The Sui Foundation has strongly denied allegations of insider selling after claims surfaced of a $400 million SUI token selloff by insiders. This had sparked widespread backlash within the cryptocurrency community.

An on-chain investigation led by well-known crypto analyst Light fueled the controversy. He suggested that large transfers of SUI to Binance, OKX, and Bybit originated from wallets associated with the Sui Foundation.

Rumored $400 Million SUI Insider Selloff

Light’s investigation revealed that during a period of rising SUI token prices, a large foundation wallet transferred millions of tokens. The insiders likely sold the tokens, valued at approximately $400 million. While Light did not disclose specific wallet addresses, he pointed to an infrastructure partner linked to the Sui Foundation.

The analyst highlighted a staking account (0x7f3b…3239e4) that holds 183 million SUI, valued at around $418 million. He also connected several other addresses to large SUI transfers.

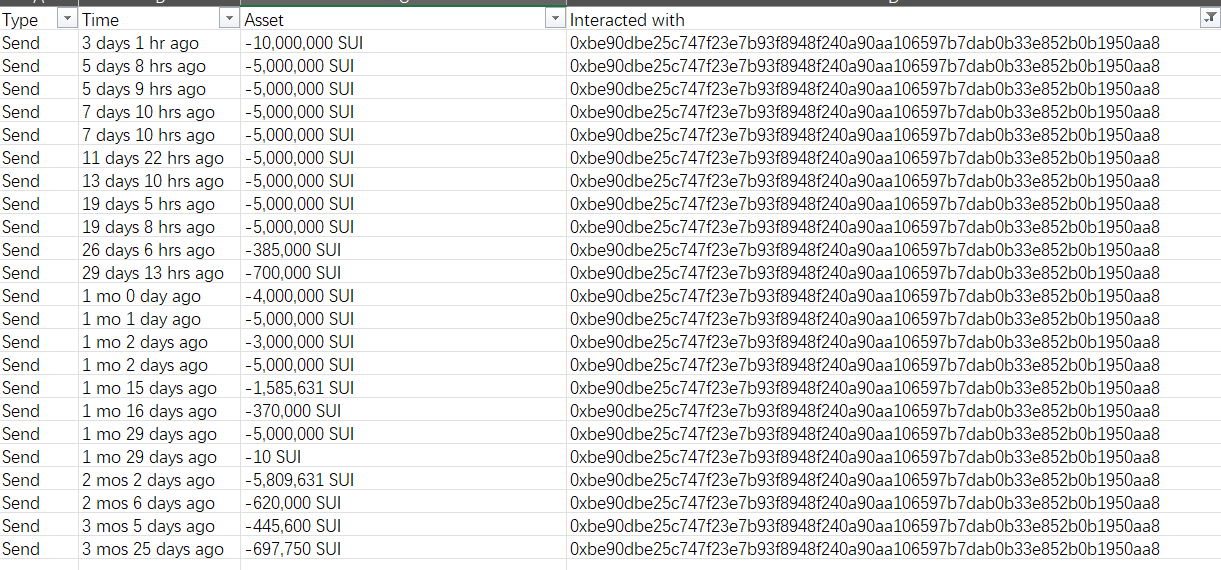

One key address (0xbe90…950aa8), supposedly acting as a transit wallet, has been used to transfer tokens in small, frequent transactions to another address (0x457f…6715e7). The investigation linked the latter address to major crypto exchanges like Binance, OKX, and Bybit.

Read more: Everything You Need to Know About the Sui Blockchain

Since late June, the key address (0xbe90…950aa8) has redeemed over 82.6 million SUI from the staking account. It currently holds 10 million SUI tokens. Taken together, these transfers, particularly the ones to exchanges, raised concerns about large-scale insider selloffs.

Meanwhile, the controversy surrounding SUI is not new in South Korea. In 2023, the Sui ecosystem faced scrutiny during a Korean National Assembly audit. The concerns were over opaque SUI token allocation management.

Further complicating the latest situation, South Korean media outlet Block Media observed similar wallet activity in June. The report suggested that it was not an isolated event. Noting that these wallets did not transfer tokens directly to prominent Korean exchange Upbit, the local report articulated that they were funneled through Binance, OKX, and Bithumb.

“…of particular note is the absence of any direct coin transfer from the Sui Foundation to Upbit. Instead, investigations uncovered a series of transfers totaling 95 million Sui coins from Binance, OKX, and Bithumb to Upbit. This unusual pattern and Upbit’s confirmation of compliance with ‘Travel Rule’ regulations raise questions about the Sui coin transfers that demand the Sui Foundation’s clarification,” the report read.

In the early stages, Upbit held a dominant position in SUI trading, commanding over 20% of the market at its peak. Although its share has since dropped to 7.5%, Upbit remains a key player, second only to Binance, which controls 16.5% of SUI trading.

Sui Foundation Responds to Light’s Allegations

In response to the allegations, the Sui Foundation issued a statement denying any involvement of its employees, insiders, or foundation members in the alleged $400 million token selloff. The Foundation stated that neither its employees nor those from its partner, Mysten Labs, had sold tokens in violation of lockup agreements or the circulating supply schedule.

The Foundation believes that Light’s reference is to an infrastructure partner, which holds tokens under a lockup schedule. According to the Foundation, qualified custodians oversee all token lockups, and the partner in question is in full compliance with the lockup terms.

However, the ongoing investigation and the transparency of SUI’s token distribution remain under close watch. The crypto community continues to scrutinize the transfers, seeking further clarity on the actions of the whales involved and the impact on SUI’s market value.

“Infrastructure partner that has >$400m to sell under a lock-up schedule but is not considered an insider? Right…,” one user commented.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

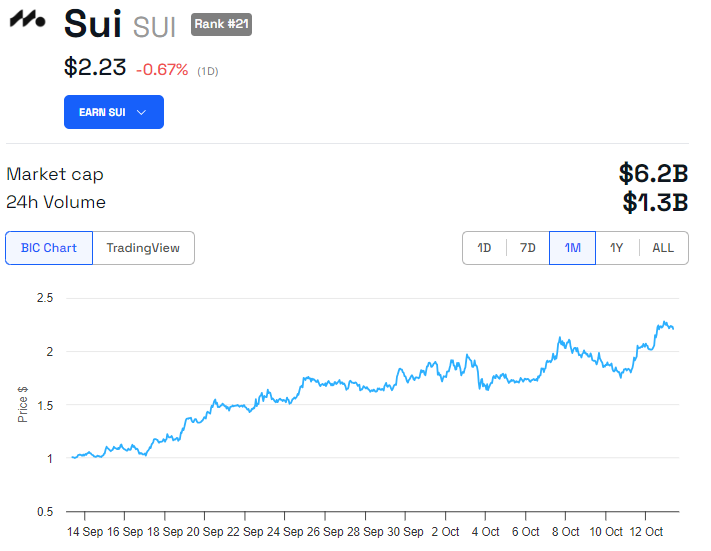

BeInCrypto data shows that the SUI token is down by 0.67% against this controversy, trading at $2.23 as of this writing.