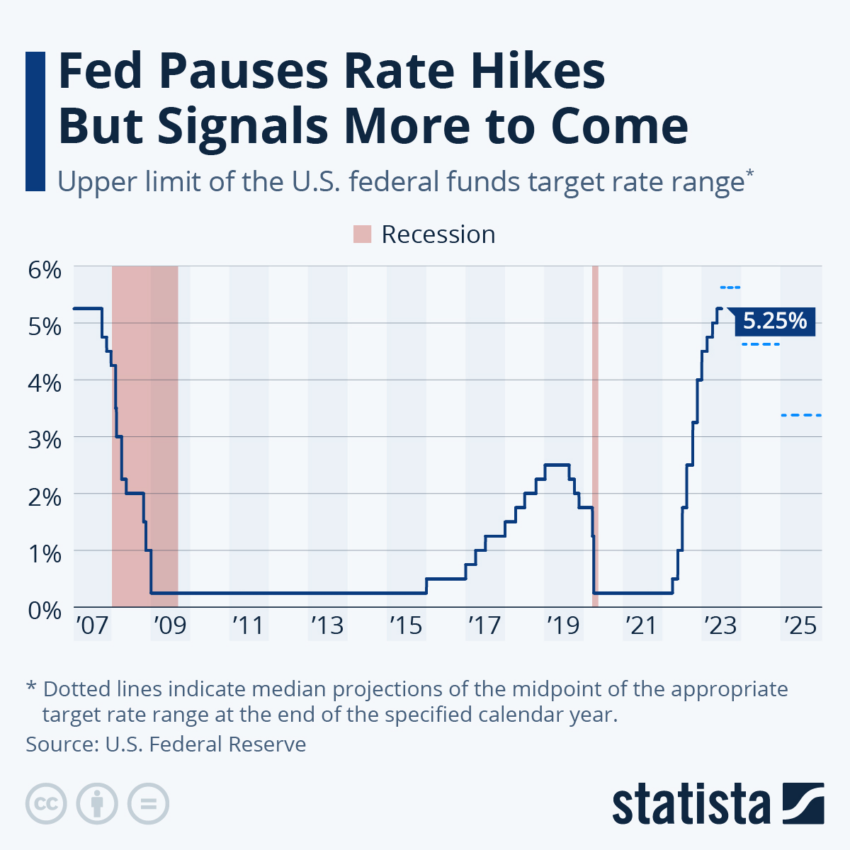

The Federal Reserve rates decision on Wednesday, September 20, will be the one to watch out for.

However, the central bank is not expected to change its stance on interest rate policy. It is also not expected to say anything definitive about its near-term outlook at this week’s policy meeting.

Moreover, the focus will be on the Fed’s economic forecast, known as the Summary of Economic Projections (SEP).

Macroeconomics outlet The Kobeissi Letter noted that the week could set the tone for the rest of the year.

“Fed guidance on Wednesday sets the tone for the next few meetings. Expect to see lots of volatility this week.”

Furthermore, the Fed could lower its core inflation forecast to 3.7% from 3.9%, according to reports. Moreover, economists agree that the Fed might boost its estimate for the longer-term neutral rate, MarketWatch noted.

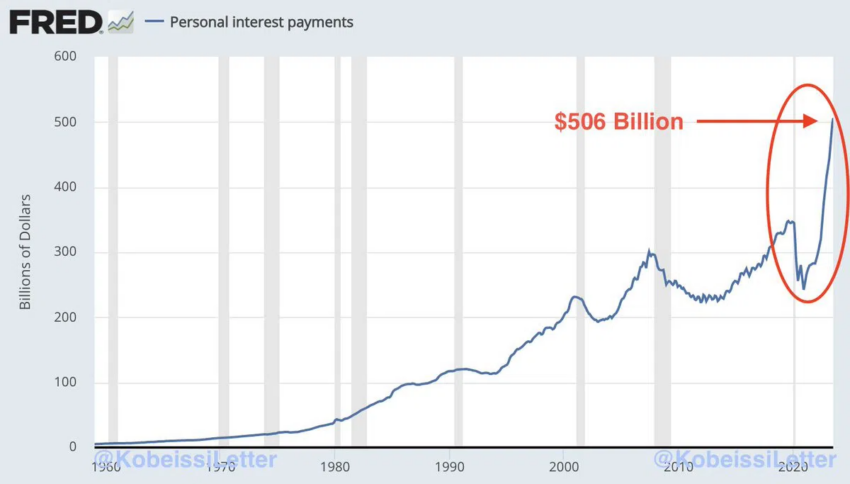

Central bank officials have previously said that they intend to keep the benchmark interest rate high to continue to push inflation down.

This will continue to hurt households getting deeper into debt as personal interest payments soar to record levels.

September 21, we will see data for jobless claims and existing home sales, neither of which are expected to affect markets.

Crypto Market Outlook

Crypto markets remained sideways during the Monday morning Asian trading session. As a result, total capitalization was at $1.1 trillion at the time of writing.

However, the figure is up around $50 billion since the same time last Monday.

Bitcoin briefly jumped to $26,700 but started to retreat very quickly, trading at $26,668 at the time of writing. Meanwhile, Ethereum has shown very little activity over the weekend, hovering around the $1,630 level.

With a very low probability of a Fed rate change this week, crypto markets are likely to maintain their consolidation and lethargy.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.