Gary Wang, FTX’s co-founder and former Chief Technology Officer of the bankrupt exchange, has revealed details of the special privileges the defunct firm granted to sister company, Alameda Research.

An October 6 post on X (formerly Twitter) by Inner City Press detailed the court proceeding involving the testimony of Wang.

The Special Privileges

Per Wang’s testimony, Alameda enjoyed special privileges on the defunct cryptocurrency exchange, allowing it to trade faster and beyond its balance.

Wang revealed that he and the Chief Engineer, Nishad Singh, had introduced a unique code. This code enabled Alameda to maintain a negative balance right after the launch of FTX.

Furthermore, the affiliated company could withdraw funds even if their accounts showed zero balance. Thanks to an extensive line of credit.

In contrast, regular customers held credit lines up to $1 million. A a far cry from the billion-dollar limit enjoyed by Alameda. Importantly, the “allow negative” feature was exclusively accessible to Alameda.

The former CTO clarified that these privileges were extended to Alameda due to its pivotal role as FTX’s market maker. According to Wang, liquidating Alameda’s huge position could cause damage to the platform.

SBF Lied About FTX Financial Health

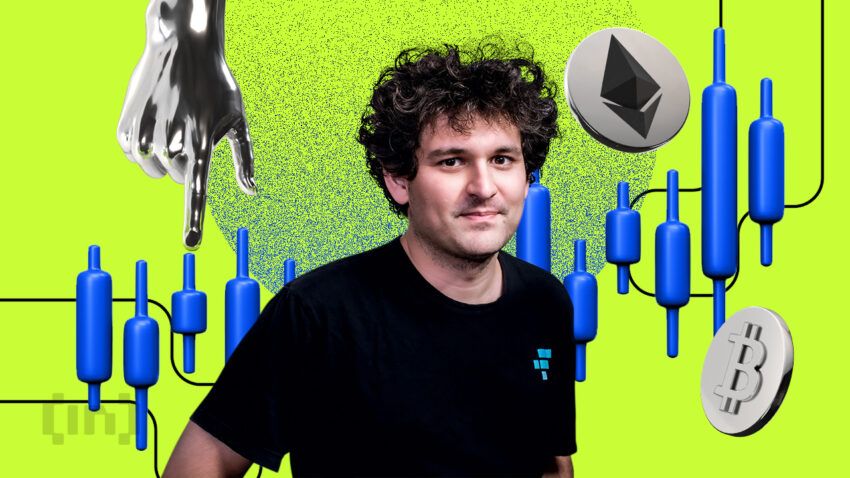

Wang further revealed that Sam Bankman-Fried lied in a tweet that FTX was “fine” despite knowing that the firm faced an $8 billion hole.

According to Wang, several of SBF’s claims about the financial health of the bankrupt firm were far from reality. He said:

“FTX was not fine. Assets were not fine, because FTX did not have enough assets for customer withdrawals.”

Wang’s testimony further showed that Alameda was allowed to withdraw the exchange’s customers funds. Per the prosecutors, SBF used these withdrawals to fund property purchases, political donations, marketing gimmicks, and others.

Wang’s revelation is part of his testimony in the ongoing trial of SBF at a New York Court. The former CTO has already pleaded guilty to charges brought against him following the exchange collapse.

On the other hand, SBF has maintained his innocence. It faces seven fraud charges, including wire fraud, conspiracy to commit wire fraud, conspiracy to commit commodities fraud, conspiracy to commit securities fraud, etc.

Read More: 9 Best Crypto Demo Accounts For Trading

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.