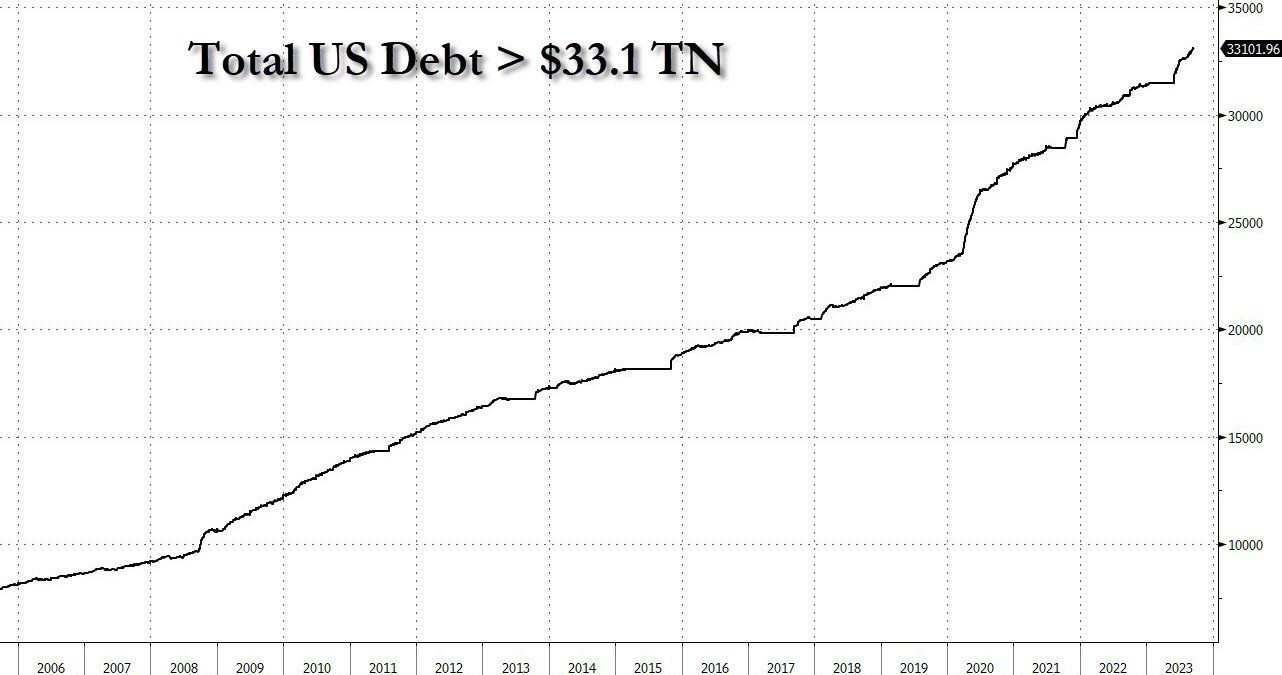

The national debt in the United States has been surging since it surpassed a record $33 trillion last week. Moreover, the amount piled on daily is larger than the market capitalization of the seventh-largest crypto asset.

On September 26, macroeconomics outlet The Kobeissi Letter reported that total US debt has jumped by $100 billion since it crossed $33 trillion exactly one week ago.

US National Debt Crisis

Moreover, that equates to $14.3 billion per day being added to US debt over the last week. This is more than the total amount of Ethereum staked on Lido, which is valued at around $13.8 billion.

Add in around $3 billion per day of interest expenses, and that is over $17 billion per day, Kobeissi added.

That equates to more than the total market capitalization of Cardano and Solana combined being added PER DAY.

“US debt and interest expense are on track for exponential growth. When will this be called a “crisis?””

The outlet added that deficit spending has become so large that the US is issuing $2 trillion in bonds over 6 months which is driving rates higher:

“Simultaneously, the US is refinancing debt at current rates which have more than doubled.”

Moreover, the debt ceiling remains unlimited until January 2025, so these whopping figures will be the new normal. The US debt clock tracker predicts that it will reach an epic $45 trillion over the next four years.

Not Just America

The parabolic debt problem is not limited to Uncle Sam. Central banks worldwide have been printing money, pushing global debts to a record high of $307 trillion.

However, markets such as the United States and Japan were driving the rise, according to the Institute of International Finance (IIF). Global debt in dollar terms had risen by $10 trillion in the first half of 2023 and by $100 trillion over the past decade, it reported last week.

Meanwhile, crypto markets are a minnow compared to these figures. The total capitalization of all digital assets is just a trillion dollars. More than this amount has been piled onto the US national debt so far this year.

Crypto markets remain lackluster, with sentiment at bear market lows. As a result, there has only been a minor move upward over the past 24 hours, pushing the total market cap to $1.09 trillion.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.