It’s no secret that stablecoins have become a massive keystone of the crypto ecosystem. But after a rough period for the crypto market in 2022, they’re struggling to find a foothold.

A large portion of the world has begun to usher in digital payment systems while decreasing its reliance on physical cash. This trend became even more prominent during the worst parts of the COVID-19 pandemic.

Stablecoins are a key talking point within this sector, especially considering their massive uptick in market capitalization and dominance over the past few years. Problems began to arise, however, after instances of these coins becoming depegged and skepticism around their reserves grew.

Will a new year be able to bring about the changes needed to repair the damage that’s been done?

Stablecoin Market Cap Slump

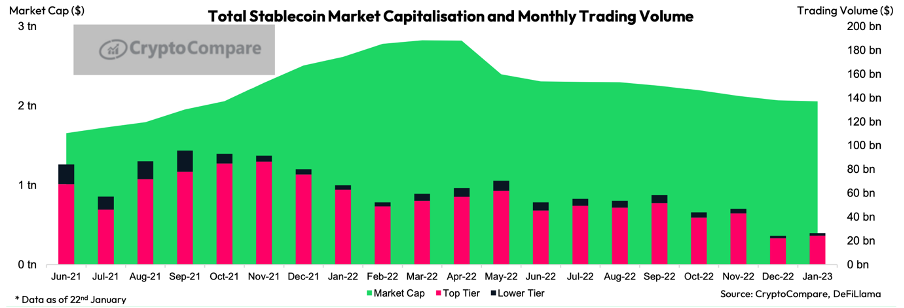

The market capitalization of stablecoins has decreased significantly, now falling below the $140 billion mark. The amount currently stands at $138 billion, according to data from a recent CryptoCompare report. This is the lowest value seen since September 2021.

The report also hinted that their market dominance declined below 12.5%, suggesting that market participants rotated out of stablecoins and into risk assets. Multiple different stablecoin collapses last year exacerbated a sinking crypto market. Even leading projects like Tether (USDT) and Circle’s USDC briefly lost their USD pegs.

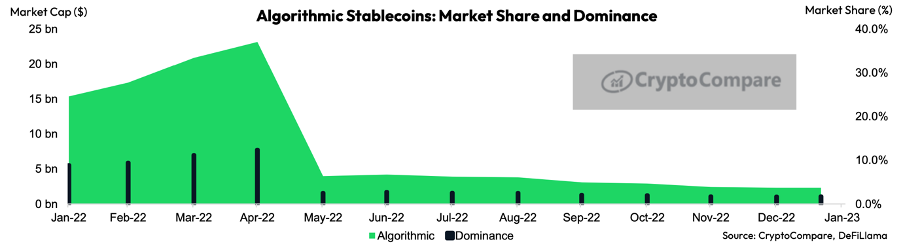

The most disastrous among these, however, was Terra USD (UST), the famed algorithmic stablecoin led by Do Kwon. UST essentially went to zero within one day alongside its sister token, LUNA. This caused a ripple effect that spread to other related assets.

A Rippling Effect

Vader Protocol paused the minting of its USDV after the collapse of UST and spent the remainder of the year trying to implement a more sustainable and capital-efficient algorithmic stablecoin design, which proved to be in vain. Meanwhile, NeutrinoUSD, which has a market cap of $20.70 million, could not recover its peg after being off parity for more than five months.

These events were extremely detrimental to the algorithmic stablecoin market cap:

There is some optimism that things will turn around for the better in 2023. Moody’s, a credit rating firm, is now taking steps to incorporate a scoring system for stablecoins, with analysis for up to 20 digital assets, Bloomberg reported on Jan. 27.

Will Stablecoins Flourish in 2023?

For years now, there has been a great deal of uncertainty and mistrust surrounding Tether and its reserves. Steps like regular audits and even a third-party rating system could help boost the legitimacy of this asset class.

Regulations on this sector are at the top of the agenda, especially in the U.S.

Two leading Australian banks have already unveiled stablecoins projects, while Japan is also considering adopting them into their economy.

Apart from this, stablecoins have seen support from Apple Pay, Mastercard, and many other major industry players. These integrations make it easy for new users to enter the space.

In addition, stablecoins have had a noticeable impact on crypto adoption. Of late, one of the leading platforms, Cardano, launched its own dollar-pegged currency called DJED.

A Payment Gateway

Visa’s outgoing CEO, Alfred Kelly, highlighted the potential of stablecoins as a payment gateway. Speaking to BeInCrypto, the chief executive asserted:

“It’s very early days, but we continue to believe that stablecoins and central bank digital currencies have the potential to play a meaningful role in the payments space, and we have a number of initiatives underway.”

Visa has maintained an undeterred positivity toward cryptocurrencies, even in the face of adverse market conditions. Stablecoins are a tremendous innovation that can help to bolster how finances are conducted in our day-to-day lives.

With stablecoins, one can send vast amounts of cash in seconds to anywhere in the world for near-zero fees. As crypto adoption grows, stablecoins could be used for cross-border and retail business transactions around the world, and even have the potential to replace the US dollar as the primary trade currency.

However, it could turn out to be a double-edged sword. If Stablecoins ever reach this level of utility, governments will surely make sure they are heavily regulated.