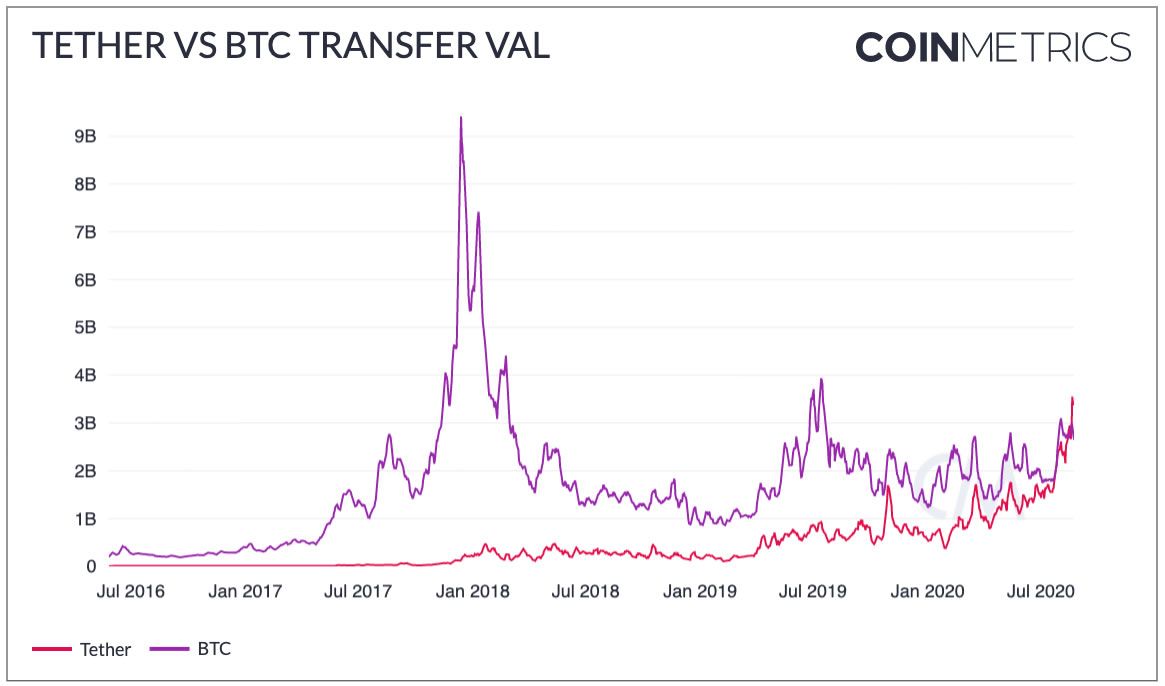

He also cited a recent Chainalysis report and suggested that there could be an increased capital flight from China as over $50 billion in cryptocurrency traveled from East Asia to addresses in other regions over the past year.Tether is now doing $3.55 billion in daily transfer value: https://t.co/CpW34wL3jA via @coinmetrics

— John Paul Koning (@jp_koning) August 25, 2020

Not bad. In Q2 2020, @PayPal did just $2.94 billion per day: https://t.co/kD3Bt9BEYF pic.twitter.com/uxaagM9pXU

Tether is by far the most popular stablecoin in East Asia, making up 93% of all stablecoin value transferred by addresses in the region. Around $18 billion of the $50 billion has been moved using Tether. Chainalysis debunked the capital flight theory, however, stating;Plenty of interesting data about Tether, the most popular US$ stablecoin: https://t.co/TUxKQleuWx

— John Paul Koning (@jp_koning) August 25, 2020

-Tether just beat Bitcoin to be the most-received cryptocurrency by East Asian addresses.

-Around $50 million Tethers leave East Asia each day. Chinese capital flight? pic.twitter.com/2umNo6Bhbp

It’s highly unlikely that all of this is capital flight. Much of it is likely related to mining activity, as we’ve heard anecdotally that China-based miners or their counterparties often convert newly-mined coins into Tether before sending it on to larger exchanges serving more regionsAccording to the Tether Transparency report, the total supply is now in excess of $13 billion, though crypto analytics websites such as CoinMarketCap still report it the total at $10 billion. Coin Metrics also noted the milestone and Tether’s rapid growth. The USDT supply was less than $10 billion on June 1, and less than $5 billion on March 1, 2020. This year alone, USDT supply has expanded by 225% as the stablecoin continues to be integrated into more networks.

According to ETH Gas Station, Tether is the second-highest source of Ethereum network fees, with a gas usage of $8.6 million over the past thirty days. This has prompted it to seek faster and cheaper alternatives such as the Layer 2 OMG Network. The researchers noted that as a result, OMG’s daily active addresses have already shot up to their highest levels since August 2018.

Tether stated that uncertainty could be driving people to seek out better payment methods;

According to ETH Gas Station, Tether is the second-highest source of Ethereum network fees, with a gas usage of $8.6 million over the past thirty days. This has prompted it to seek faster and cheaper alternatives such as the Layer 2 OMG Network. The researchers noted that as a result, OMG’s daily active addresses have already shot up to their highest levels since August 2018.

Tether stated that uncertainty could be driving people to seek out better payment methods;

Amid these uncertain and challenging times, the utility, security and viability of digital currencies have come to the forefront. People are looking for alternatives to antiquated banking and payment systems.The trend is set to continue as DeFi markets make new milestones on a regular basis, so it shouldn’t be long before the USDT supply hits $20 billion.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.