The recent development of spot Ethereum (ETH) exchange-traded funds (ETFs) by the US Securities and Exchange Commission (SEC) has significantly influenced the crypto investment environment.

Following the SEC’s preliminary approval for spot Ethereum ETFs, Bitcoin (BTC) counterparts continue to record positive inflows.

US Spot Crypto ETFs Surge Amid Renewed Optimism

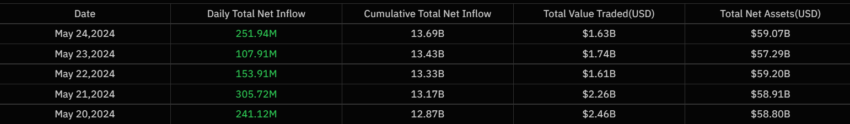

SoSo Value data reveals that as of May 24, US spot Bitcoin ETFs had a total net inflow of $251.94 million. This marks ten consecutive days of inflows. On the same day, BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) received inflows of $182 million and $44 million, respectively.

Meanwhile, Grayscale Bitcoin Trust ETF (GBTC) received no flows on the same day. This is noteworthy considering the negative flow streak for US spot Bitcoin ETFs from late April until early May.

Read more: Crypto ETN vs. Crypto ETF: What Is the Difference?

Indeed, the spot Ethereum ETFs have infused the crypto market with renewed optimism. BeInCrypto reported that Ethereum and some tokens in its ecosystem have shown impressive performance since Monday.

However, it is important to note that the spot Ethereum ETFs have yet to be officially launched, and SEC approval for the S-1 filings is awaiting. James Seyffart, an ETF analyst at Bloomberg Intelligence, expects that the spot Ethereum ETFs will ” take a couple of weeks but could take longer” to trade in the market.

“Typically, this process takes months. Like up to 5 months in some examples, but Eric Balchunas and I think this will be at least somewhat accelerated. Bitcoin ETFs were at least 90 days. Will know more soon,” he explained.

Nonetheless, experts remain optimistic. Another ETF analyst, Eric Balchunas, predicts that spot Ethereum ETFs could acquire “10% to 15% of the assets of the spot Bitcoin ETFs.”

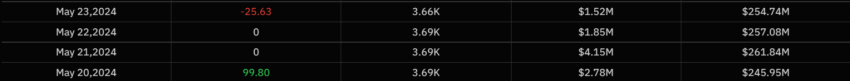

Despite renewed interest in the US market, spot crypto ETFs in Hong Kong saw a relatively muted performance. Data shows that from May 20 to May 23, Hong Kong’s spot Bitcoin ETFs recorded no flows for two consecutive days. Meanwhile, their Ethereum counterparts only recorded an inflow of 62.80 ETH on May 22.

Read more: Why do Hong Kong Spot Crypto ETFs Matter?

However, a recent report mentioned that Hong Kong’s regulator is considering including staking for spot Ethereum ETFs. This is particularly interesting since potential issuers in the US have removed staking from their filings. By including staking rewards, Hong Kong’s spot Ethereum ETFs could provide a competitive edge, offering extra yield for investors.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.