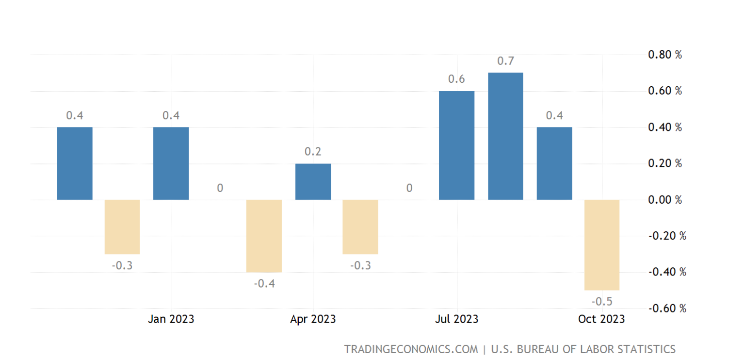

The US October Producer Price Index (PPI) rose 1.3% year-on-year, undercutting estimates of 1.9%. Core PPI rose 2.4%, coming in below estimates of 2.7%.

This is the first time in four months that so-called wholesale inflation has fallen. Earlier this week, the markets celebrated lower-than-expected October retail inflation in most sectors.

US PPI Helped by Gasoline Price

Month-on-month, the producer price index fell 0.5%, while core PPI remained unchanged. Most of the decline in goods prices occurred because of a 15.3% drop in gasoline cost.

The report also showed that retail sales for October slowed 0.1% monthly, coming in lower than analysts’ expectations of 0.3%. Sales are likely to pick up ahead of the holiday season.

The Producer Price Index (PPI) is what domestic producers pay to produce finished goods. Any increase in the cost of production can cause increase in prices for retail customers. Hence a lower PPI means a lower chance the consumer will pay more.

Bitcoin and Stocks Like US PPI Numbers

The stock market appeared set for positive gains following Tuesday’s favorable CPI numbers. It met expectations after the improved PPI numbers, with the Dow Jones Industrial Average up 0.2%, while the S&P 500 Futures gained 0.3%.

Read more: Crypto vs. Stocks: Where To Invest Your Money in 2023

Bitcoin rose from $36,056 to $36,167.60 but is down 1.3% in the past 24 hours. Ethereum dipped briefly to $2,007 but is now up to $2,021.

The US also added fewer jobs than expected last month, which could see the US Federal Reserve create a soft-landing for the economy. Market pundits predict the Fed will not increase rates in December, although the chairman Jerome Powell has not ruled out the possibility.

“The Fed will welcome the reprieve, after producer prices recorded a 4.9% annualized gain in [the third quarter], and coupled with yesterday’s CPI report, it bolsters the case for no further rate increases,” wrote Matthew Martin, US economist for Oxford Economics.

Read more: How to Use BeInCrypto Jobs Board: A Step-by-Step Guide

Do you have something to say about the lower October US PPI or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.