SUI price impressed the market yesterday, noting the best performance among altcoins.

However, this bullish event may not be as positive as it appears to be. Bearish cues are still lingering, and SUI could witness their impact.

SUI Breaks the Downtrend Line

SUI price rise resulted in the altcoin breaching the nearly four-month-old downtrend. Interestingly, this downtrend line, along with the Relative Strength Index (RSI), is currently forming a hidden continuation divergence.

This pattern typically indicates a bearish outcome and suggests that the overall trend may continue downward. As the hidden continuation divergence takes shape, it reinforces the notion of a prevailing drawdown, which could send SUI back down below the downtrend line.

What this means is that the price could continue to face downward pressure.

Read More: Everything You Need to Know About the Sui Blockchain

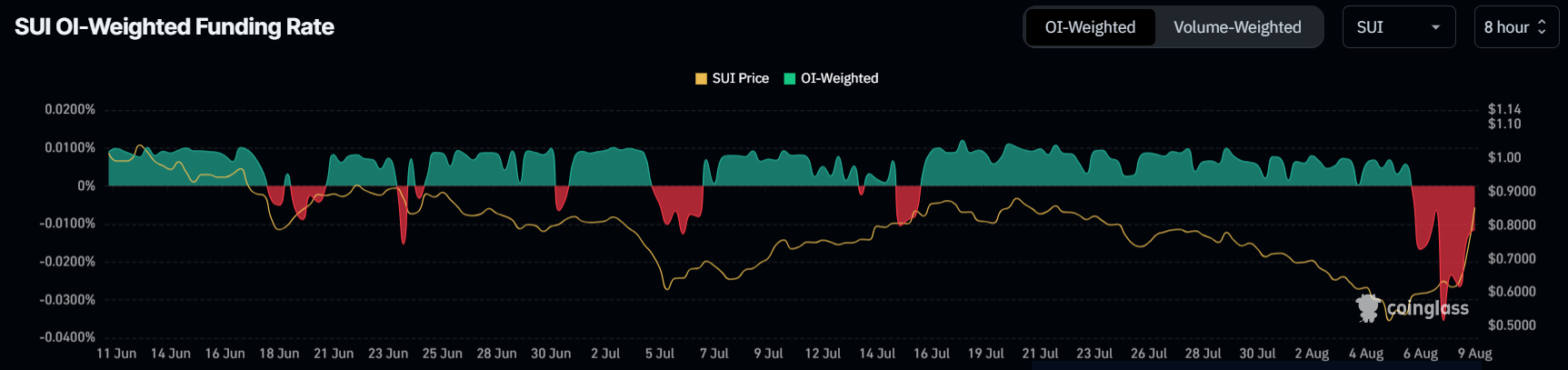

Adding to the bearish sentiment, SUI’s negative funding rate further supports the pessimistic outlook. A negative funding rate generally signifies that more traders are betting against the asset, which can contribute to downward price pressure and reinforce bearish trends.

The persistent negative funding rate indicates a growing bearishness among investors regarding SUI’s future performance. As more traders align with this sentiment, it can amplify the negative outlook and potentially lead to continued price declines.

SUI Price Prediction: Rise Ahead? Not Really

The SUI price could be taking an about-turn and heading back down to test support at $0.779. The aforementioned cues indicate that the altcoin is not witnessing enough strength to fight the market’s bearishness.

Should this sentiment intensify, SUI could fall toward $0.707. If it further loses the $0.707 support, the price could drop to $0.639. Any more drawdown would completely wipe the 38% rise from yesterday.

Read More: A Guide to the 10 Best Sui (SUI) Wallets in 2024

However, if investors’ sentiment changes and the crypto asset holds above $0.779, it could have a shot at breaching $0.894. Thus, SUI could invalidate a two-month-old barrier and the bearish thesis.