Singapore’s Monetary Authority has specified new protocols for transferring digital programmable money.

The central bank released a whitepaper describing the life cycle of so-called purpose-bound money and how it could be programmed to settle transactions between businesses and vendors.

Banks Pursue Programmable Purpose-Bound Money for Rapid Settlements

Citizens can spend central bank digital currencies, stablecoins, and tokenized bank deposits from wallets supporting the purpose-bound money universal protocol.

The protocol will allow transactions to be settled across different ledgers and embrace multiple use cases.

Grab Holdings, a Singapore-based financial institution, is exploring escrow to clear online buyers’ payments only upon receipt of goods.

Banks favor the speed at which parties can exchange illiquid assets using blockchains. Transactions can also occur independently of a broker.

Citigroup predicts that the total addressable market covered by tokenization could increase 80 times by 2030.

The Bank of England (BoE) and the US Federal Reserve (Fed) will soon implement real-time settlement systems to speed up the exchange of assets.

The Fed’s FedNow system will address interbank settlements starting in July, while the BoE’s real-time gross settlement system will likely go live next year.

The BoE’s recent Project Rosalind trial explored how citizens could exchange funds without an intermediary.

The Role of Tokenization in Bridging CeFi and DeFi

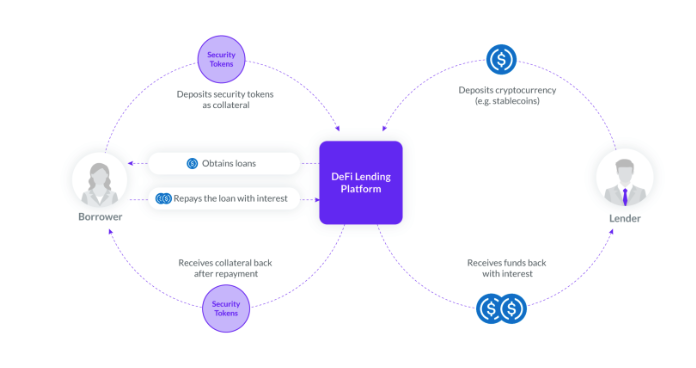

While the crypto community sees the tokenization of bank deposits and other assets as Wall Street’s attempt to hijack crypto, DeFi protocols can use the technology to onboard users onto decentralized finance.

Read here about the basics of decentralized finance.

A Korean consortium’s DeFi lending protocol ELYFI accepts tokenized real estate as collateral for lending. ELYSIA DAO LLC, a decentralized autonomous organization registered in Wyoming, tokenizes assets.

Users of ELYFI have legal recourse through ELYSIA DAO if hackers infiltrate smart contracts to steal assets.

Singapore’s own Project Guardian tested DeFi-compatible tokenized bonds and deposits.

JPMorgan, DBS bank, and SBI digital holdings participated in the buying and selling tokenized Singapore Government Securities, Singapore dollars, Japanese government binds, and Japanese yen.

The project’s success spawned a Standard Chartered project to tokenize tradable assets into transferable and transparent instruments. Later, HSBC, UOB, and Marketnode will work together to issue wealth management products digitally.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.