Bitcoin exchange-traded funds (ETFs) have enjoyed significant success, igniting hopes for similar offerings for other cryptocurrencies like Ethereum.

However, crypto attorney Jake Chervinsky holds a contrary view. He suggested that pending applications for an Ethereum ETF might face rejection from the US Securities and Exchange Commission (SEC).

Why The SEC Will Deny Ethereum ETFs

Chervinsky said approval of a spot Ethereum ETF would intensify political pressure on the financial regulator. He pointed out that the SEC faced “a ton of political blowback for approving Bitcoin ETFs” despite its decision being influenced by the court.

The lawyer highlighted the SEC’s precedent of adopting legally dubious stances to align with political agendas, suggesting the federal agency might lean on similar reasoning for denial.

“The SEC has a legal argument that, even if wrong, likely passes the laugh test by enough to justify denial if it wants. And we know the SEC is willing to take wrong legal positions in court to satisfy political priorities,” Chervinsky explained.

Moreover, Chervinsky noted that the Bitcoin ETF approval has heightened market sentiment, coined as “animal spirits,” where prices react to human emotions rather than inherent value. With Bitcoin soaring past $60,000 post-approval, largely due to ETF inflows, an Ethereum ETF would amplify this trend.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

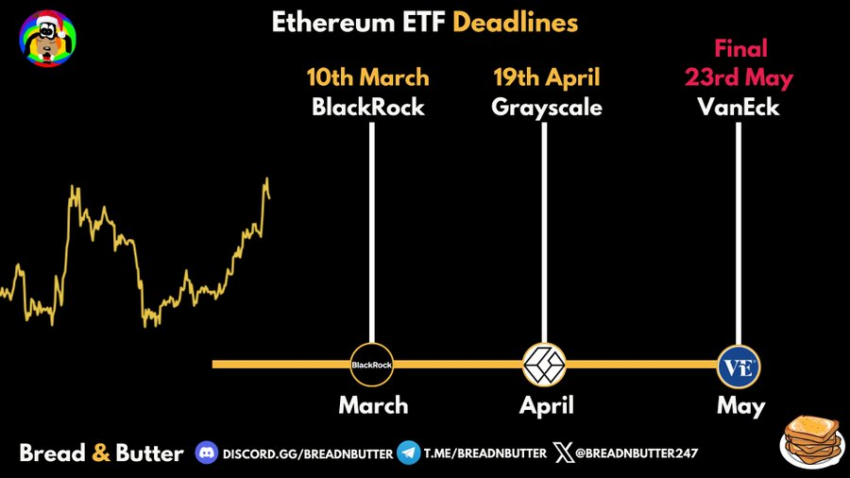

Consequently, he predicted that the SEC would reject Ethereum ETF applications to retain market oversight. Chervinsky’s arguments align with a recent report stating that the SEC remains uncomfortable with cryptocurrencies. Besides, industry sources expect the Commission to move cautiously because of ETH’s ambiguous legal status.

BlackRock’s Interest Might Not Matter

While many view BlackRock’s interest in an Ethereum ETF positively, Chervinsky cautioned against assuming that the asset management firm’s interest guarantees approval from regulators. He suggested that the SEC might prompt BlackRock and other ETH ETF issuers to withdraw their applications for various reasons.

“Yes, Blackrock is on the other side of this one. But Blackrock’s nearly perfect record in getting ETFs approved has as much to do with a collaborative relationship with SEC as it does the ability to put on pressure. If the SEC asks Blackrock and the other ETH ETF sponsors to withdraw (a common practice), I bet they will,” Chervinsky asserted.

Read more: Ethereum (ETH) Price Prediction 2024 / 2025 / 2030

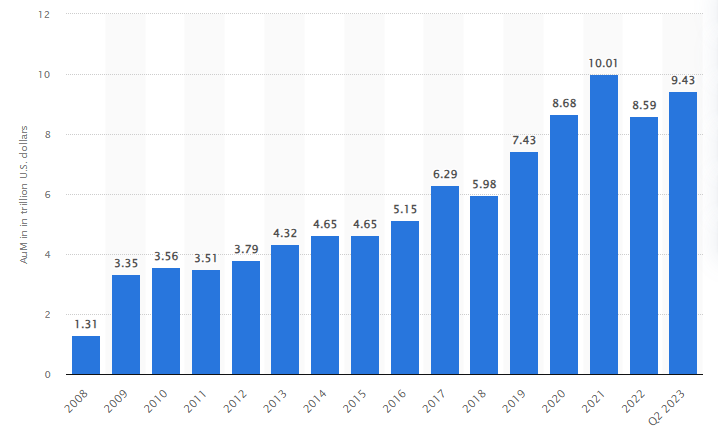

BlackRock, the world’s largest asset management firm, manages over $9 trillion in assets. Known for its successful ETF applications, BlackRock recently led the charge to get the SEC’s approval for a Bitcoin ETF.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.