Binance has unveiled eight pivotal narratives poised to sculpt the crypto market’s future in 2024.

This forecast, rooted in the vibrant growth and innovation of the past year, offers a glimpse into what lies ahead.

Crypto Market Trends to Dominate 2024

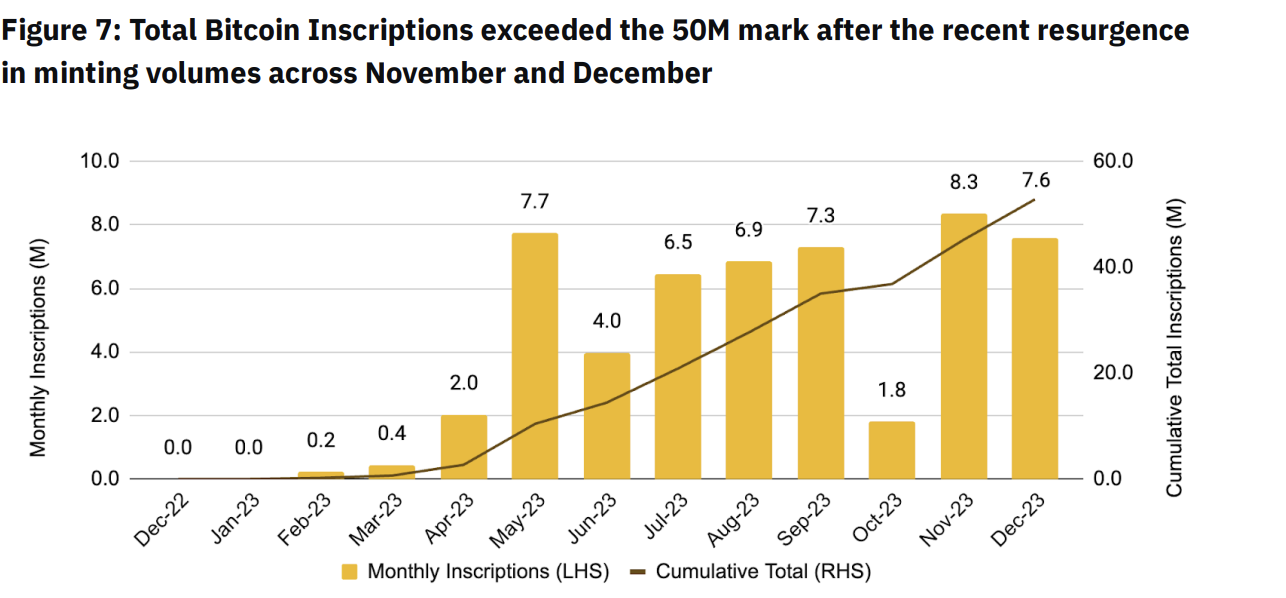

At the forefront, Bitcoin continues to assert its dominance. The year 2023 was marked by significant strides in Bitcoin’s journey, including the introduction of innovations like Ordinals and BRC-20 tokens and the establishment of spot Bitcoin ETFs, culminating in the much-anticipated 2024 halving event.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

According to Binance, these developments and favorable SEC rulings will potentially inject heightened activity and volatility into Bitcoin’s orbit. Digital assets like Ordinals and BRC-20 tokens will potentially experience dramatic shifts due to their memecoin-like qualities and smaller market caps.

Parallel to Bitcoin’s ascent, the rise of the ownership economy, enabled by blockchain technology, is reshaping user control over data and creative content. The previous year saw a surge in decentralized physical network infrastructure (DePin) and decentralized social media (DeSoc). Notably, platforms like Friend.tech led substantial growth in DeSoc.

“These protocols are viewed as having high growth potential due to their extensive total addressable market and their ability to scale rapidly through bottom-up growth strategies,” Binance wrote.

As these DePin and DeSoc projects continue to expand in 2024, they promise enhanced control and monetization opportunities for users over their digital assets.

The Integration of AI and Cryptocurrencies

Another growing crypto narrative is the integration of Artificial Intelligence (AI) with cryptocurrency. Sparked by the global traction of OpenAI’s ChatGPT in 2023, this synergy is opening new avenues in trade automation, predictive analytics, and data management.

As AI intertwines with the crypto ecosystem, it has the potential to democratize AI model training. It also has the potential to enhance transparency and security through decentralized storage, which is becoming increasingly evident.

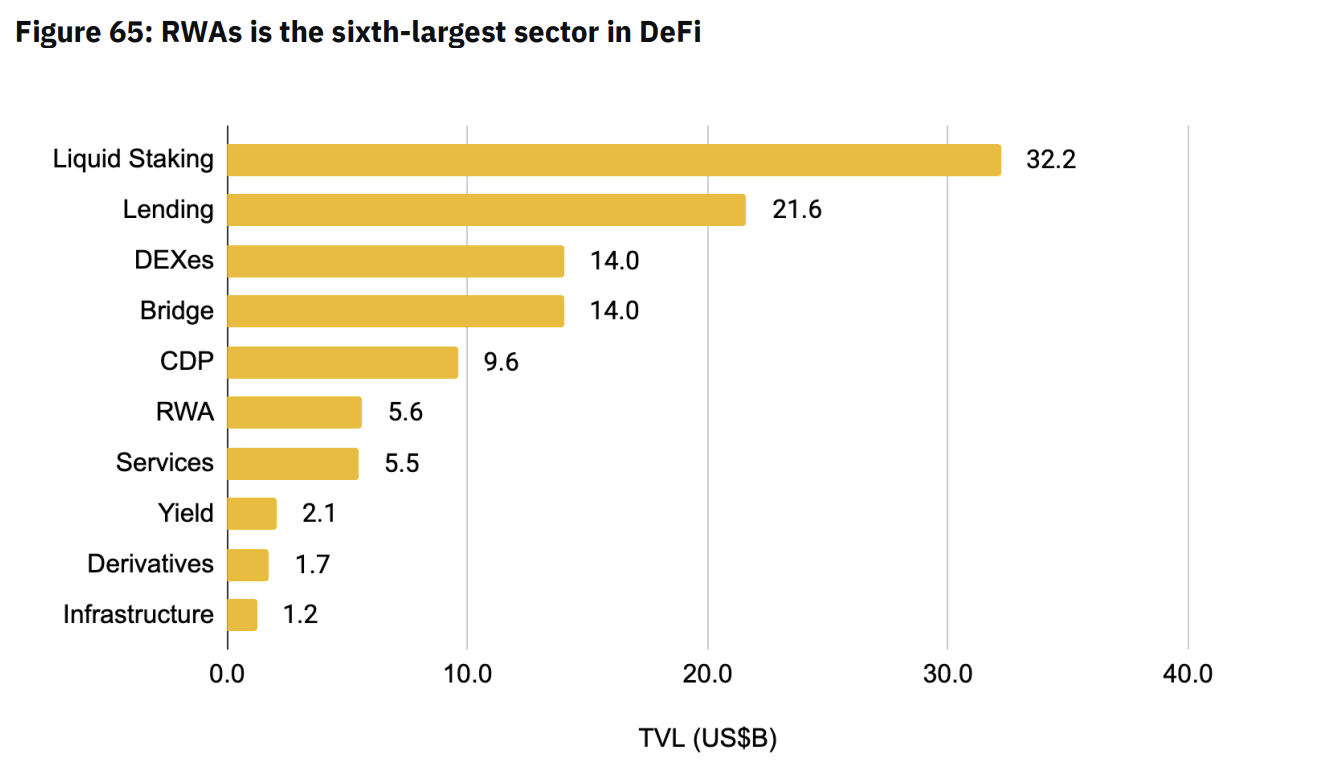

Simultaneously, the tokenization of Real-World Assets (RWAs) is revolutionizing blockchain utility. This process is bringing off-chain assets onto the blockchain, enhancing transparency and efficiency in the process.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

As 2024 unfolds, tokenized treasuries, buoyed by elevated interest rates, are emerging as an attractive yield source for crypto investors. Moreover, accelerated institutional adoption of RWAs, alongside advancements in related infrastructures like decentralized identity and oracles, will likely bolster this trend.

Even Larry Fink, CEO of BlackRock, highlighted tokenization as a groundbreaking technological advancement that could revolutionize asset management.

“We have the technology to tokenize today. If you have a tokenized security and identity, the moment you buy or sell an instrument on a general ledger, that is all created together. You want to talk about issues around money laundering. This eliminates all corruption by having a tokenized system,” Fink explained.

Other Crypto Narratives to Pay Attention To

Regarding on-chain liquidity, a fundamental component of the DeFi ecosystem, Binance believes that a significant evolution is underway. Sophisticated liquidity models, such as Uniswap V3’s Concentrated Liquidity Market Maker (CLMM) and Request for Quote (RFQ) systems, are reshaping this market sector.

These models, designed to address challenges like Impermanent Loss and Just-In-Time liquidity, indicate the growing sophistication and potential within on-chain trading. Moreover, they are expected to elevate the scale and accessibility of on-chain financial activities.

Hand in hand with the evolution of on-chain liquidity is the accelerated institutional adoption of cryptocurrencies. Moreover, the entry of heavyweight asset managers like BlackRock and Fidelity into the crypto market signifies a robust belief in the industry’s long-term potential.

The forthcoming Bitcoin halving will likely draw even more institutional players into the crypto industry. CoinShare study reveals the average cost of production per Bitcoin post-halving is likely to rise to between $27,900 and $37,800. This will position only a few miners to remain profitable, further impacting the cryptocurrency market.v

“The cost of production and profitability structures for miners will change following the 2024 halving… Most miners will face challenges necessitating cost reductions to remain profitable. Only a handful of miners are expected to operate profitably if Bitcoin prices remain [below] $40,000,” analysts at CoinShares noted.

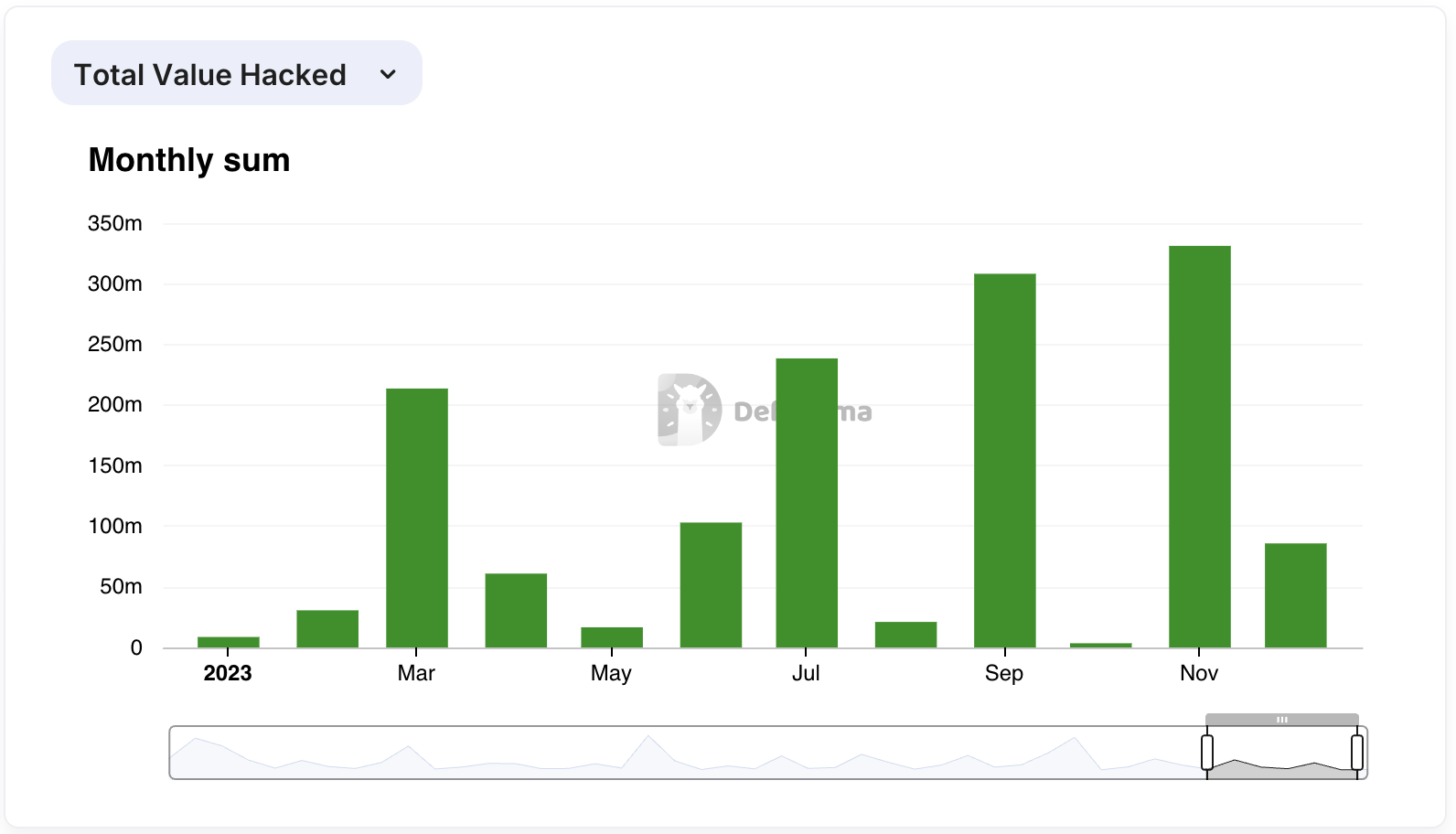

In the backdrop of these exciting developments, security remains a paramount concern. The industry has made commendable strides in enhancing security measures, as evidenced by decreased DeFi exploits. However, the focus on fortifying defenses remains unwavering.

Finally, the importance of account abstraction is coming to the fore. It is a crucial step in making blockchain technology more accessible and inclusive. Innovations in this space, particularly in creating user-friendly smart contract wallets, are set to revolutionize how users conduct on-chain activities.

Read more: What is Account Abstraction?

With intense competition among wallet providers, rapid advancements in this area are anticipated. Lastly, the crypto community and developers believe that account abstraction can pave the way for the next billion users to join the Web3 sector.