South Korea’s largest domestic crypto exchange has sounded the alarm over the de-pegging of Tron’s USDD and Waves’ Neutrino USDN stablecoins.

Upbit exchange said: “At the moment, there is a situation where there is concern that the peggings of USDN and USDD are not being maintained normally. This may increase the possibility of price fluctuations in the WAVES and TRX associated with each of the above stablecoins, so members should be aware of investing in WAVES and TRX.”

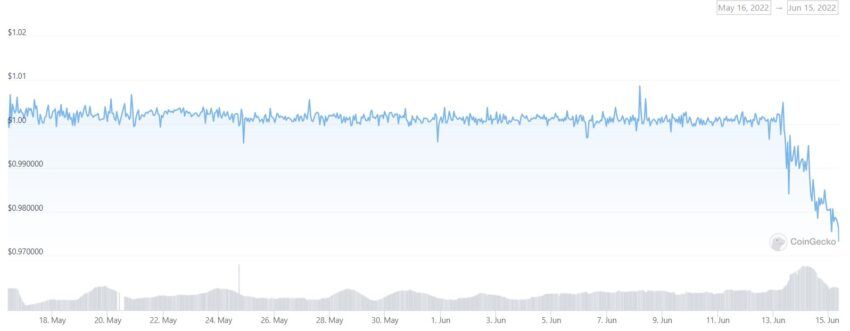

The two stablecoins remain volatile, both are trading under a dollar. USDD is down over 1.5% in the last 24 hours, and USDN is down close to 1%, according to data by CoinGecko.

Tron overcollateralized

Tron has been on a downward spiral since last month, which could possibly mean that the decrease is a result of the de-pegging of USDD, which had been announced as an overcollateralized stablecoin.

Blockchain analytics platform Nansen recently said a fund has been transferring huge amounts of USDD and other stablecoins.

South Korea launches crypto committee

Earlier this month, the South Korean government said it would launch a Digital Asset Committee in the wake of the Terra-led collapse.

Recently, top domestic exchanges announced the delisting of Litecoin (LTC) over investor protection and money laundering concerns that came with its token announcement.

These actions demonstrate that the South Korean government is looking to stringently regulate the sector.

And with the tightening of crypto rules, Lee Bok-hyun, director of the Financial Supervisory Board, said: “The authority related to the formulation or interpretation of laws and regulations is in the financial sphere, and we are now taking a good look at the policy keynote.”

Market mayhem continues

In the current market weakness, the bearish sentiments are keeping bitcoin under the $22,000 level. The fall is so steep that CoinGecko calculates that the global cryptocurrency market cap has dropped to $975 billion, down from just over $3 trillion in Nov.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.