This week, Bitcoin kissed $66,000, hitting its monthly highs, and the sentiment started turning bullish. Donald Trump survived an assassination attempt and emerged strongly as the crypto President.

The German government has finally run out of Bitcoin, a sigh of relief for the crypto ecosystem. Moreover, the launch of the Ethereum exchange-traded fund (ETF) is around the corner.

Assassination Attempt on Donald Trump

The week in crypto began with a shocking event – former US President Donald Trump narrowly escaped an assassination attempt. While attending a campaign event in Pennsylvania, Trump was struck in the upper part of his right ear.

He was quickly escorted to safety and received medical care for injuries. This incident stirred also influenced financial markets. After the attack, Bitcoin surged from about $60,000 to $66,000.

Read more: Who Owns the Most Bitcoin in 2024?

“Based on Bitcoin’s reaction so far, looks like markets are going to begin pricing in a full Trump victory,” Will Clemente, the co-founder of Reflexivity Research, stated.

Trump’s connection to pro-crypto policies likely fueled this increase. Meanwhile, betting platforms like Polymarket continue to favor Trump over Joe Biden, whose presidential odds dipped following a recent COVID-19 diagnosis.

Ethereum ETFs Set to Launch

Furthermore, industry leaders predict that Ethereum exchange-traded funds (ETFs) will start trading on July 23. Eric Balchunas from Bloomberg claimed that the SEC had contacted issuers for the final adjustments to their S-1 forms.

If there are no last-minute complications, these ETFs will offer a new way for investors to engage with Ethereum. Prominent financial players such as BlackRock, VanEck, and Franklin Templeton are expected to receive approval from the SEC to move forward with their ETF offerings.

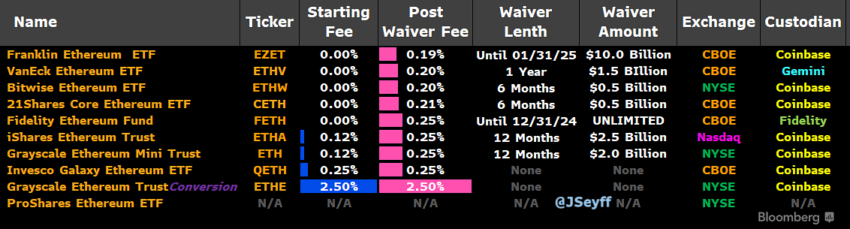

The ETF issuers also released the fee details. The fees for most of the ETFs range between 0.19% to 0.25%. However, Grayscale Ethereum Trust has the highest fee, i.e., 2.5%.

Read more: Ethereum ETF Explained: What It Is and How It Works

German Government Concludes Bitcoin Sales

According to Arkham Intelligence, the German government has sold off its entire Bitcoin stash. This move followed the earlier seizure of 50,000 Bitcoin. Crypto expert Michaël van de Poppe noted that such liquidations are typically mandated by legal obligations and are not influenced by market conditions.

Although the crypto community breathed a sigh of relief, some observers speculate that Germany might regret this decision in the future. German officials, however, maintain that the sales were conducted sensitively to avoid major market impacts.

Potential US Treasury Leadership Shifts

Potential shifts in the US Treasury Department could impact financial regulations. Donald Trump suggested in a Bloomberg interview that he might nominate Jamie Dimon, the CEO of JP Morgan, as the next Secretary of the Treasury.

“Jamie Dimon was, you know, very negative and now all of a sudden he’s changed his tune a little bit,” Donald Trump said.

This follows a meeting with leading business figures, hinting at a possible alignment in Dimon’s views towards Bitcoin. Simultaneously, FDIC Chair nominee Christy Goldsmith Romero has expressed support for banks servicing crypto companies. If she is confirmed, this stance could mark a significant policy shift, potentially easing current pressures on the sector.

Crypto Exchange WazirX Lost $235 Million to Hackers

On Thursday, hackers stole around $234.9 million from the Indian crypto exchange WazirX. Following the incident, the crypto exchange paused withdrawals and started further investigations.

Web3 security experts such as Cyvers believe the infamous Lazarus Group might be responsible for the incident.

“The use of TornadoCash to fund the transactions is indicative of methods used in previous high-profile attacks. While it is too early to definitively link this incident to the Lazarus Group, the similarities are concerning. Cyvers is closely analyzing the situation,” Deddy Lavid, the CEO of Cyvers told BeInCrypto.

Read more: Crypto Project Security: A Guide to Early Threat Detection

In related news, the cyber attackers of CDK Global reportedly received over $25 million in Bitcoin as a ransom. This event disrupted operations at about 15,000 US car dealerships, highlighting the persistent threats in cyber security.

The ransom payment was traced through blockchain analysis, highlighting the traceability of crypto transactions despite their perceived anonymity.

This Week’s Crypto Top 10

Lastly, this week, the crypto market exhibited strong growth, with total market capitalization reaching $2.34 trillion. Most of the top 10 crypto assets surged by double digits. Bitcoin has been up by 11.52%, while Ethereum has been up by 10.39% in the past seven days.

Read more: 11 Cryptos to Add to Your Portfolio Before Altcoin Season

Solana (SOL) stood out with nearly a 20% increase, while Toncoin (TON) and Cardano (ADA) showed more subdued performances.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.