The Stellar (XLM) price increased significantly on July 13, reaching a new yearly high. However, the price has fallen since.

Despite the drop, the price action and indicator readings in multiple timeframes support the bullish trend reversal. They suggest the increasing price is not yet finished and will reach another new yearly high.

Stellar Price Breaks Out From 400-Day Resistance

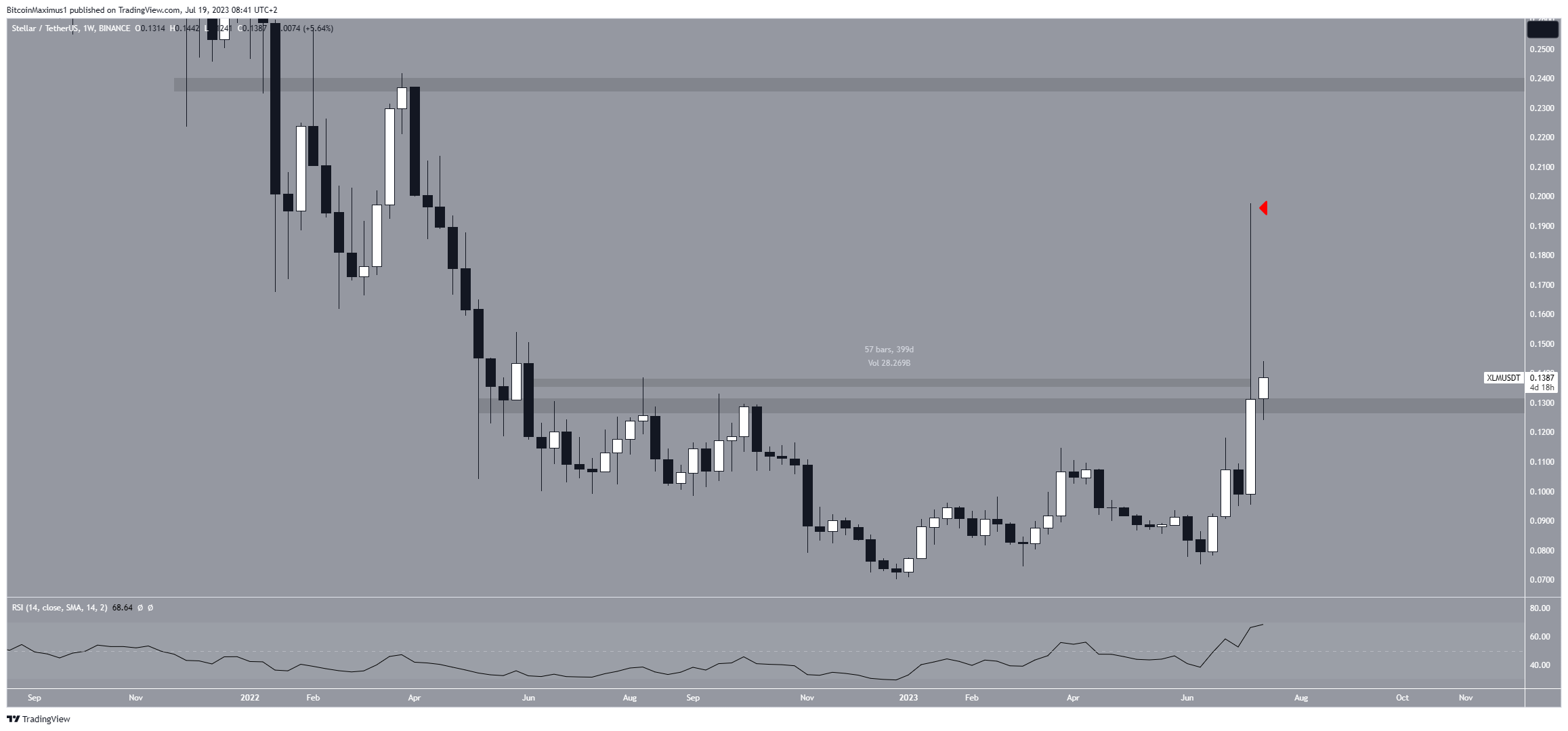

The weekly time frame technical analysis shows that the XLM price broke out from the 400-day resistance area of $0.13 on July 10. The increase led to a new yearly high of $0.20. Breakouts from such long-term structures often indicate that the price has begun a new bullish trend reversal.

Read More: 9 Best Crypto Demo Accounts For Trading

XLM fell sharply after the all-time high, creating a long upper wick (red icon). However, the price remains above the $0.13 area, likely validating it as support. This is common after the price breaks out from a resistance level.

The weekly Relative Strength Index (RSI) gives a bullish reading. Traders utilize the RSI as a momentum indicator to assess whether a market is overbought or oversold and to determine whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls still have an advantage, but if the reading is below 50, the opposite is true. The indicator is increasing and is above 50, both signs of a bullish trend.

XLM Price Prediction: What Does the Wave Count Say?

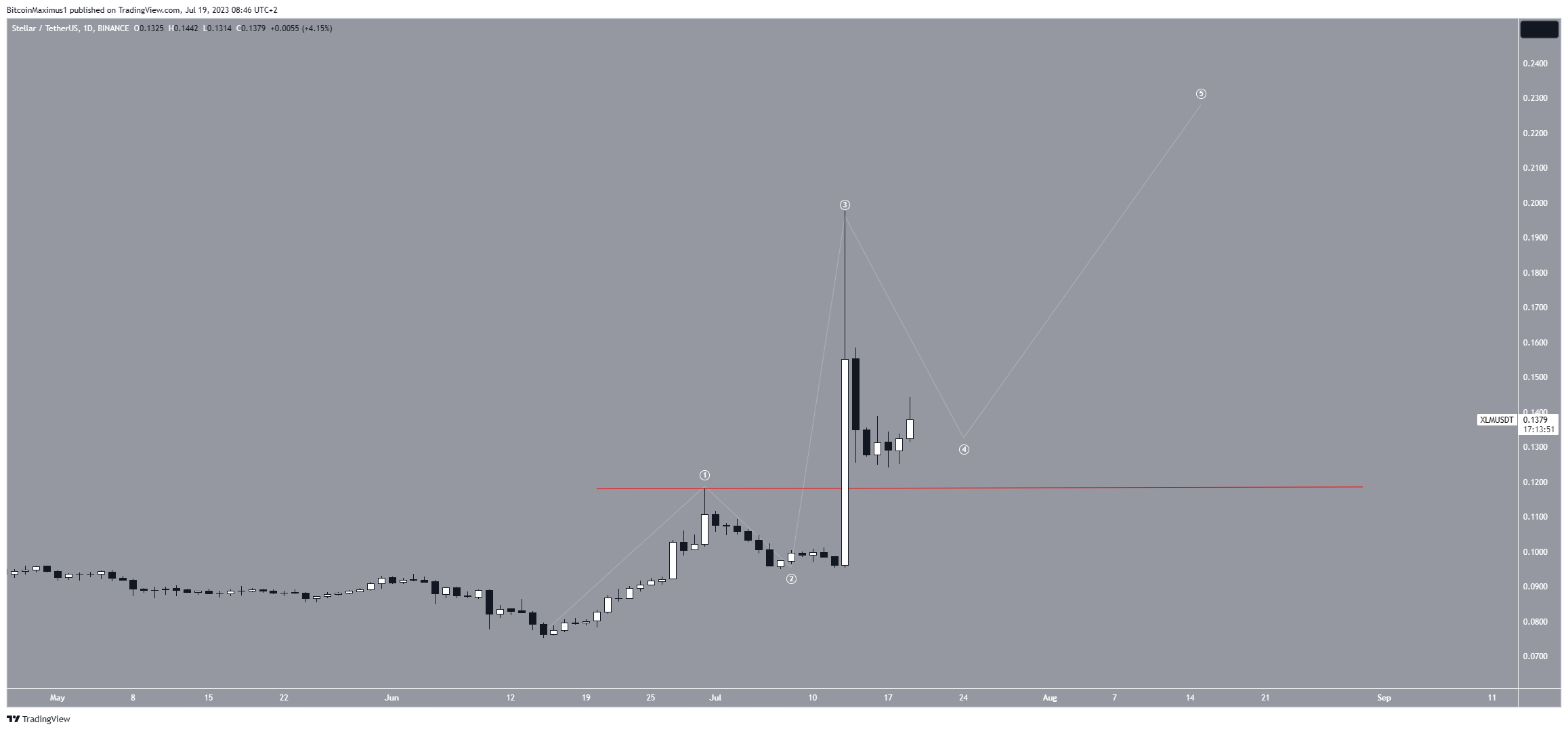

The Elliott Wave count from the daily time frame gives a bullish outlook. Utilizing the Elliott Wave theory, technical analysts examine long-term price patterns and investor psychology that recur to determine the direction of a trend.

The most likely count suggests that the XLM price is in wave four of a five-wave increase. If the count is correct, the price has already reached a local bottom and will soon increase to the next resistance at $0.23. This will conclude the five-wave increase, after which a correction will follow.

However, despite this bullish XLM price prediction, a drop below the wave one high (red line) of $0.12 will mean that the trend is bearish since that will invalidate the bullish count.

In that case, the XLM price can fall to the next support at $0.09.

Read More: How To Make Money in a Bear Market

For BeInCrypto’s latest crypto market analysis, click here.