The XRP price faces notable downward pressure as more investors choose to cash out their profits. Currently trading at $0.56, the token has dropped nearly 10% over the past week.

The profitability of recent daily transactions has prompted many XRP holders to sell, contributing to the ongoing decline.

Ripple Traders Lock in Their Gains

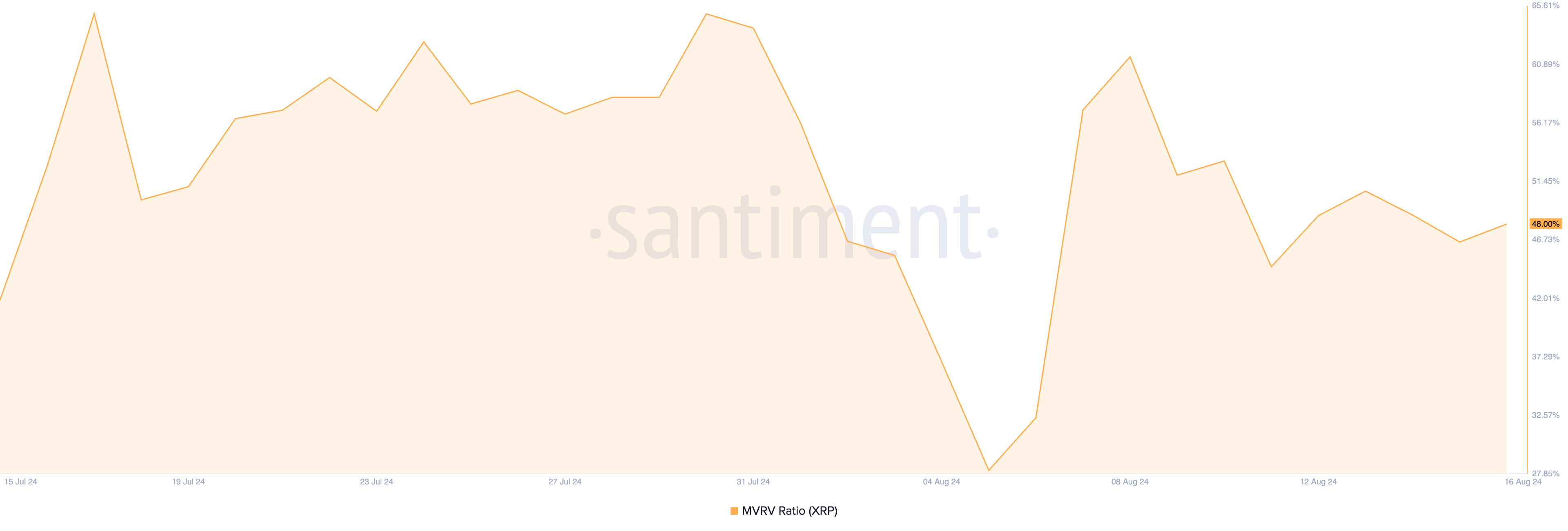

Readings from XRP’s market value to realized value (MVRV) ratio show that the altcoin is currently overvalued. As of this writing, the token’s MVRV ratio is 48%.

The MVRV ratio measures the difference between an asset’s current market price and the average acquisition cost of its circulating supply. A value above one indicates the asset trades higher than its average purchase price, often leading holders to sell for profit when it’s deemed overvalued.

With XRP’s MVRV ratio at 48%, a large portion of holders are in profit, driving the current wave of token distribution.

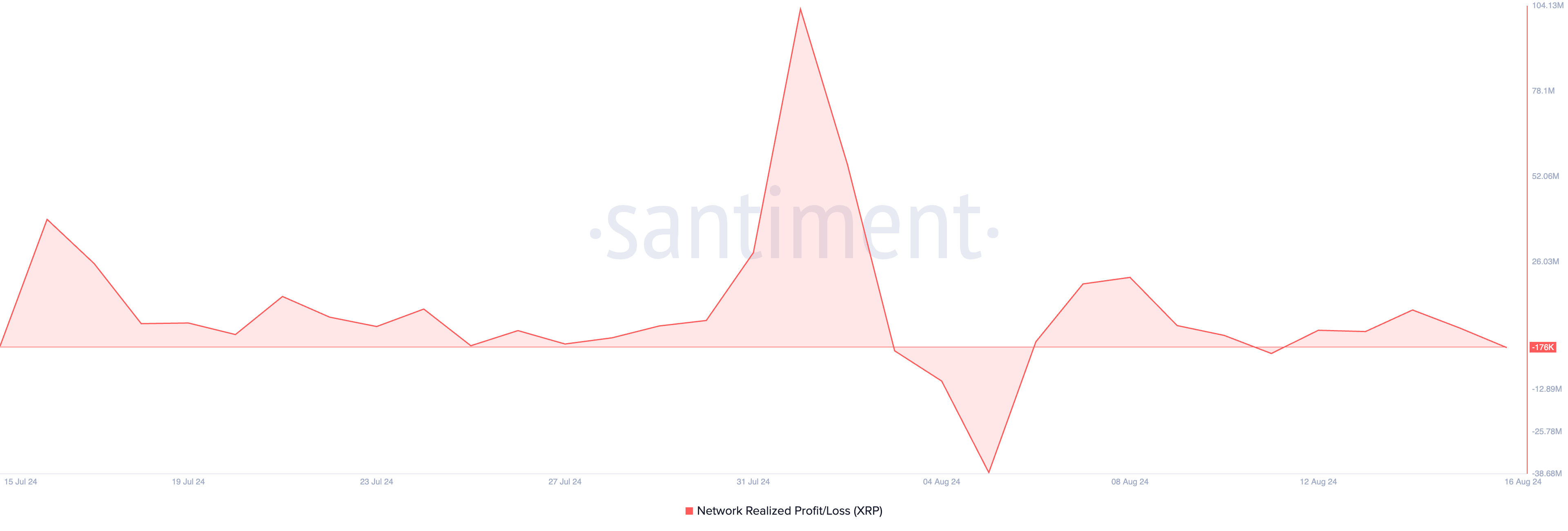

Additionally, since the start of the month, XRP’s Network Realized Profit/Loss (NPL) metric has consistently shown positive values, confirming that most XRP traders are selling their holdings at a profit.

Read more: How To Buy XRP and Everything You Need To Know

The Network Realized Profit/Loss (NPL) metric tracks the overall profit or loss realized by traders or holders within a specific time frame. Positive NPL values indicate that, on average, traders are closing their positions with gains, while negative values suggest losses.

It’s well-known that a spike in profit-taking activity creates downward pressure on an asset’s price. When sell orders surge without a matching increase in buy orders, a supply-demand imbalance occurs, leading to a price decline.

XRP Price Prediction: Liquidity Exit Equals Falling Prices

The liquidity exit from the XRP market is reflected in its negative Chaikin Money Flow (CMF). As of this writing, the indicator rests below the zero line and has been so positioned since August 11.

An asset’s CMF measures how money flows into and out of its market. A negative CMF is a sign of market weakness. When accompanied by a price fall, it signals a potential extension of the decline.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

If XRP does not see a notable spike in new demand to counter the surging selloffs, its price may drop to $0.52. However, it may reclaim the $0.60 price level and exchange hands above it if this happens.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.