Hong Kong’s recent crypto developments have raised the stakes for a war over crypto supremacy between the US and China.

While the US Securities and Exchange Commission struck the US crypto industry a devastating blow with a lawsuit against the nation’s largest exchange, China could capitalize to leave the US behind.

Hong Kong’s Clarity Beats US SEC Enforcement

The US Securities and Exchange Commission arguably recorded its most prolific week of crypto crackdowns by suing the largest global and US crypto exchanges, Binance and Coinbase. Despite industry pleas for new rules, the agency refused to budge on its view that most cryptocurrencies are securities.

On the other hand, the Hong Kong Securities and Futures Commission’s new crypto regulations define a clear, if arguably burdensome, path to compliance that could divert capital from the US.

They protect customers’ crypto, prevent money laundering, and only allow exchanges to list a handful of cryptocurrencies.

On the other hand, US exchanges only legally know they are listing unregistered securities when the SEC sues them.

The clarity in Hong Kong has already attracted industry participants. Asian exchange OKX plans to apply for a Hong Kong virtual asset provider license, while Bybit wants to run its Asian business from there.

Rising Asian Crypto Volumes Challenge US Supremacy

Crypto customers have also voted with their pockets to take business away from the US to Asia.

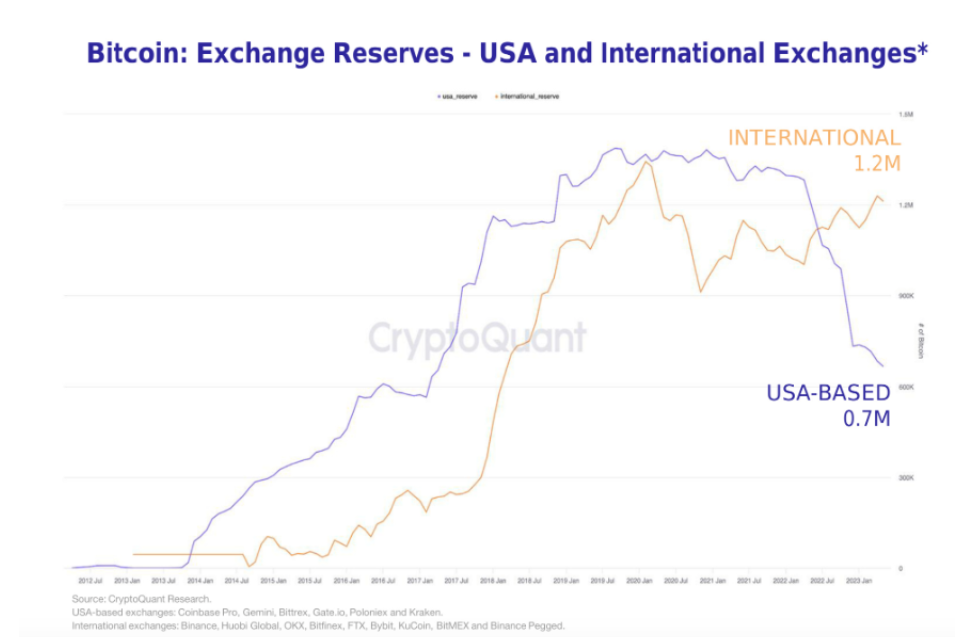

Asian hourly spot volume grew 30% in 2023 amid US declines, while firms stateside also hold lower Bitcoin reserves than their eastern rivals.

Both these metrics could rise as Hong Kong regulations also open Bitcoin and Ethereum to retail traders for the first time.

Grayscale’s Bitcoin Trust helps boost US volumes. However, the firm’s reserves have stagnated while it fights the SEC to convert GBTC to a spot Exchange-Traded Fund.

Spot ETFs are not currently allowed in Hong Kong, which has leveled the playing field between the two regions.

Stablecoin Dominance Up For Grabs

Both regions also have no national stablecoin laws, but Hong Kong could be hurt the most since it does not allow exchanges to list the fiat-pegged crypto. Stablecoins enable traders to buy and sell cryptocurrencies faster than they can with bank transfers.

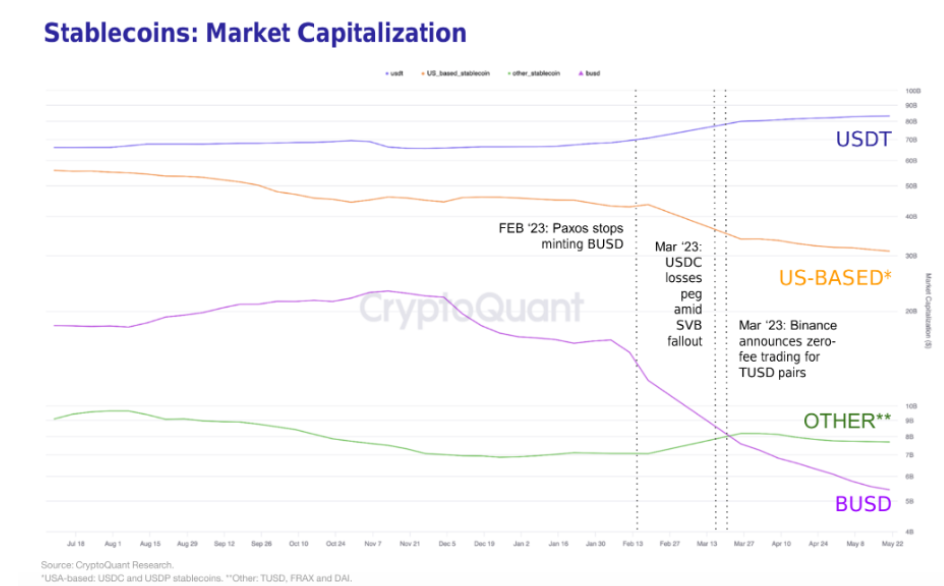

New York’s state regulator recently ordered Paxos to stop minting the Binance-branded BUSD stablecoin.

Shortly after, non-US-regulated stablecoins USDT and TrueUSD saw their market caps surge, while US-based stablecoins’ USDC and BUSD market caps fell 35%. Global exchanges also saw a sharp decline in U.S.-based stablecoin reserves, now dominated by USDT.

Hong Kong plans to release new stablecoin regulations in 2024. In the meantime, traders in the region can buy crypto with fiat through regional banking partners.

US Still Dominates Mining as China Recovers From Ban

Recent government scrutiny has discouraged miners from operating in the US.

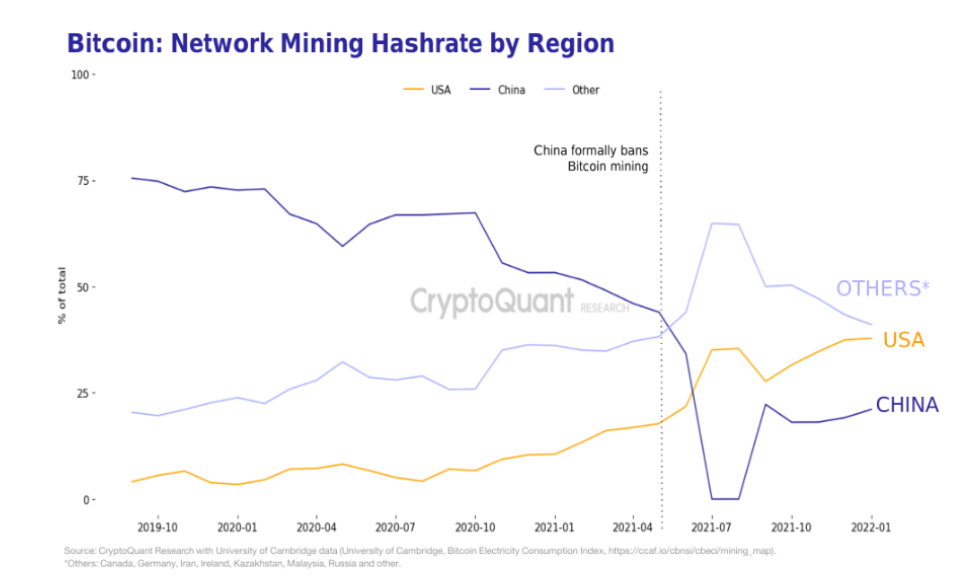

While the US still dominates mining with a hashrate share of 38%, until recently, federal regulators sought to impose a hefty excise tax on miners. However, state laws welcome additional revenue, with Texas incentivizing gas-flared mining with tax kickbacks.

Interested in learning about cloud mining? Click here.

Still, the US could lose hashrate to countries it is not politically aligned with if federal laws erode miner profitability. China’s hashrate, although down from a peak of almost three-quarters of the global hashrate share, is believed to have recovered to around 21% despite a nationwide ban.

Kazakhstan gained 4% hashrate after China’s ban to take its slice of mining activity to 13%.