After consolidating just below $0.000010, Shiba Inu (SHIB) closed the week strongly, extending its 30-day price gains to 42%. On-chain data analysis examines how SHIB price could react as investors begin to position for upcoming projects.

Shiba Inu (SHIB) price raced to a 4-month peak of $0.000011, bringing its 30-day gains to 42%. On-chain data reveals how recent community projects have influenced SHIB investors’ behavior. Can these changes drive the ongoing SHIB price rally to new heights?

Shiba Inu (SHIB) Investors are Now Holding Longer

From a native SHIB hardware wallet to the upcoming Shibarium L2 Network, the Shiba Inu team has rolled out several community projects and product updates in recent months.

Some vital on-chain data now reveal that Shiba Inu investors have reacted positively, holding on longer to their tokens. Presumably, this is a play to participate in potential upside from this series of new projects in the future.

In confirmation of this bullish outlook, data from IntoTheBlock shows that another 3,460 Shiba Inu investors have become long-term holders in August.

Digging deeper, this has brought the total number of long-term holders to an all-time peak of 883,000, or 69.16% of total Shiba Inu wallet addresses.

To put things in a clearer perspective, at the start of 2023, there were only 740,000 long-term holders, which was only 60.4% of all SHIB wallet addresses. This means a staggering 143,000 SHIB holders have become long-term holders this year.

Meanwhile, simultaneously, the number of short-term traders dropped from 50,760 (4.14%) to 47,530 (3.76%).

Long-term Holders are wallet addresses that have held their tokens for at least 1-year. Typically, an increase in the number of long-term holders is a bullish signal.

It indicates that existing network participants are committed to the Shiba Inu ecosystem’s overall viability and are optimistic about future projects.

At 70%, Shiba Inu long-term holders are now the overwhelming majority. This could positively impact SHIB price action in the coming weeks.

Firstly, since most Shiba Inu investors are in for the long haul, SHIB will likely maintain higher support levels and avoid flash price drops. Furthermore, it could also attract new entrants to buy big into the Shiba Inu ecosystem.

Whale Investors Are Already Buying Big

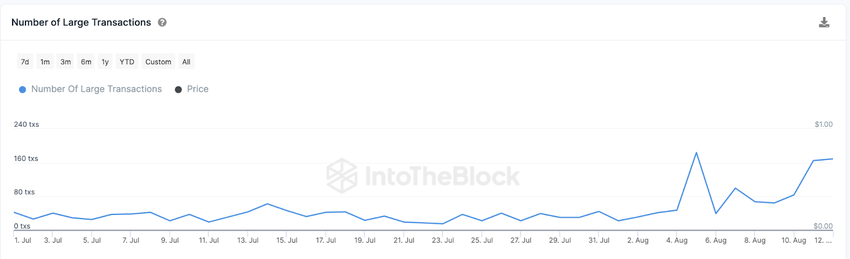

As highlighted above, it appears that the growing optimism among long-term holders has attracted whale investors. Evidently, so, SHIB whale transactions have now reached a 6-month peak.

The chart below shows that SHIB recorded 169 Large Transactions at the close of August 12. The last time it was higher was back in February 2023.

Perceptibly, Large Transactions sum up the number of confirmed transactions that exceed $100,000 in value on any given day. This provides insight into the level of confidence and optimism among large institutional investors.

Consistently high incidences of Large Transactions provide much-needed market liquidity and boost the overall confidence of retail investors.

The growing number of Shiba Inu long-term holders and the whales’ optimism could facilitate a sustained price rally.

Check out the 9 Best AI Crypto Trading Bots to Maximize Your Profits.

SHIB Price Prediction: Consolidation Above $0.000009

Considering the bullish indicators highlighted above, SHIB will likely avoid a large correction and consolidate around the $0.000009 territory.

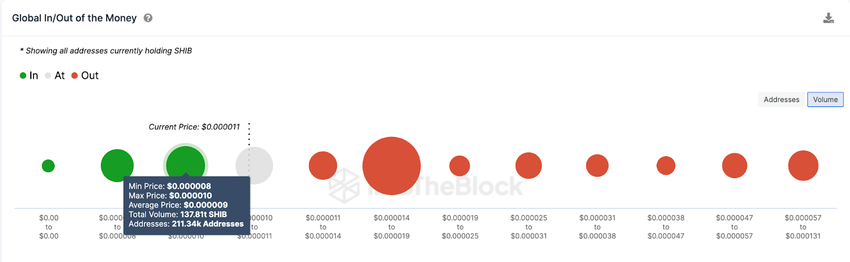

The Global In/Out of Money (GIOM) data which shows the purchase price distribution of current SHIB token holders, also validates this stance.

As seen below, 211,340 addresses had bought 137.8 trillion SHIB tokens at an average price of $0.000009. If they remain committed to holding long-term, they could trigger another upswing.

But if that support level gives way, SHIB could retrace toward $0.000008.

Conversely, the bull rally could continue if SHIB can break above the $0.000014 support. As seen above, a cluster of 90,820 holders had bought 423.6 trillion at the minimum price of $0.000014. SHIB could have difficulty clearing that resistance if they look to book profits.

But if that resistance level cannot hold, SHIB could rally toward $0.000015.

Looking to be profitable? Learn How To Make Money in a Bear Market.