One of the dominant narratives in crypto in 2025 is around ETFs. But why do they matter, and what’s the significance of Hong Kong’s involvement? Find the answers to this and more in this Hong Kong spot crypto ETF deep dive.

What are exchange-traded funds (ETFs)?

Exchange-traded funds (ETFs) are baskets of investments that are designed to mimic the performance of an index or sector. They are similar to mutual funds because they pool investors’ assets and use professional fund managers to invest the money. ETFs are bought and sold on an exchange like any other listed stock. ETFs can hold a variety of asset types, including:

- Stocks

- Bonds

- Commodities

- Real Estate

- Cryptocurrency

Why are ETFs popular?

ETFs are typically considered low-risk investments because they are low-cost and hold a basket of securities or other assets, which is great for diversification. They also attempt to replicate the performance of a specific market. As a result, many ETFs own the same assets as the index they track.

Institutional investors can create additional ETF shares or redeem them for a basket of the underlying assets. This procedure helps to match the ETF’s market price with its net asset value (NAV).

If an ETF’s price differs from its NAV, traders can buy or sell the ETF while simultaneously holding opposing positions in the underlying assets or a linked derivative (e.g., futures or options). This arbitrage can help bridge the price gap, ensuring the ETF price closely reflects its intended index. It also enables traders to profit from market inefficiencies.

Lastly, in the context of cryptocurrency and Bitcoin ETFs, ETFs allow investors to gain exposure to Bitcoin and crypto without the risk of actually holding the asset. ETF fund managers are subject to rigorous regulations on the custody of the underlying assets. Therefore, they are required to appoint a custodian to hold their underlying assets. The custodian is usually a reputable bank or financial institution.

Did you know? Coinbase Custody secures the majority of spot Bitcoin ETFs in the U.S.

Why are Hong Kong ETFs significant?

Recently, three fund managers have launched six crypto ETFs in Hong Kong. The Hong Kong branches of mainland Chinese firms Harvest Global Investments, China Asset Management (CAM), and Bosera Asset Management issued the Bitcoin and Ether ETF funds. This move marks a significant development in Bitcoin and Hong Kong’s financial markets.

Here’s why Hong Kong spot crypto ETFs matter to the crypto ecosystem.

Bitcoin price impact: Expectations

Many traders believed that due to a slew of converging events, with the Hong Kong ETFs being the culmination, the price of Bitcoin would pump tremendously on news of the approval.

The start of this chain of events began in Q1 2024 when the U.S. Federal Reserve announced interest rate pauses and potential cuts.

We believe that our policy rate is likely at its peak for this tightening cycle and that if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.

Jerome Powell, Federal Reserve Chair: FOMC Press Conference, March 20, 2024

This is traditionally viewed as a bullish event by investors. In other words, many believe that when the U.S. Federal Reserve cuts interest rates, the prices of assets like Bitcoin or equities increase, which is good for investors worldwide.

Additionally, with the debut of the U.S. Bitcoin spot ETFs (another bullish event for Bitcoin), followed by the Bitcoin halving, prospects were generally optimistic regarding the positive performance of Bitcoin. In summary, many anticipated that the price of Bitcoin would pump because of:

- U.S. Federal Reserve Interest rate pauses and potential cuts in 2024

- U.S. Bitcoin spot ETF approval

- Bitcoin halving

- Hong Kong spot Bitcoin and Ethereum ETFs debut

The reality of the price impact (short-term)

In fact, the price impact on BTC was much more tepid than many expected, with trading volumes initially looking lower than was anticipated. The leading crypto asset managed to reclaim $64,000 upon the news of Hong Kong spot ETF approval but has since dipped below $60,000 (accurate as of May. 3, 2024).

Proximity to Asian markets

Much hype around Hong Kong ETFs also centers around their proximity to Asian markets, particularly China — where cryptocurrency was banned in 2017.

Note: Hong Kong is a Special Administrative Region (SAR) sitting just on the border of China. It has its own judicial, legislative, and executive powers and a separate legal system.

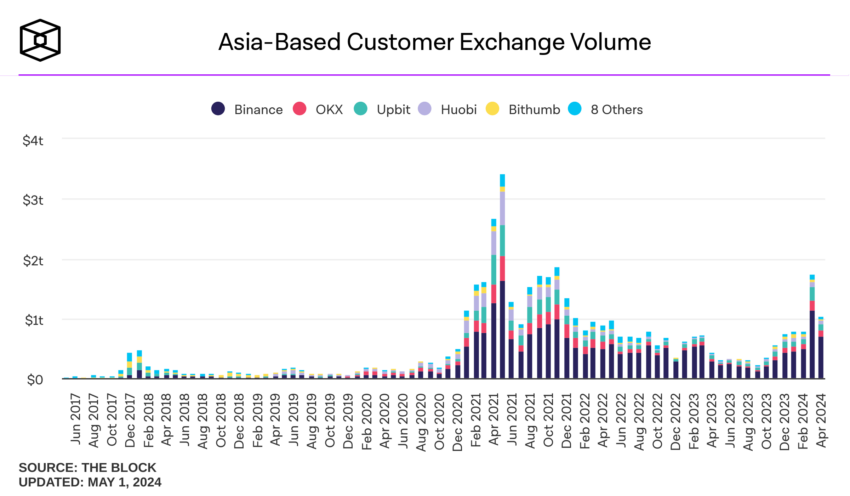

With a massive population of 1.4 billion (17.72% of the world’s population) and a transaction volume of $90 billion in just a single month in 2023 on Binance from Chinese traders, Hong Kong ETF inflows from mainland China could prove to be a significant value-add to Bitcoin’s performance.

In total, Asia-based customer exchange volume exceeded 1 trillion dollars in March and April of 2024. Although this may not necessarily translate to ETF trading, it does make a significant case for Asia’s growing interest in crypto.

Competition with US markets

As stated previously, Asia-based exchange crypto trading volume exceeded $1 trillion in late Q1 2024 and early Q2 2024. This overshadows North American markets, which sit between $100-$200 billion in monthly trading volume. As a result, many people believe Hong Kong ETFs will be serious competitors to U.S. markets.

This comparison has much to do with the sentiments of how both markets view crypto. While Hong Kong is positioning itself to become a crypto hub, the U.S. has taken the opposite approach, levying a heavy-handed and oftentimes criticized enforcement towards crypto-related activities, businesses, and developers.

Notably, the U.S. approved futures-based crypto ETFs before, and at the chagrin, of approving spot-based crypto ETFs. Many believe spot-based ETFs to be superior products to futures ETFs. This is due to roll costs and contango risks.

As a result, the U.S. has been criticized for inadvertently putting customers at risk, while Hong Kong has been praised for its progressive policies towards crypto-based financial products. Moreover, while U.S. crypto ETFs have been relegated to cash redemptions, Hong Kong has opted to use in-kind redemptions, which are considered less complex and more cost-efficient than the latter.

US vs. Hong Kong spot crypto ETFs debut

Despite the hype, the debut of Hong Kong crypto ETFs was relatively lukewarm. The U.S. ETFs achieved $4.6 billion in trading volume on their first day, while Hong Kong produced about $12 million in trading volume. However, this performance is more impressive when contextualized within the regional markets.

Unlike the U.S., where daily trading volumes can reach $166 billion, Asia sees an average of only $20 billion. Specifically, the ChinaAMC Bitcoin ETF’s first-day intake of $123 million is impressive, ranking it 6th among the 82 ETFs launched in Hong Kong over the past three years.

The U.S. Bitcoin ETF’s assets under management (AUM) reflect the United States’s status as the world’s financial center and may also reflect a preference for investors to trade ETFs in the U.S. rather than Hong Kong. As of May 3, 2024, the AUM of U.S. crypto ETFs is between $500 million and about $2.5 billion.

| Issuer | Ticker | AUM (Billion) | Bitcoin |

|---|---|---|---|

| Ark/21 Shares | ARKB | $2.48 | N/A |

| Bitwise | BITB | $1.08 | 33,421.46 |

| Blackrock | IBIT | $16.45 | 274,462.04950 |

| Fidelity | FBTC | $8.81 | 152,902.7200 |

| Grayscale | GBTC | $17.56 | 296,713.9055 |

| Invesco/Galaxy | BTCO | $0.347 | N/A |

| Valkyrie | BRRR | $0.459 | 7,656.69 |

| VanEck | HODL | $0.531 | 9,276.535 |

On the one hand, the U.S. signifies a larger market for institutional players to trade. On the other, Hong Kong presents a more progressive haven for crypto investors. As of 2025, the U.S. has only approved Bitcoin ETFs, while Hong Kong has both Bitcoin and Ether ETFs.

Hong Kong vs US ETF markets

Although Asia dominates crypto trading volume, North America dominates ETF trading volume. Comparatively, the ETF markets in the U.S. and Hong Kong also differ in size, variety of offerings, trading behavior, and regulatory frameworks.

Market size

With almost $50 billion in assets, Hong Kong has a comparatively small market size. Hong Kong’s ETF market has grown but is still smaller than the U.S. Moreover, ETF offerings in Hong Kong have traditionally focused more on Asian markets and specific regional investments.

The U.S. ETF market is one of the largest in the world, with assets totaling almost $9 trillion. It offers a wide variety of ETFs, including those covering:

- Market indices

- Niche sectors

- Commodities

- Currencies

- Financial strategies

Variety of assets

U.S. ETFs are also known for having a high degree of innovation. The U.S. market features a broad array of ETFs, including thematic ETFs, ESG (environmental, social, and governance) focused ETFs, leveraged and inverse ETFs, and more.

In contrast, the focus in Hong Kong has traditionally been more on conventional assets and less on alternative or niche markets. However, recent years have seen an expansion into more specialized products, including those targeting mainland Chinese investors — although mainland China is currently restricted from trading Hong Kong Bitcoin and Ether ETFs.

Bitcoin ETFs in 2024

2024 will go down as the year of crypto ETFs. Many countries are opening up to the idea of crypto-related financial products being a viable investment strategy.

The U.S. kicked off the year by approving spot Bitcoin ETFs on Jan. 10, 2024. Despite historical skepticism towards cryptocurrencies, the approval of Bitcoin ETFs by the U.S. in January reflects a commendable shift towards embracing innovation. Following the U.S., Hong Kong was next in line to approve spot Bitcoin ETFs for trading.

By the end of 2024, the ASX stock exchange in Australia is anticipated to list the first batch of spot bitcoin ETFs that have been approved. Although Australian investors have traded spot bitcoin ETFs on CBOE Australia since 2022, ASX is Australia’s leading equities exchange, handling most domestic trades.

In March 2024. the U.K.’s Financial Conduct Authority (FCA) of the U.K. announced that it would not object to requests for crypto asset-backed exchange-traded notes. Shortly thereafter, the London Stock Exchange (LSE) disclosed that it would accept applications for crypto ETNs, with a tentative listing date set for May 28, 2024, and only for institutional investors.

Spot crypto ETF vs ETN

Although the U.K. listing is a big win for crypto-related financial products, it is important to recognize the distinction between crypto ETFs vs. ETNs and how they differ from North American and Asian markets.

European regulations, particularly those under UCITS, require investment funds to be diversified to reduce risk. ETFs can hold a variety of assets to achieve this diversification. However, cryptocurrencies like Bitcoin and Ether are single assets, so creating a diversified fund solely focused on a single crypto asset is impossible within the UCITS framework.

As a result, financial institutions have turned to alternative structures like Exchange-Traded Notes (ETNs) to provide exposure to cryptocurrencies such as Bitcoin. ETNs are debt securities that track the performance of an underlying asset.

In this way they are similar to ETFs, except ETNs do not require direct asset ownership. However, LSE-approved crypto ETNs are required to hold the underlying asset, unlike typical ETNs.

Another step towards global recognition

The year 2024 is shaping up to be one of the most prolific for crypto developments, particularly in the area of institutional adoption. Whereas in previous cycles, success was characterized by massive startup valuations, froth, and huge profits, this cycle is categorized by a shift towards legitimacy and validation, as major players in finance embrace digital assets.

The significance of Hong Kong spot crypto ETFs is most clearly that they are another step towards global recognition and integration of digital assets into traditional financial systems.

Frequently asked questions

Yes, on April 30, 2024, Hong Kong investors began trading six Bitcoin and Ether spot ETFs. They were sponsored by three prominent institutions from mainland China, Harvest Global Investments, China Asset Management (CAM), and Bosera Asset Management. Hong Kong has historically positioned itself as a hub for cryptocurrency.

China banned cryptocurrency trading in 2021. The nation has a history of imposing bans and restrictions on cryptocurrencies. Although, at times China has reversed its policies, it has yet to change its latest ban.

Exchange-traded funds are investment funds, traded on stock exchanges, mirroring the performance of an underlying index or asset. Likewise, exchange-traded notes are debt securities issued by financial institutions that track the performance of an underlying asset or index. The difference between the two is that ETFs typically hold the underlying asset, ETNs normally do not, but also typically expose investors to credit risk.

There are many reasons why some would view Hong Kong ETFs as an important event. Many people hypothesized that the debut of Hong Kong ETFs, which followed the Bitcoin halving, would cause the price of Bitcoin to pump. Additionally, the ETFs could be viewed as a sign of mainstream adoption.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.