Hong Kong is exploring the possibility of enabling staking services for Ethereuma-based exchange-traded funds (ETFs).

This initiative could position the Asian financial hub as a pioneer in the crypto investment market, notably diverging from the conservative US stance.

Can Staking Revive the Struggling Ethereum ETFs in Hong Kong?

According to Bloomberg, the Securities and Futures Commission (SFC) and various local ETF issuers are actively discussing integrating staking mechanisms into these financial products. Staking involves committing crypto holdings to support network operations, in return earning holders a potential yield. Specifically, Ethereum staking could yield about 4% annually.

“It would be a milestone for Hong Kong to add staking into spot-ETH ETFs,” Serra Wei, CEO of Aegis Custody said.

Read more: 9 Cryptocurrencies Offering the Highest Staking Yields (APY) in 2024

This development aligns with Hong Kong’s broader strategy to reaffirm its position as a leading global financial center. After experiencing political upheaval, city officials have proactively fostered a progressive digital asset environment. This initiative was marked last year by the establishment of a dedicated regulatory regime.

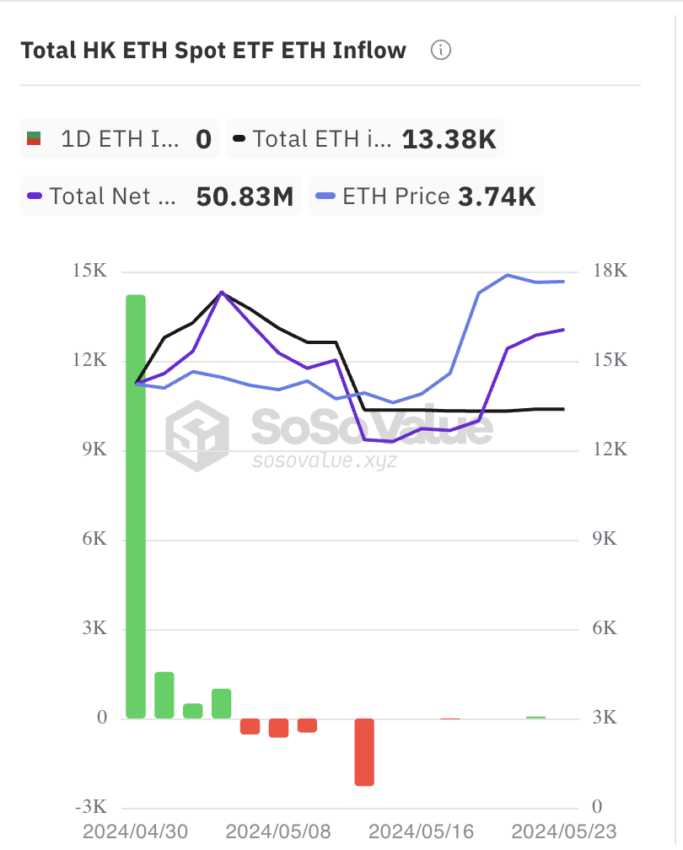

Despite these innovations, spot-crypto ETFs in Hong Kong have encountered tepid demand since their debut in April. According to data from SoSoValue, the total net assets of all Hong Kong spot Ethereum ETFs currently stand at approximately $50 million.

However, the potential introduction of staking options could enhance the attractiveness of these ETFs compared to direct crypto purchases on exchanges.

Contrastingly, in the United States, financial giants like Fidelity Investments, BlackRock, Grayscale, Bitwise, and Ark Investment Management have recently retreated from including staking features in their proposed Ethereum ETFs. Aimed at facilitating smoother regulatory approvals, these decisions could render the ETFs less appealing compared to other investment avenues offering higher yields through active crypto staking.

Read more: Ethereum ETF Explained: What It Is and How It Works

Moreover, Hong Kong’s ambition to establish itself as a crypto hub extends beyond ETFs. The region is also examining applications to expand its array of licensed digital-asset exchanges and is developing a framework for stablecoins. These cryptocurrencies aim to minimize price volatility by being pegged to a reserve asset, such as fiat currency.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.