SUI, the native coin of Layer-1 (L1) blockchain Sui Network, rallied to an all-time high of $2.36 on October 14. However, as profit-taking activity gains momentum, SUI has initiated a downward trend.

The altcoin trades at $2.04 as of this writing, noting a 14% decline in the past two days. Its technical setup suggests that SUI is poised to extend this fall. The question remains: how low will SUI go?

Sui Traders Sell For Profits

At its current price, SUI trades just above the resistance formed at $1.97. If rising selling pressure causes this level to fail to hold, SUI’s price will seek support at its Ichimoku Cloud, which tracks its market trends and momentum and acts as support/resistance levels.

As in SUI’s case, the Ichimoku Cloud can act as a support level if the price approaches from above. If its price enters or breaks below the cloud, it indicates a trend reversal from bullish to bearish. The cloud often acts as a transition zone; falling into or below it shows weakening momentum and could signal a potential bearish phase.

Read more: Everything You Need to Know About the Sui Blockchain

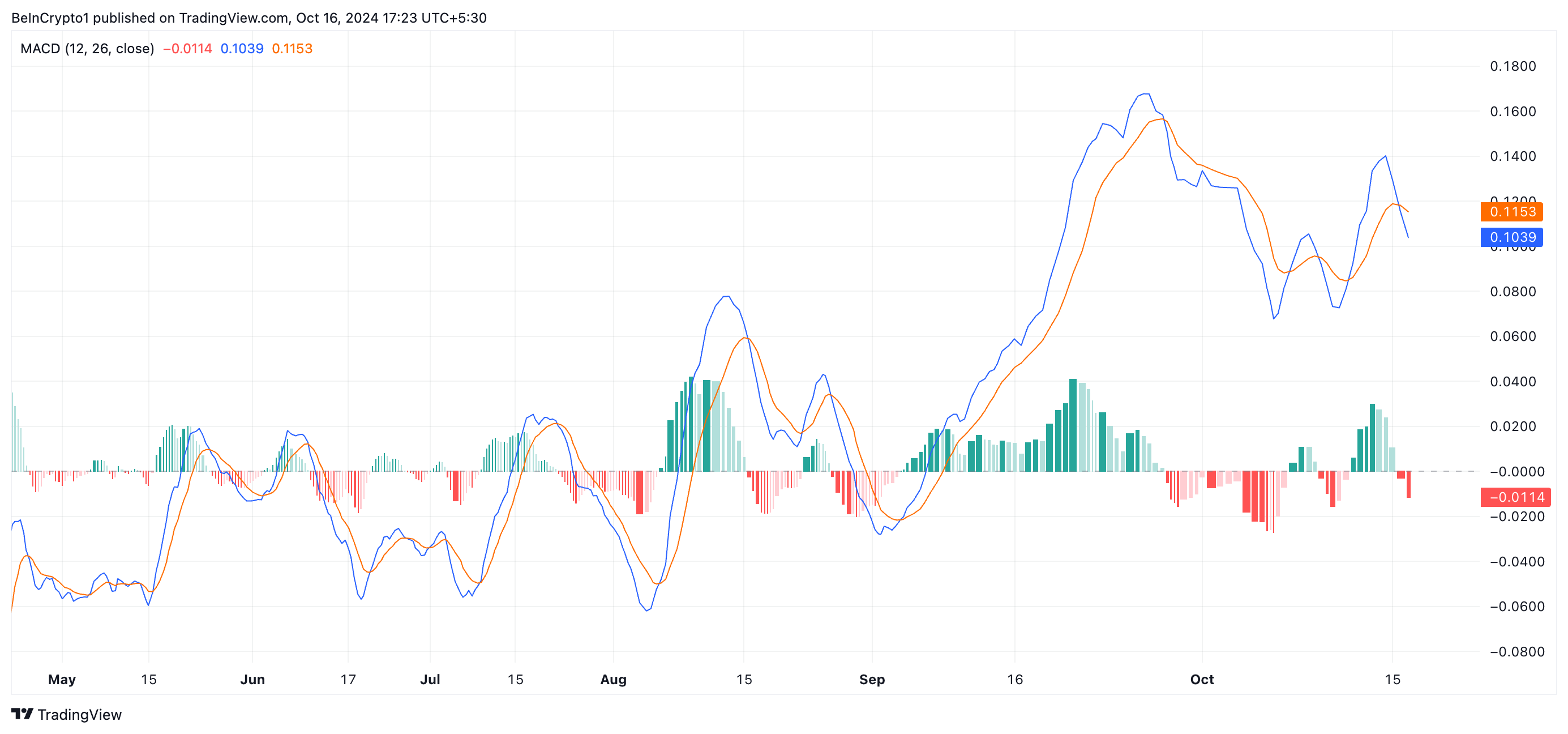

Readings from SUI’s moving average convergence/divergence (MACD) confirm this bearish outlook. Its MACD line (blue) recently crossed below its signal line (orange), signaling a shift in the market’s sentiment from bullish to bearish.

The cross below the signal line shows that an asset’s shorter-term moving average (represented by the MACD line) is falling faster than the longer-term average (signal line). This typically reflects increased selling pressure in the market, which many traders view as a sign to sell or exit long positions.

SUI Price Prediction: Interest in Coin Has Dropped

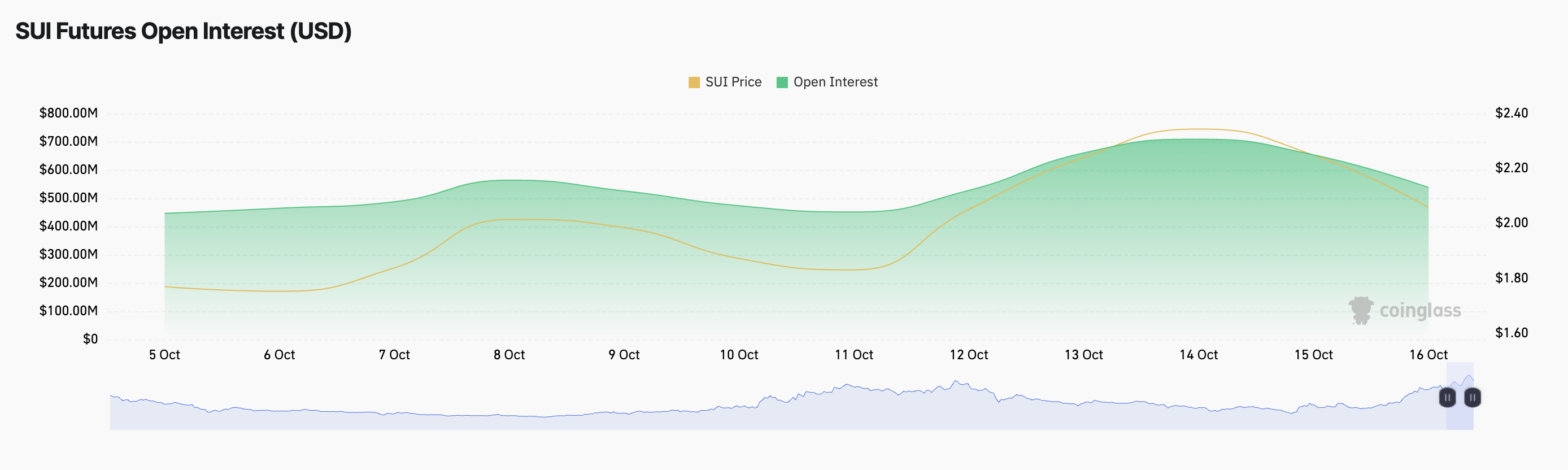

SUI’s declining open interest is another strong indicator of reduced interest in the altcoin. After reaching an all-time high of $709 million on October 14, open interest has steadily trended downward, signaling that fewer traders are maintaining active positions in SUI. It has fallen by 24% in just two days, now at $538 million.

This drop suggests a reduction in market participation and could indicate that investors are closing out positions, potentially expecting further price declines. If the selling pressure increases, SUI’s price may fall by 55% to trade at $0.91.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

However, this bearish outlook could be invalidated if new demand enters the market. SUI may reclaim its all-time high of $2.36 and potentially surge beyond it.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.