During last year’s terrorist attacks in Israel, crypto was quickly blamed for funding the violence. Critics, however, have challenged this claim, pointing to a lack of substantial evidence. A key testimony from Brian Nelson, the US Department of the Treasury’s Undersecretary for Terrorism and Financial Intelligence, has further shifted the narrative.

Nelson clarified to lawmakers that the role of crypto in terrorism financing has been overstated.

Crypto Gets Clean Chit From US Treasury Official

The Wall Street Journal initially linked substantial crypto payments to groups like Hamas. This was based on misinterpreted data from Elliptic, a blockchain analytics firm. However, subsequent data from Elliptic painted a different picture, leading to a revised report.

Despite these corrections, several lawmakers, including Senators Sherrod Brown and Elizabeth Warren, have used the inflated figures to push for strict crypto regulations. Over 100 lawmakers have cited the Wall Street Journal’s report to advocate for anti-crypto legislation, arguing that these measures are essential for national security.

However, Representative Tom Emmer highlighted the discrepancy during a committee hearing, emphasizing the need for accurate information in legislative debates. He believes that such regulations could hinder innovation and potentially push the crypto industry overseas.

“Senators are writing legislation based on the Wall Street Journal’s inaccurate reporting. Since Treasury has accurate data, it has an obligation to correct the record on the size of Hamas’s digital asset fundraising efforts,” Emmer said.

Read more: 8 Best On-Chain Analysis Tools in 2024

Nelson’s testimony revealed that traditional financial systems are still the preferred method for terrorist groups, not cryptocurrencies. Elliptic’s clarification that Hamas only received $21,000 via crypto further challenges the notion of cryptocurrencies as a significant tool for terrorism financing.

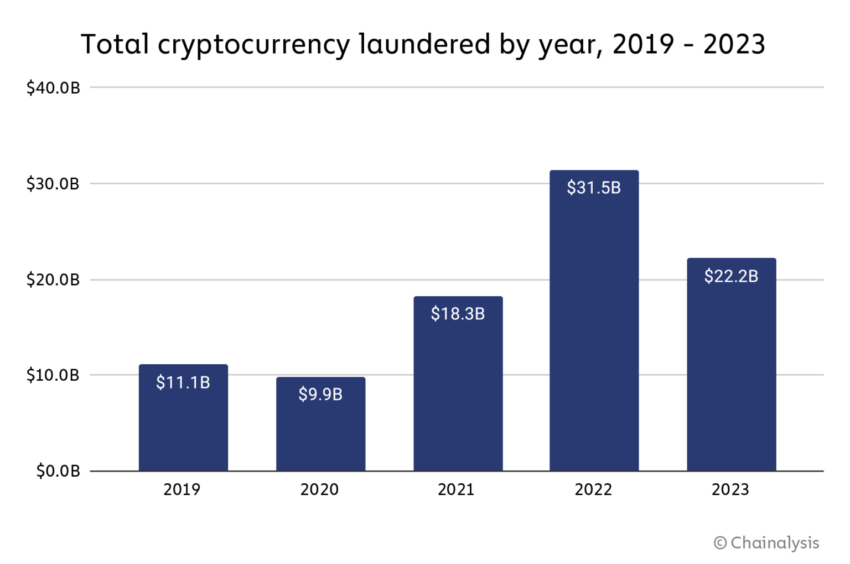

Nelson’s recent comments underscore the Treasury’s broader concerns about illicit finance in the crypto market. He called for additional resources to combat these challenges effectively, advocating for reforms to update governmental tools and authorities. The ongoing debate has significant implications for the crypto industry and policy-making.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.