Sygnum Singapore has secured a license from the Monetary Authority of Singapore (MAS) to run a crypto brokerage. The Singapore branch of the Swiss bank received its Major Payment Institution License (MPIL) approval on Tuesday.

The license activates Sygnum’s Digital Payment Token brokerage service to give large investors access to crypto. The service offers a crypto-fiat gateway and executes trades for multiple cryptocurrencies.

MAS Approval Can Boost Crypto Interest

Sygnum Singapore received in-principle approval for the MPIL license in June. According to the initial application, the Singapore business would handle custody and brokerage, while Sygnum Switzerland would execute trades.

According to Sygnum Singapore’s CEO Gerald Goh, the approval highlights MAS’ progressive approach to crypto regulation.

“The MAS is one of the most progressive regulators in the world when it comes to providing a clear and robust framework around digital assets. The most recent guidelines on stablecoins have shown the industry a well-defined path forward. We believe such developments will empower investors to increase their exposure to digital assets with complete trust.”

Read more: Crypto Portfolio Management: A Beginner’s Guide

Singapore’s history of attracting direct foreign investment is promising for crypto. Last year, the city attracted $195 billion in foreign inflows, according to the Financial Times.

In addition, the region has been particularly accommodating to digital asset payment businesses. MAS has already approved Digital Token Payment Service applications from Coinbase, Circle, Ripple Labs, and Revolut.

Crypto Pulls Away From Macro

Even as US investors await the approval of Bitcoin spot exchange-traded funds, the move from Sygnum could introduce some much-needed liquidity into crypto markets. Institutional demand for a regulated crypto investment vehicle could cause asset managers to buy and hold crypto on behalf of clients.

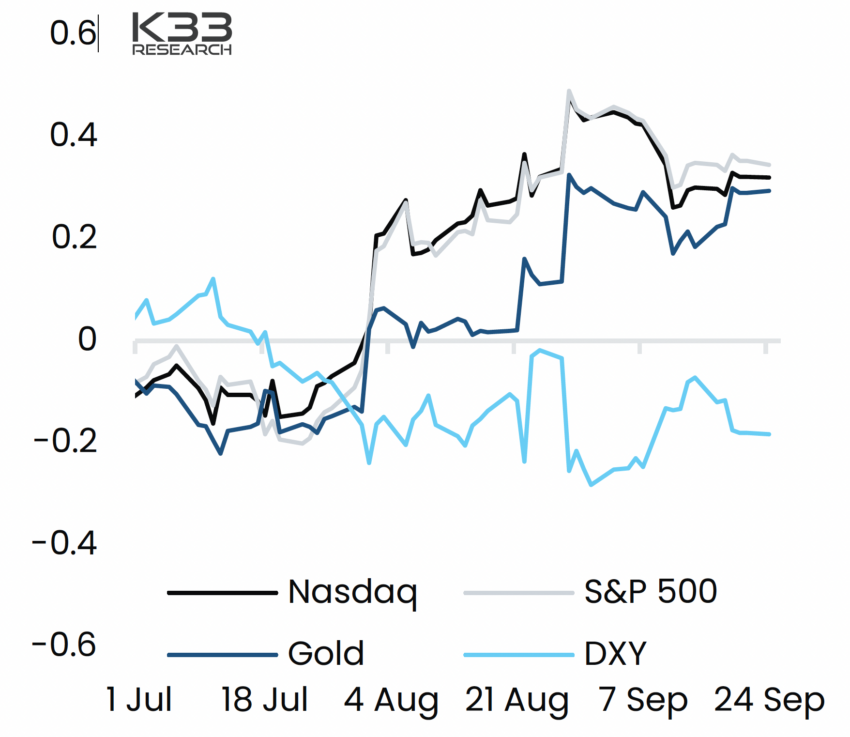

The need for capital inflows is especially important since crypto assets’ inverse correlation with equities appears to be growing. Last week, K33 Research said that the correlation between crypto and stocks had fallen to about 0.2.

Therefore, crypto investors may need to look to more crypto-specific events to guide investment decisions. License approvals like Sygnum’s, as well as next year’s halving event that reduces the reward Bitcoin miners receive for solving transaction blocks may cause prices to rise.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

Got something to say about Sygnum Bank securing a crypto license, current crypto market liquidity, or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.