The decentralized finance (DeFi) market has breached a new milestone reaching an all-time high locked-in value of $106.9 billion in early November. Layer 2 scaling solutions are also experiencing great growth, with an all-time high locked value of $4.93 billion recorded at the same time.

The DeFi market shows no sign of flagging as the total value locked has reached a new all-time high, touching $106.9 billion on Nov 3, 2021. The new high marks a fairly steady growth over the course of the year, boosted by several new developments and NFT-related launches.

DeFi keeps trucking

The advent of DeFi has sent shockwaves through the market, with many in traditional finance sectors and regulators taking note of the novel financial ecosystem. The niche allows investors to lend and borrow assets, invest in tokenized versions of real-world assets, derivatives, and more, overseen by the trustless power of smart contracts.

The decentralized finance market is currently dominated by Convex Finance, Yearn.Finance, and Rari Capital, which respectively have $9.6 billion, $4.7 billion, and $1.3 billion locked. Convex Finance is one of the new players in the market.

Ethereum, which is the bedrock for the vast majority of the DeFi market, has also grown alongside the DeFi market. However, scalability has been a thorn in the side of the network, with investors chiding the fees and transaction times that sometimes affect their decisions.

Ethereum is working on its own solution, ETH 2.0, which is undergoing a phased release that will see sharding introduced in the near future. Meanwhile, several other projects are working on solutions that will tackle this problem and unshackle the DeFi market.

Total value locked in L2 also reaches ATH

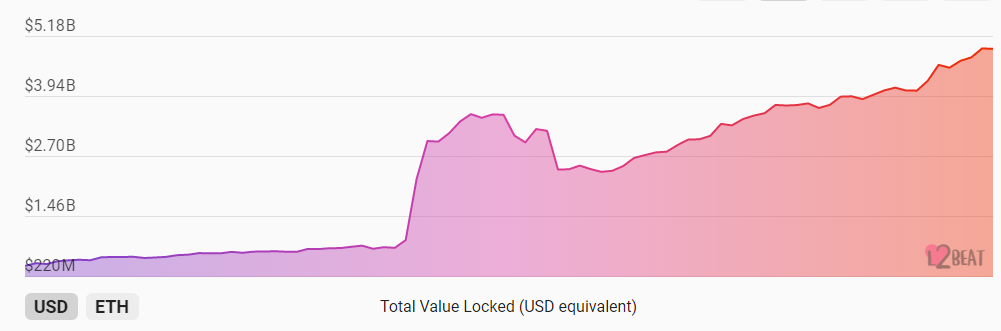

Accompanying the growth of the DeFi is the increased value locked in layer 2 scaling solutions, like that of Arbitrum, Loopring, and Optimistic Ethereum. Layer 2 scaling solutions provide much higher transaction throughput and negligible transaction fees, a necessity with the growing adoption of DeFi platforms.

The total value locked into layer 2 solutions has reached an impressive $4.93 billion, up from $800 million at the start of September 2021. The remarkable rise in layer 2 scaling value suggests an impending large-scale shift towards these solutions. Among the designs employed by these projects are Optimistic Rollups, ZK Rollups, and Plasma.

Layer 1 usage for DeFi has resulted in gas fees that can cross the $100 mark, which can be a barrier for many investors. This has been a frequent complaint from market investors, and several projects have successfully released solutions to much relief.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.