The Spent Output Profit Ratio (SOPR) is an on-chain analysis indicator that gives an overall view of the behavior of Bitcoin market participants. In recent days, interesting things have happened on the SOPR chart and its derivatives for short- and long-term investors.

The SOPR chart is showing more and more fractal similarities to the summer of 2021, when the cryptocurrency market was undergoing a deeper correction. Moreover, as the short-term holder SOPR rises above 1, there are signals that the current correction may have already ended.

SponsoredWhat is the Spent Output Profit Ratio?

Spent Output Profit Ratio (SOPR) is an on-chain indicator calculated by dividing the realized value (in USD) by the value at creation of a spent output (in USD). In simple terms, it is: price sold / price paid. If the ratio is above 1, the owner of the sold asset records a profit. If it is below 1, then it makes a loss. The greater the deviation from 1, the greater the profit/loss.

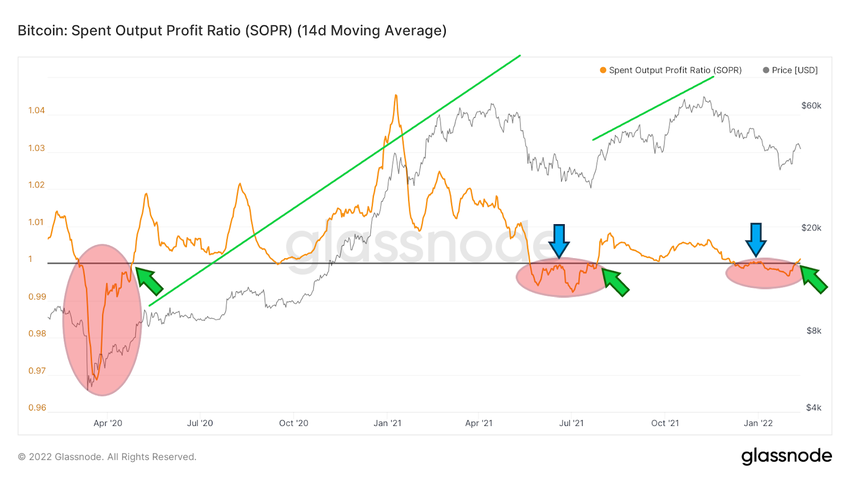

The last very deep drop in the SOPR (14-day moving average) below 1 occurred in March 2020, when the BTC price recorded a macro low at $3782. Following this COVID-19 pandemic onset event, the SOPR quickly recovered above 1 and did not fall below until a deeper correction in May-July 2021.

SOPR stayed below the 1 level throughout this 3-month period. It attempted a breakout but was rejected by the 1 line, signaling a selling pressure of BTC without profit or loss (blue arrow). It was only with the end of the BTC price correction that the indicator decisively broke above the 1 level and remained higher for the following months.

However, as the BTC price declined from the all-time high at $69,000 in November 2021, the SOPR again fell below 1 in early December 2021. Similarly to summer 2021, we see a failed attempt to break out above 1 (blue arrow) and rejection in late December.

It was only after BTC found a bottom at $32,900 that the SOPR indicator began to rise dynamically and successfully broke through the critical level of 1 on February 7, 2022. This signals that once again the average BTC holder is recording a small profit, choosing to sell at the current price. If the value of the indicator does not break down and stays above 1, it will be a bullish signal. In the past, it has been the beginning of an upward trend on Bitcoin (green arrows and lines).

SponsoredLong-term holder SOPR

An interesting perspective on the current health of the Bitcoin market is provided by the long-term holder SOPR. It only takes into account assets that have moved with a period longer than 155 days.

In a chart of the long-term SOPR going back to 2013, we again see the importance of the 1 level. Whenever it fell and stayed below 1, and long-term holders sold at a loss, that’s when a bear market lasted on Bitcoin (red areas and lines).

However, until the indicator definitively dropped below 1, BTC continued its upward rally. A good analogy for the current attempt to hold long-term SOPR support is the end of 2013 (green circle). At that time, the indicator approached a value of 1, but did not fall below. After that event, BTC began another parabolic rise.

SponsoredShort-term holder SOPR

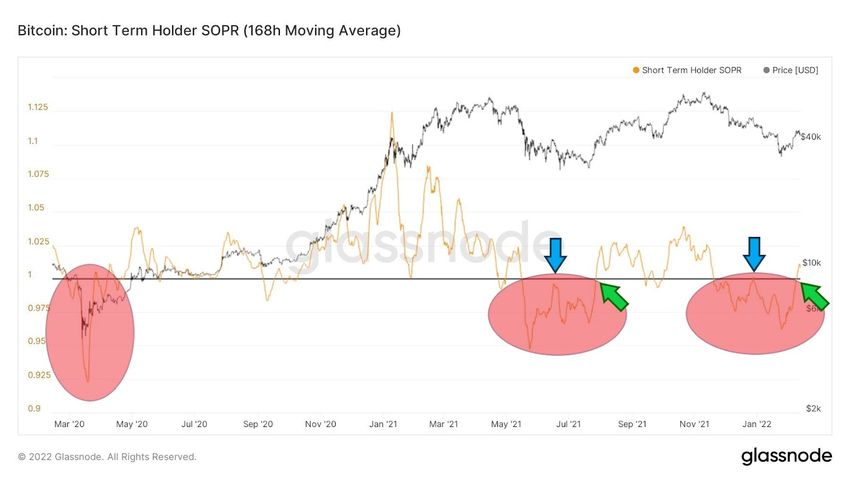

Despite the interesting events in the above charts, the most exciting today is the SOPR of short-term holders. Contrary to the previous indicator, it only takes into account assets that have moved in less than 155 days.

The 7-day moving average of this indicator presents a similar perspective to the chart of the 14-day moving average of the SOPR discussed in the first section. Here we similarly see the March capitulation and parallels between the May-July 2021 period and the current correction. Equally, there was a failed attempt to break out above 1 (blue arrows) and a successful breakout of that level (green arrows).

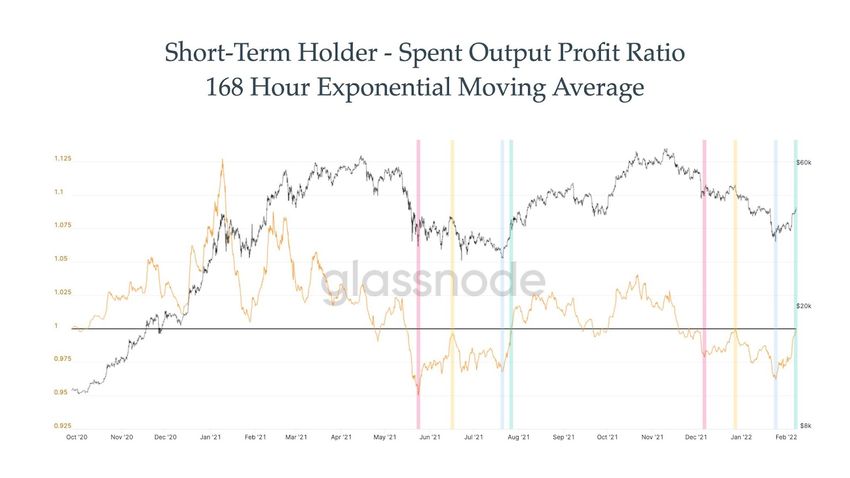

A more detailed analysis of the fractal similarities of these two loss periods for short-term holders was provided by @TheRealPlanC. In a chart he recently posted on Twitter, he used 4 colors to describe these similarities. Red is capitulation, yellow is a failed recovery, blue is reaching a bottom and green is confirmation of a trend reversal:

According to the analyst, the return of short-term holder SOPR above the value of 1 is a signal of Bitcoin trend reversal. It is worth mentioning that this conclusion coincides with the bullish signal generated recently by the so-called “Market Reversal Indicator“, which is also authored by him.

Another market analyst @SwellCycle comes to a very similar conclusion. He points out the persistence of the short-term SOPR above 1 despite high market volatility. He has taken February 4 as the cut-off point for the bullish trend change, which coincides with both the breakout of the short-term SOPR above 1 and the breakout of the BTC price above a long-term descending resistance line.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.