In a world where the boundaries between physical and digital assets are increasingly blurred, an exciting new era of real-life monopoly is unfolding. As the tokenization of real-world assets breathes life into once-immovable markets, wealth creation, and investment opportunities are rising as never before.

Tomorrow’s financial landscape will be one where tokenization reimagines real-world assets, unlocks unprecedented access, and profoundly reshapes industries.

“Whereas the internet created a better standard for how text, photos, audio, and video were exchanged, DeFi will create a better standard for how assets are exchanged,” said Teej Ragsdale, co-founder of Entheos Network.

The Emergence of Tokenized Assets

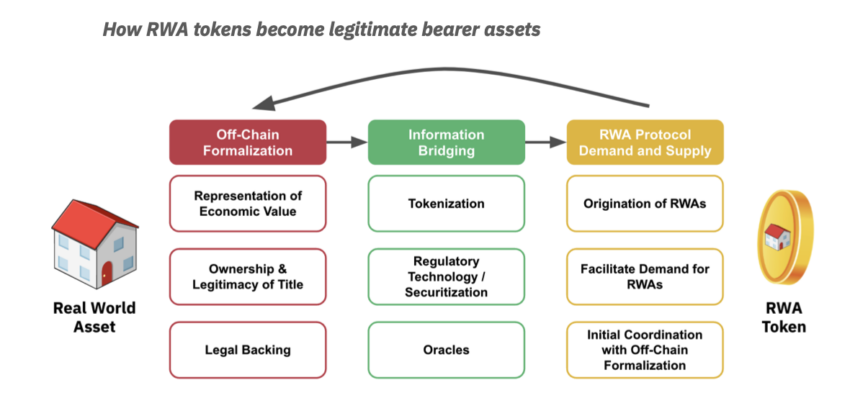

The rapid growth of digital assets has led to the emergence of tokenization. This is a process that converts real-world assets into digital tokens.

Tokenization allows for seamless and efficient trading, investment, and management of these assets. Indeed, it is becoming a key driver of digital asset adoption, as a Bank of America report highlights.

“Tokenized gold provides exposure to physical gold, 24/7 real-time settlement, no management fees and no storage or insurance costs,” analysts Alkesh Shah and Andrew Moss described.

The reduced minimum investment requirement bolsters accessibility. Meanwhile, “fractionalization enables the transfer of physical gold ownership and value that was not previously possible,” added Shah and Moss.

Tokenization is limitless to any asset, and its potential applications are vast. It can apply to real estate, fine art, and even intellectual property. This enables fractional ownership, liquidity, and access to previously illiquid markets.

Binance’s Real-World Asset report states that tokenization has the potential to disrupt traditional financial markets, unlock new investment opportunities, and democratize wealth creation. The core objective of real-world assets is in their long-term prospects.

Advocates for incorporating real-world assets into the blockchain champion the idea based on their belief that, over time, DeFi will offer unparalleled opportunities and market advantages to asset holders who find such benefits unattainable within conventional financial systems.

“Decentralized financial systems hold promise to dismantle some of the constraints found within TradFi, and in turn, deliver material improvements in regards to market efficiency and opportunities for asset holders. DeFi minimizes or completely cuts out the intermediation systems found in TradFi to effectively decentralize the back-end of financial markets,” noted Binance Research.

Likewise, Maple Finance CEO Sidney Powell maintains that tokenized real-world assets enhance DeFi by extending its services to businesses and clients without a crypto-centric background. As long as only Bitcoin or Ethereum is accepted as collateral, DeFi lending remains limited in scope.

“Being able to accept tokenized real estate or security over the property of a company reduces the risk for crypto lenders and investors because it makes it possible for businesses in the real world to use DeFi,” Powell concluded.

The Tokenization Revolution in Real Estate

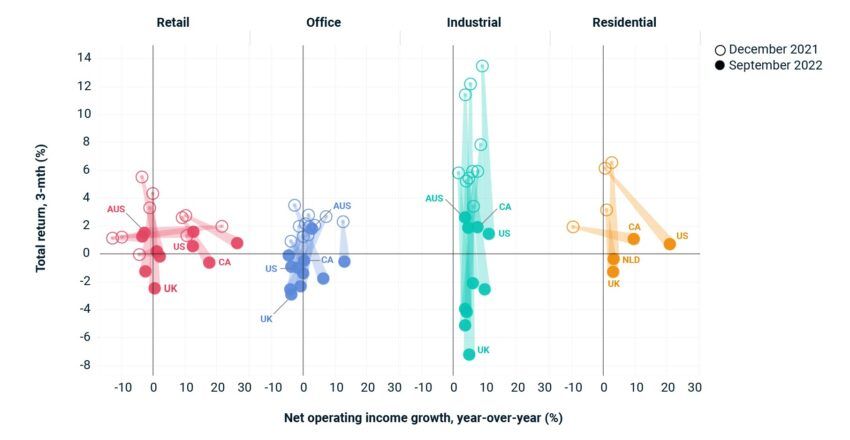

Real estate is a prime example of an industry that can greatly benefit from tokenization. Traditionally, investing in real estate has been an exclusive and illiquid market, with high entry barriers and cumbersome processes.

However, tokenization can potentially change this by making real estate investment more accessible and affordable.

Real estate mogul Grant Cardone points out that millennials tend to choose to rent over homeownership, as they are uninterested in being tied to long-term mortgages. They seek a lifestyle that offers flexibility and mobility, favoring a more transient existence. This coincides with baby boomers preparing to retire and leave their comfortable homes.

In light of this, tokenizing real-world assets opens up a distinct market opportunity for investors and real estate agents. Businesses can modify their marketing strategies to meet the demands of the millennial demographic.

Additionally, trading tokenized real estate on digital asset exchanges becomes easier, enhancing liquidity and price discovery.

In a recent blog post, Chainlink notes that tokenized real estate assets have the potential to provide new yield opportunities in DeFi markets. Users can leverage these assets as collateral for loans or stake them for passive income.

Art and Collectibles: Unlocking New Possibilities

Tokenization has also extended to the fine art and collectibles world, transforming how these assets are traded and owned.

Tokenizing art pieces or collectibles divides ownership into multiple shares, making them more accessible to a broader range of investors. This democratizes the art market and boosts liquidity and price transparency.

Essentially, tokenization can help combat issues such as forgery and fraud in art, as blockchain technology provides an immutable record of provenance and ownership. Investors find tokenized art assets more appealing, as they can easily trade them on digital platforms.

Zurich-based bank Sygnum made headlines after transferring the legal ownership rights of Picasso’s 1964 masterpiece, Fillette au béret, onto the blockchain. The digital asset was split into 4,000 tokens, with over 50 investors purchasing them at $1,040 each.

With the emergence of blockchain technology and its ability to provide immutable data, the legal system automatically acknowledged these digital tokens as legitimate portions of the artwork.

Tokenizing Intellectual Property and Patents

Another sector where tokenization makes waves is intellectual property (IP) and patents. Traditionally, IP rights have been difficult to manage, transfer, and monetize. Tokenization, however, addresses these challenges by transforming IP rights into digital tokens that can be effortlessly traded, licensed, or sold.

The potential benefits of tokenized IP include providing inventors and owners with new revenue streams while making IP investment more accessible to a wider audience. Furthermore, integrating tokenized IP into DeFi platforms creates new opportunities for lending and borrowing IP assets as collateral.

The case of Hermes International SA v. Rothschild brought into focus the intersection between intellectual property rights and the burgeoning world of tokenization.

In this lawsuit, Mason Rothschild, the creator of MetaBirkins NFTs, faced off against Hermès. The central question revolved around whether Rothschild’s work infringed on Hermès’ “Birkin” trademark rights or if the First Amendment protected it as an expression of free speech.

Determined by a nine-member jury in a Manhattan federal court, the monetary damages were inconsequential for a company that reported over $10 billion in revenue in 2021. Still, the decision significantly impacted companies that primarily derive their market value from their intellectual property.

Leann Pinto, President of IPwe (a FinTech specializing in IP valuation and currently focusing on tokenizing patent information), commented:

“Though Hermès’ victory may be largely symbolic, it represents a substantial win for those of us advocating for the tokenization of real-world assets, particularly intellectual property assets.”

Regulatory Challenges and the Road Ahead

Regulatory challenges have emerged as tokenization continues to gain traction across various industries. Governments and regulatory bodies are working to develop frameworks. The goal is to ensure the protection of investors while promoting innovation and growth in the tokenized asset market.

Clear guidelines and regulations ensure tokenized assets comply with existing laws, such as anti-money laundering (AML) and know-your-customer (KYC) regulations. Regulatory clarity is essential to foster institutional adoption and integration of tokenized assets into traditional financial systems.

Despite these challenges, the future of tokenized assets appears promising. With continuous innovation and the development of robust regulatory frameworks, tokenization can revolutionize the transfer of value and wealth in the digital age.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.