The largest stable coin, Tether (USDT) has grown in market cap by $1 billion over the last 9 days. This could be a response to the Bitcoin’s (BTC) rocketing price.

Perpetual Growth

The US dollar-pegged stablecoin Tether (USDT) grew once again over the last week. While the company claims that each USDT is backed 1-to-1 by a US dollar, it has come under scrutiny in the past. After all, where does $1 billion come from?

Indeed, the exchange Bitfinex, the alleged origin of USDT (though the independence of Tether is under debate), appears to be behind the rise in market cap. Paolo Ardoino serves as CTO of both Bitfinex (a large exchange) and Tether, though the companies insist they are separate.

In fact, Bitfiniex and Tether were subject to a lawsuit over the issue. A class action lawsuit alleges that Tether and Bitfinex colluded to manipulate the price of Bitcoin in 2017. It says that Bitfinex printed Tether to buy up Bitcoin and inflate the price, only to sell it for more Tether. On Jun 4, 2020, the lawsuit was amended to include the exchanges Bittrex and Poloniex as well.

Tether denounced the allegations.

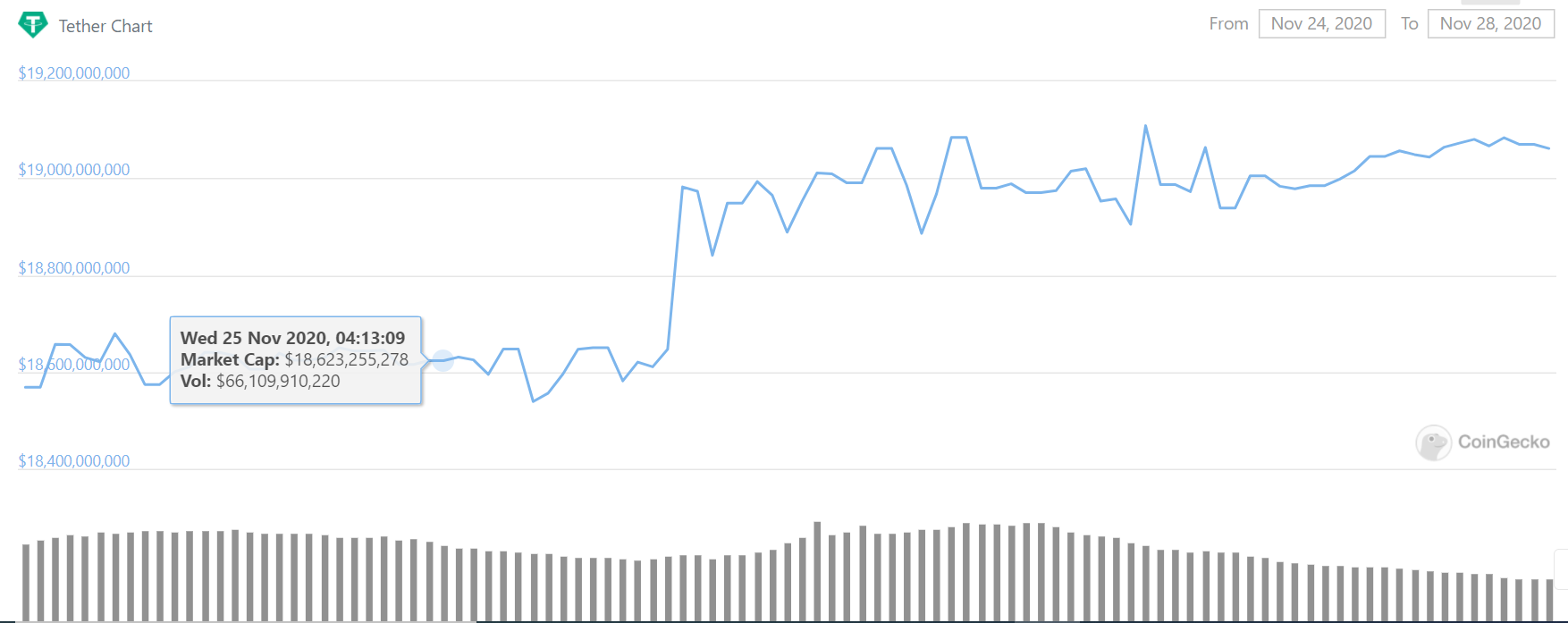

Ardoino tweeted on Thursday, Nov 26, 2020 about the event. This expansion is the second largest in history. The record, set on Sep 4, 2020, saw the supply increase another billion over eight days.

Overnight Billionaires

At the start of 2020, the USDT market cap was around only $4 billion. This is double the $2 billion that was consistent for most of 2019. It is unclear where Tether acquired the $15 billion to back the market cap over the last year.

Regarding this most recent jump, $370 million appeared over the course of November 25th, according to CoinGecko.

The stablecoin has seen other milestones. In 2020, it added 2 billion USDT to the Tron network, $300 million of which was later returned to Ethereum because of lack of interest. It also briefly surpassed XRP as the number three cryptocurrency by market cap.

Money Machine Goes Brrrrrr

Some users on Twitter poked fun at this massive growth as a scam. One animated gif compares Tether to the US Federal reserve which printed 20% of all USD cash in the last year. The animation shows the press spewing out dollars.

The GIF is used to satire the Fed’s inflationary policy, often in defense of Bitcoin’s supposedly more stable value. The use of the meme for Tether turns the satire on its head.

Demand could be dictating new printing. In February, the large crypto exchange Binance ran out of Tether because of a surge in margin trading. Users were longing Bitcoin. This came just after Tether burned $102 million in USDT for redemptions. Tether eventually printed more to meet demand.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.