The Uniswap (UNI) price has been posting green candlesticks for the past five weeks, during which it gained considerably. However, despite charting a 164% increase, the Decentralized Exchange (DEX) token still fell short.

What will it take for UNI to join the league of tokens, posting fresh all-time highs?

Can Uniswap Price Continue Its Rise?

Uniswap price, trading at $15.82 at the time of writing, has shot up by more than 25% in the last 24 hours. These gains have massively contributed to the ongoing rally witnessed by the DeFi token as UNI rose by 164% from $5.97 to its current trading price.

Doing so brought significant profits to its users, but not everyone. This is because Uniswap’s price is far from its former all-time high of $42.66, registered in April 2021. The altcoin would need to rally by another 170% to breach this level and establish new highs.

While a rise as massive is uncertain, given UNI just marked a rally, it could still inch a little further and flip the $19.20 resistance level into support. Doing so would allow UNI to potentially test the barrier of $20 and maybe possibly breach the key psychological price level.

This would strengthen the conviction present in the market and initiate further increases. Investors are refraining from selling their holdings and instead aiming at accumulation. The intensifying buy pressure can be witnessed as a decline in the supply on exchanges.

This shows that UNI is exiting the exchanges potentially into wallets, exhibiting a bullish signal.

DEX Users Jump on the Bandwagon

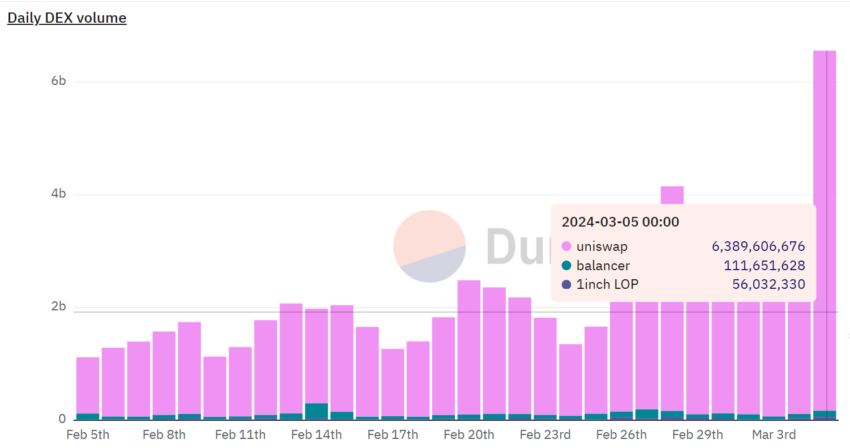

Beyond network participation, usage of the Uniswap DEX has also surged as users actively conduct transactions on the platform. The daily exchange-traded volume of Uniswap crossed $6.3 billion in the last 24 hours.

This is not only the largest single-day volume in the past month but also the largest volume in more than three months. Generally, users tend to hold back following significant rallies since there is potential correction, but Uniswap users’ conviction is much stronger than skepticism.

UNI Price Prediction:

Uniswap price is just as much at risk of a decline as it is at the opportune of a rally. The reason is the gains observed by investors in the past month. The Market Value to Realized Value (MVRV) ratio evaluates the average profit or loss of investors who bought an asset. The 30-day MVRV measures this for those who bought in the last month.

For Uniswap, the 30-day MVRV stands at 44%, suggesting recent investors hold 44% profits. They may off-load their holdings to lock in gains, potentially causing a sell-off. Historically, UNI experiences significant corrections when MVRV reaches the 11% to 33% area, termed a “danger zone” in the chart below.

Since, at the moment, the ratio has surpassed the danger zone, it is more likely to witness corrections. This would potentially push UNI to below $12, which could send Uniswap’s price to $10, with the next support at $7. Losing any of those key support zones would invalidate the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.