The recent Israel-Palestine conflict has intensified the scrutiny of crypto transactions in the United States. This is predominantly due to reports suggesting militant groups, including Hamas, received financing via cryptocurrencies.

The link between cryptocurrencies and the financing of global security threats is reshaping political discourse around crypto legislation.

US Anti-Crypto Bill Gains Ground

Hamas reportedly adopted cryptocurrencies early on, as pointed out by blockchain intelligence company Elliptic. While most of the funding still comes from traditional channels, some links to the group continued to solicit crypto donations after the attacks.

The pseudo-anonymous nature of cryptocurrency transactions, combined with the decentralized platforms they run on, makes them attractive for such purposes. However, proponents argue that public ledgers and increasing sophistication in blockchain analytics can trace these transactions, ensuring transparency.

Senator Elizabeth Warren has taken this opportunity to drive her anti-crypto bill further. She’s pushing for a bill that enforces new anti-money laundering rules on cryptocurrencies. Warren recently emphasized the urgent need to address “crypto-financed terrorism.”

“The danger of crypto-financed terrorism is real and should be an urgent priority for Congress. There’s a growing bipartisan coalition of senators who are committed to passing this bill and fighting back against terrorism worldwide by choking off the financing,” Warren stated.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

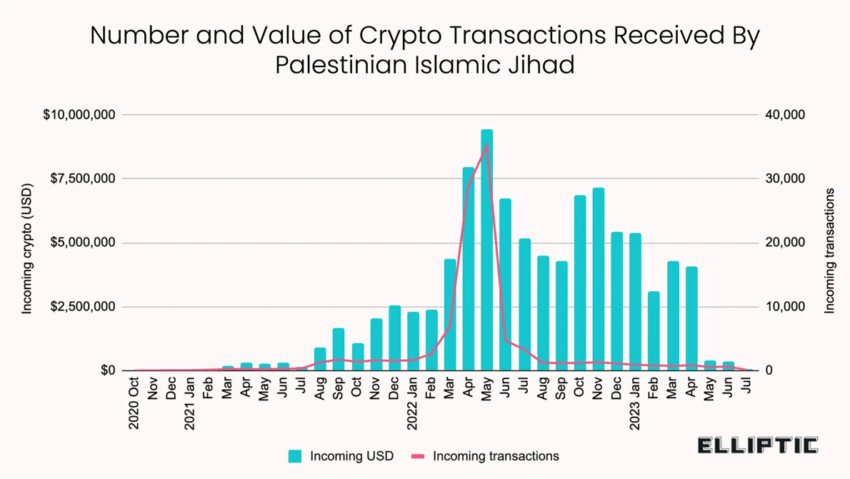

The bipartisan support Warren’s bill is receiving makes it an increasingly formidable proposition. In fact, crypto wallets linked to groups like Hamas reportedly received over $41 million since 2020, as cited by Arda Akartuna, Senior Cryptocurrency Threat Researcher at Elliptic, bolstering the arguments of crypto skeptics.

Crypto Firms Unite to Prevent Illicit Activity

Coinbase and other crypto firms have responded proactively to the brewing controversy. For instance, Binance collaborated with Israeli authorities to identify and halt Hamas’ fundraising efforts on social media platforms, soliciting the public to contribute cryptocurrency to their wallets.

Likewise, Tether has firmly opposed terrorism by freezing 32 wallet addresses in Israel with a combined value of $873,118. In partnership with Israel’s National Bureau for Counter-Terror Financing (NBCTF), the company aims to address the growing concern of terrorism and warfare funded through cryptocurrencies.

Read more: Stablecoin Regulations Around the World

Yet, despite the industry’s defense, the Israel-Hamas conflict seems to have catalyzed the political momentum against crypto in the US. Senate Banking Chair Sherrod Brown now appears more aligned with Warren’s anti-crypto bill, recognizing the potential threats that unregulated crypto transactions can pose.

“The Banking and Housing Committee will examine the financing behind Hamas’s attacks, including whether cryptocurrency was involved, and what additional economic tools we need to stop state sponsors of terrorism, including Iran, from supporting Hamas and other terrorist groups,” Brown said.

This is a significant deviation from earlier perspectives where concerns regarding cryptocurrency were more focused on market volatility, consumer protection, and potential misuse for drug trafficking.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.