Ripple (XRP) presents a unique case, offering investors a blend of optimism and caution. As a new bull market emerges, understanding Ripple’s position is crucial for anyone interested in the crypto market.

Here are three compelling reasons to be bullish about Ripple, along with a note of caution to keep in mind.

The Legal Tussle’s Silver Lining

A recent episode of CryptoLaw TV featured renowned crypto lawyer John Deaton. He discussed Ripple’s ongoing legal battle with the SEC.

Deaton’s analysis follows a critical scheduling order outlining the SEC vs. Ripple lawsuit’s final steps. Indeed, the key dates to watch are:

- February 12, marking the end of the discovery phase;

- March 13, when the SEC reveals its proposed penalties;

- Ripple’s response is due by April 12;

- And, the SEC’s final reply is on April 29.

What’s noteworthy is Ripple’s focus on remedies rather than allegations of fraud. Deaton’s insights suggest that Ripple’s financial penalties could be limited to profits gained from the alleged wrongdoing.

“Ripple will not come close to paying $770M. The SEC seeks disgorgement related to XRP sales in the UK, Japan, Switzerland, etc. Not only does the Supreme Court’s Morrison decision exclude those sales, but XRP is deemed a non-security in those and other jurisdictions,” Deaton emphasized.

This nuanced approach could mean a less severe outcome for Ripple, instilling a sense of optimism among XRP holders.

Championing Financial Inclusion

James Wallis, Ripple’s VP for central bank engagements, underscored the role of Central Bank Digital Currencies (CBDCs) in enhancing global financial inclusion. He highlighted how CBDCs can provide financial services to the underbanked, especially in regions where traditional banking is inaccessible or unaffordable.

“Banks are commercial organizations, and they have shareholders that they have to be responsive and it’s very difficult to make money out of people that have no money. It’s a bit of a conundrum. However, with CBDCs we can fix that. CBDCs are very low cost and can allow financial services to be provided at a much lower cost basis than you do today, so that will enable people to have simple payment opportunities. It will allow people to build up some credit history and have the ability to borrow some money so they can grow their business,” Wallis said.

Ripple’s involvement in over 20 global CBDC initiatives, including Georgia’s Digital Lari project, positions it as a frontrunner in leveraging digital currency for economic inclusivity.

This commitment to breaking financial barriers adds to Ripple’s credibility and amplifies its potential impact on a global scale.

Expanding Remittance Services in Asia

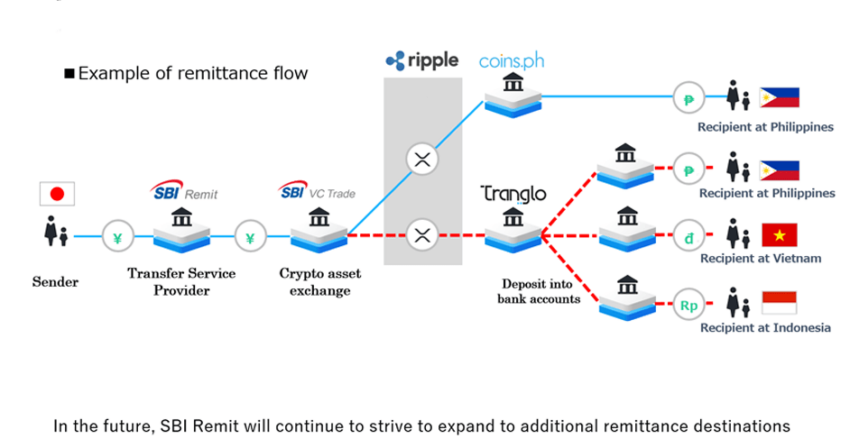

SBI Remit, a subsidiary of Japan’s SBI Holdings, has expanded its remittance services using Ripple’s XRP in the Philippines, Vietnam, and Indonesia. In partnership with SBI VC Trade and San Francisco-based Ripple, this move aims to facilitate quicker, more cost-effective money transfers.

The strategy targets Southeast Asian markets, a region with soaring remittance inflows.

“By using XRP as a bridge currency, you can transfer money quickly and at low cost. Furthermore, it has excellent scalability, allowing users to easily send money to Ripple’s partners around the world, and we believe this will lead to stronger competitiveness in the international remittance business,” SBI Remit said in a statement.

By leveraging XRP as a bridge currency since 2021, SBI Remit has positioned itself as a pioneer in utilizing crypto for cross-border transactions. Subsequently reinforcing Ripple’s standing in the remittance industry.

A Note of Caution: The Escrow System

Despite these bullish indicators, it is essential to consider a note of caution. In December 2017, Ripple introduced an escrow system, setting aside 55 billion XRP in a series of escrows released monthly over 55 months.

With the final tranche potentially released in December 2023, this system could impact XRP’s market stability as the circulating XRP supply may exceed the current demand levels.

Usually, about 800 million XRP is returned to escrow each month, with roughly 200 million XRP entering the circulating supply. Still, while designed for stability, it introduces a variable that could influence XRP’s market dynamics as the final release approaches.

Read more: How To Buy XRP and Everything You Need To Know

In summary, Ripple’s ongoing legal developments, commitment to financial inclusivity, and expansion in Asian remittance services present strong reasons for optimism. However, the impact of its escrow system warrants cautious observation.

As with any investment, potential Ripple investors should balance these bullish factors with understanding inherent risks in the volatile crypto market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.