In today’s on-chain analysis, BeInCrypto looks at the positions of short-term holders (STH) of Bitcoin. In the current environment, 99% of new market participants are experiencing a loss.

From a market psychology perspective, this is an extremely bearish outlook when almost all STHs are losing their funds. However, on-chain data shows that in the past such situations have been indicative of a short-term bottom in the BTC price followed by increases.

99% STH in loss

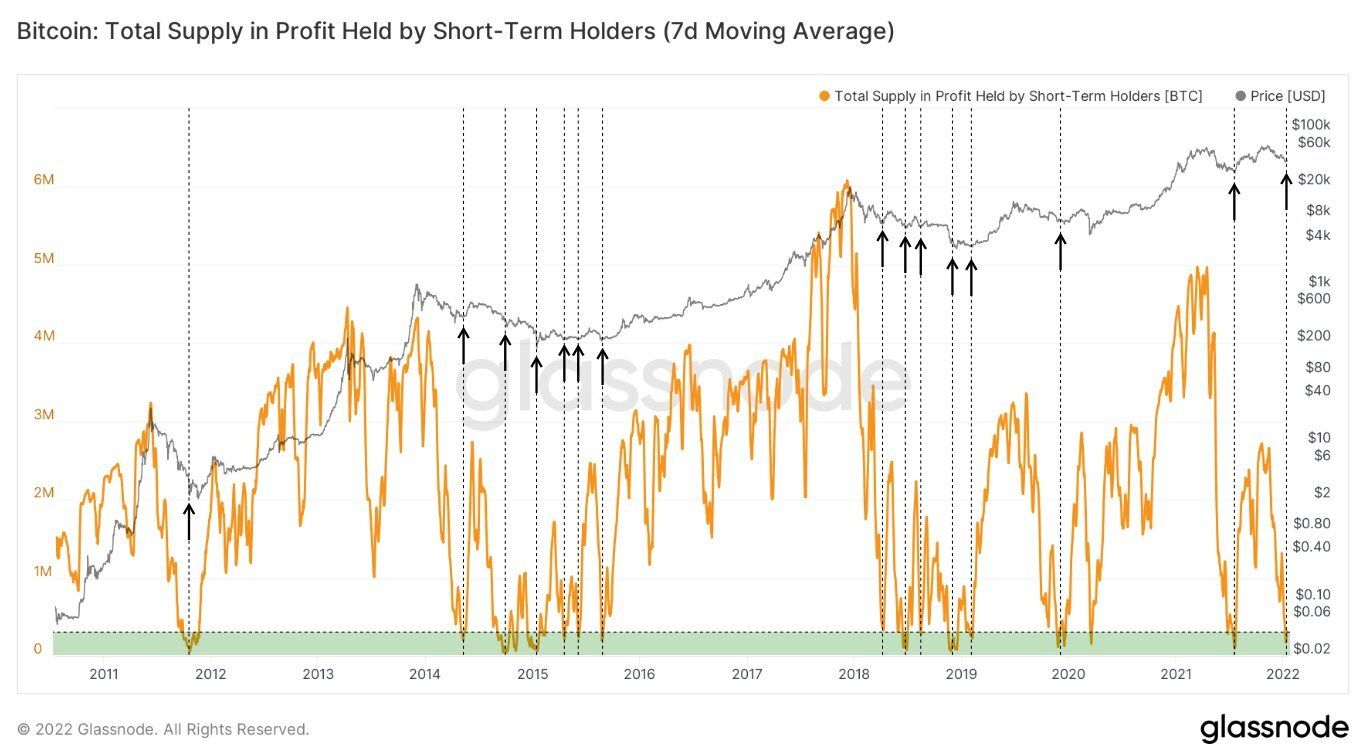

The total supply in profit held by short-term holders is an indicator that divides the total supply of BTC according to two criteria. The first is the difference between the current price and the price paid. If it is positive, the position records a profit – if negative, it records a loss.

The second criterion is the type of position owner: long or short term. If funds are held at an address for more than 155 days, it is a long-term holder (LTH). If less than 155 days, it is the short-term holder (STH) we are interested in.

Looking at the total supply in profit for STH over the last two years, we see only 3 periods where it approached 0 (red circles). The first was the cryptocurrency market crash triggered by the COVID-19 pandemic in March 2020. The price of BTC then reached a bottom at $3,782. The second was a 3-month correction in May-July 2021, when Bitcoin reached a bottom at $29,000. The third-worst period for STH positions is currently ongoing.

In the current state of the market, as Bitcoin continues to fall below support at $40,000, almost 99% of STHs are at a loss. If STHs continue to sell their BTC, they will do so at a significant loss. This behavior has historically been an indicator of a short-term bottom in the BTC price and precedes strong upward moves.

A signal to buy?

Some cryptocurrency market commentators are therefore linking the readings from the STH supply in profit chart to a Bitcoin buy signal. An example is analyst @Kellykellam, who in a recent tweet juxtaposed this indicator with other on-chain and fundamental indications:

“Bullish news stacking up, 40k holding strong, multinational government BTC adoptions, illiquid supply growing daily, and yet another onchain metric screaming BUY.”

However, since that tweet, there has been bearish news about the Central Bank of Russia wanting to ban cryptocurrencies, and Bitcoin has lost support at $40,000. Therefore, to consider the extreme low STH supply in profit as a signal to buy, one needs to look at a higher timeframe.

Another Twitter user, @SwellCycle posted a long-term chart of the 7-day average of STH supply in profit for the entire history of on-chain data for Bitcoin. On the chart, he highlighted the price of BTC at times when STH supply in profit reached near zero values (black arrows).

Arrows most often appear during periods of long-term bear markets. Examples are the 6 arrows in the 2014-2016 period and the 5 arrows in the 2018-2019 period. Moreover, although they are indeed signals for short-term lows of BTC, a small upward reaction was often followed by further declines. In other words, in a bear market, STH supply in profit repeatedly returns to the green area.

Despite this, in some market situations, extreme losses of STH positions were indeed a good buy signal. Most often, there were periods of the end of a long-term bear market or sudden and deepening corrections in a bull market.

Bullish divergence in STH SOPR

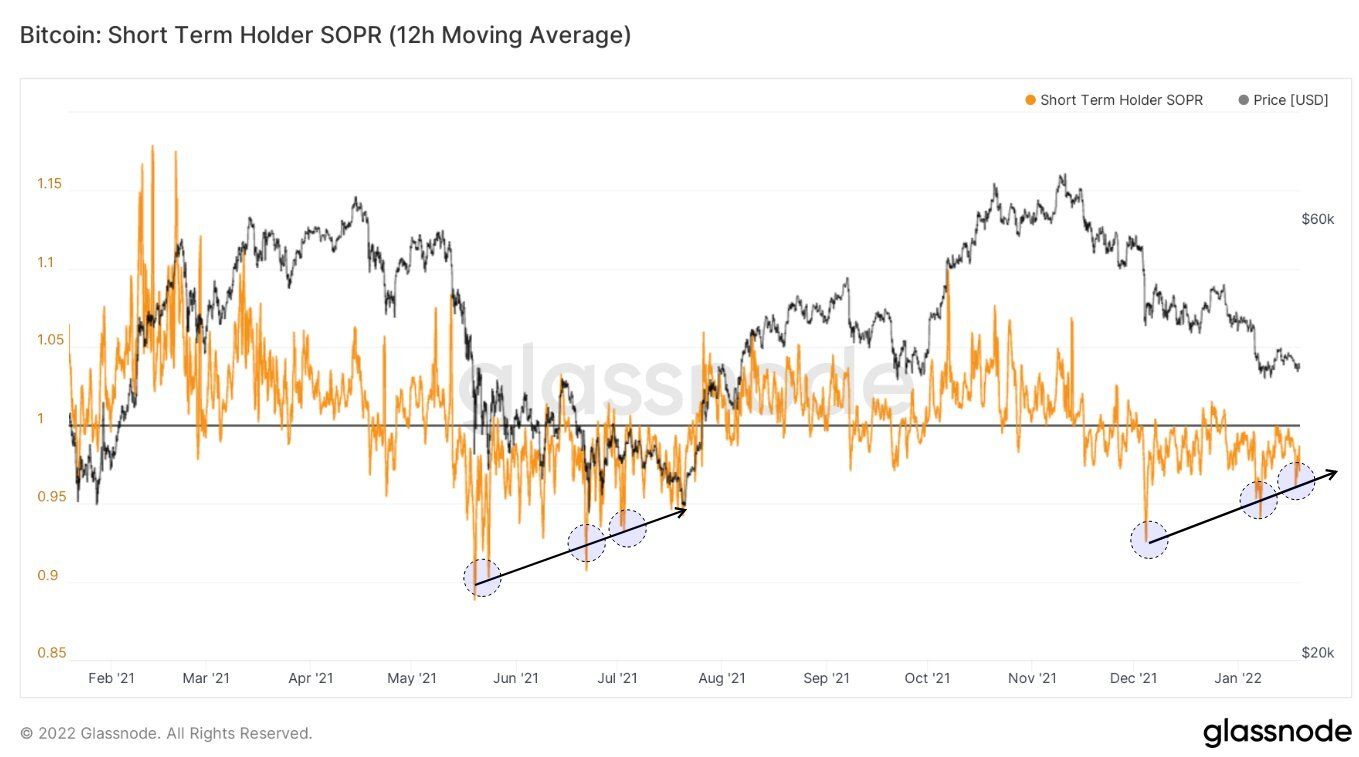

An additional indicator that sheds more light on the significance of the STH capitulation is the Spent Output Profit Ratio (SOPR). The ratio itself is a simple relation between the realized value of BTC (price sold) and the value at the time of creation (price paid). It provides an estimate of whether most market participants are selling their BTC at a profit (values above 1) or at a loss (values below 1).

The SOPR for short-term holders only takes into account positions younger than 155 days. In another chart posted on Twitter by @SwellCycle, we see a comparison of STH SOPR behavior in summer 2021 and today:

In both cases, we see a bullish divergence between the rising 12-hour average of STH SOPR (black arrows) and the falling Bitcoin price (black chart). If the fractal similarities are maintained, we should continue to expect a falling BTC price (which is happening right now) and rising STH SOPR in the near future.

Thus, if the scenario repeats itself, the recent sell-off in BTC could be followed by a strong rebound.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.