Throughout 2022, the collapse and fallout of major crypto institutions triggered a massive sell-off. Despite this, a recent Paxos report shows that most crypto users in the U.S. have no qualms with continuing to let intermediaries hold their funds.

2022 was a tumultuous year for the crypto industry, characterized by volatility and uncertainty. However, despite the challenges, the industry continued to grow and evolve. More and more people worldwide are embracing cryptocurrencies and blockchain technology.

Despite a volatile year for cryptocurrency, enthusiasm for this asset class has continued to grow. The price of cryptocurrencies like Bitcoin, Ethereum, and others has seen significant fluctuations. But, many factors contribute to the ongoing enthusiasm for these digital assets.

Investor Outlook on Cryptocurrencies

One of the main drivers of this enthusiasm is mainstream institutions and investors’ increasing adoption of cryptocurrency. For example, major companies have invested heavily in Bitcoin, while financial institutions like JPMorgan and Goldman Sachs offer cryptocurrency services to their clients. This growing acceptance of cryptocurrency by established players in the financial world has helped to legitimize this asset class in the eyes of many investors.

In addition, individuals worldwide have a growing awareness of cryptocurrency’s potential benefits, such as decentralization, security, and privacy. Many people are excited about the possibilities that blockchain technology and cryptocurrencies can offer, such as enabling faster and cheaper cross-border transactions and enabling access to financial services for the unbanked.

Finally, the pandemic also played a role in driving interest in cryptocurrency, as many people have been looking for alternative investment opportunities in the face of economic uncertainty. While the volatility of cryptocurrency prices can cause concern for some investors, the ongoing enthusiasm for this asset class suggests that it will likely continue to play an essential role in the global financial landscape.

2022 Tested the Resilience of the Crypto Space

The United States is one of the top trending geographical landscapes in the crypto space. This is evident in a recent Paxos survey shared with BeInCrypto. The survey’s main purpose was to understand how the 2022 fallout impacted U.S.-based crypto owners. Indeed, it was a volatile and potentially confidence-testing year for the ecosystem.

Here the respondents lived in the United States, represented over 18 years old, and had a cumulative household income in surplus of $50,000. Also, the candidates purchased cryptos within the last three years. Overall, the survey recruited 5,000 participants.

Crypto Enthusiasm in the US

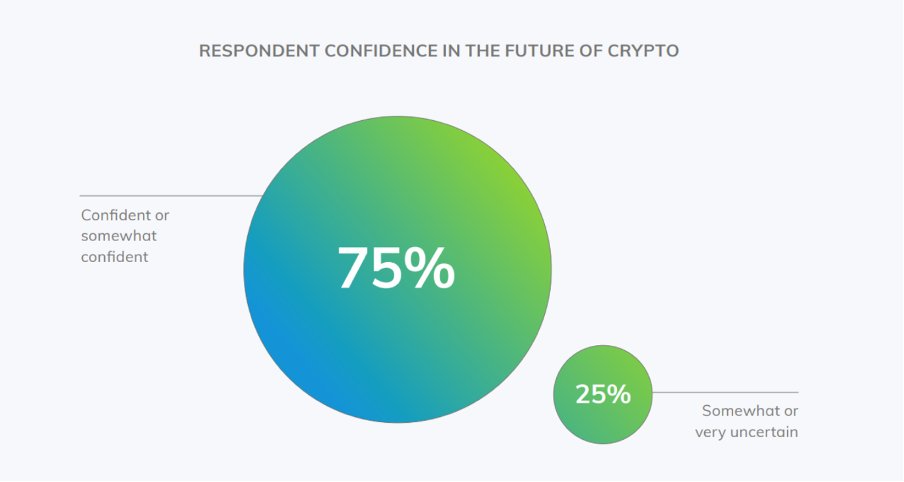

Surprising or not, consumers remained undeterred in their optimism regarding crypto investments. The cohort represented 75% of those surveyed by the firm- “confident or somewhat confident” in the future of the crypto space.

About one-third of surveyed candidates bought their first crypto despite last year’s black-swan events. Meanwhile, 72% of respondents were “a little worried or not worried at all” about volatility in crypto markets over the past year.

Overall, the fact that most respondents expressed confidence in the future of cryptocurrency suggests that many people see potential value in this emerging technology. However, it’s essential to continue monitoring the development and adoption of cryptocurrency to understand its long-term prospects better.

To understand and record more user opinions, BeInCrypto created a small survey on Reddit, asking for the reasons behind their crypto enthusiasm. Many Redditors voiced their opinion on the platforms. For instance, one of the replies read:

“I’m pretty much confident. Volatility is just a part of the market, but I have looked beyond that. Interest is growing & we are seeing major mainstream companies embracing blockchain tech. Innovative solutions from Polygon, Ocean, Algorand, etc., continue pushing adoption further, opening the opportunity for web2 companies to join web3.”

Another user echoed or instead bolstered crypto’s role as a payment gateway. The Redditor added, ‘I am quite confident in the future of crypto mainly because I can see the adoption growing exponentially as we now have more opportunity to make payments for goods and services with crypto via payment platforms.’

Putting Faith in Intermediaries

The next segment of the report might surprise many readers. 89% of respondents still trust intermediaries such as “banks, crypto exchanges and/or mobile payment apps” to hold their crypto.

“In fact, despite the high-profile collapses and underlying poor risk management practices seen in several crypto companies, crypto owners still trust intermediaries to hold crypto on their behalf.”

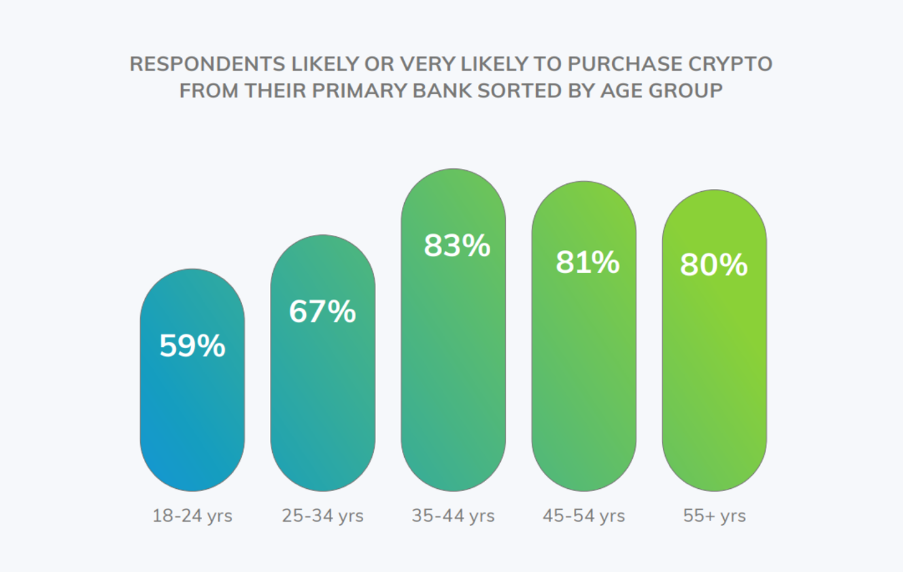

In addition, more than 70% of candidates said they are ‘likely or very likely’ to purchase crypto from their primary bank if offered. This accounted for an increase of 12% from last year’s survey outcome. Also, more than 40% of respondents are encouraged to invest more in crypto, if integrated, by banks and other financial institutions.

Needless to say, these institutions have an untapped opportunity if exposed to the full potential of cryptocurrencies. That is, opening the portal to offer digital asset custody without restrictions.

Ups and Downs of Centralized Entities

Centralized custodians are third-party entities that hold and manage digital assets on behalf of their clients. They are responsible for ensuring the security of the assets and protecting them against theft, loss, or other risks. In the cryptocurrency industry, centralized custodians are crucial in providing institutional investors and other large entities with a secure and reliable way to hold and manage their digital assets.

However, the reliance on centralized custodians has also been debated and criticized within the cryptocurrency community. Some argue that relying on third-party custodians goes against cryptocurrencies’ decentralized and trustless nature. It introduces a single point of failure and requires users to trust the custodian’s security measures.

The collapse of FTX, or any other centralized custodian, eroded such entities’ credibility and trustworthiness in the eyes of investors and the broader public. However, it’s essential to note that not all custodians are created equal. Many reputable custodians have robust security measures and track records of reliability.