US stock markets have taken a hit since Wall Street bankers and the central bank dismissed the specter of a recession. Furthermore, crypto markets are also backpedaling today but remain range-bound where they have been for months.

On Aug. 16 macroeconomics commentary provider The Kobeissi Letter reported that the S&P 500 has lost $850 billion in market capitalization. This is in just a fortnight since JP Morgan said they no longer expected a recession.

Wall Street Defies Recession Calls

“It has only been 10 days since JP Morgan announced their new view,” it said before adding, “Is this a coincidence?”

Earlier this month, JPMorgan became the latest bank on Wall Street to push out its recession forecast to 2024. The prediction followed Bank of America which also suggested that a recession may not happen until next year.

Goldman Sachs is another big bank that said there was just a 20% chance the US suffers a recession within the next 12 months.

Furthermore, Federal Reserve staff also forecast a “noticeable slowdown” rather than a recession the last time they hiked rates in late July.

“This nearly marked the exact high in the S&P 500 earlier this month,” said the Kobeissi Letter.

It commented that 14 banks are currently calling for a recession, but 6 banks are not, adding,

“The ‘soft landing’ camp has grown over the last few weeks.”

The S&P 500 Index (SPX), which tracks the stock performance of 500 of the largest US companies, hit a 2023 peak of 4,588 on July 31. Since then, it has declined by 3.3% to 4,437 on Aug. 15, closing below its 50-day moving average for the first time since March.

Furthermore, the tech-heavy Nasdaq 100 Index (NDX) has fallen 5% from its 2023 high in mid-July.

Renowned investors such as Michael Burry are also bearish. As reported by BeInCrypto, “The Big Short” analyst shorted the two US stock indexes in a massive trade this week.

On Aug 15, the Wells Fargo Investment Institute said the US economy is unlikely to avoid a potential recession. “Ultimately, we believe the economy will struggle to avoid a recession” as higher inflation and interest rates are expected to further mount pressures on the consumer, it said in a note.

Crypto Markets Decline

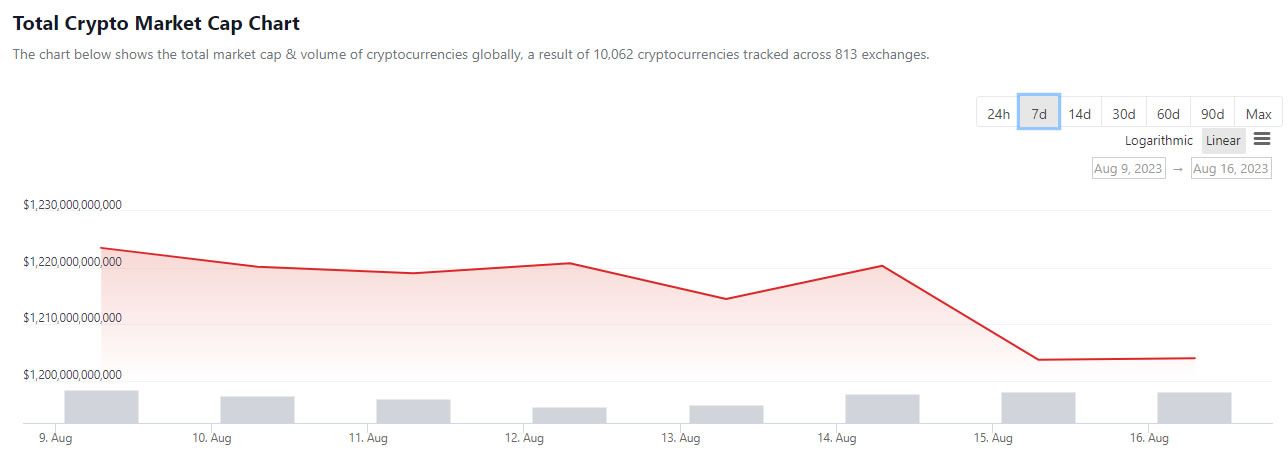

Crypto markets have followed suit this week and are in the red but remain within their long-term range-bound channel.

Total capitalization has shrunk by around $20 billion since the beginning of the week, falling to $1.20 trillion at the time of writing.

Bitcoin and Ethereum took a minor dip during the Wednesday morning Asian trading session but remain sideways.

Furthermore, altcoins are suffering heavier losses as red engulfs the crypto markets once again.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.