XRP price has recovered the losses it witnessed recently along with the crypto market, but the struggle to rally continues.

To make this worse, the investors are also turning slightly skeptical now, which could lead to selling at their hands.

XRP Investors Change Their Stance

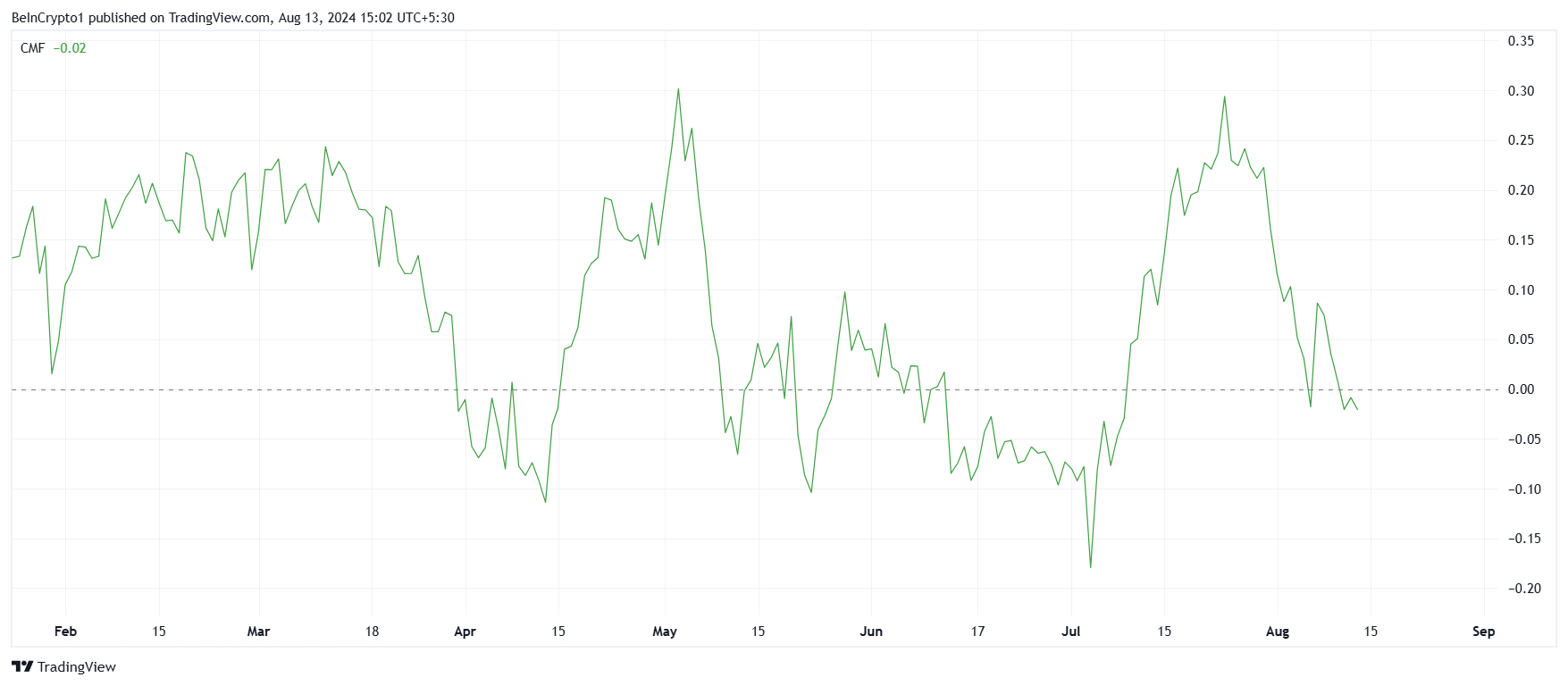

XRP price is already noting bearishness, which could intensify further as negative signals arise. XRP’s Chaikin Money Flow (CMF) indicates that outflows are at a monthly high.

This reflects an ongoing trend of investors withdrawing their funds. This elevated level of outflows suggests significant selling pressure in the market.

Read More: How To Buy XRP and Everything You Need To Know

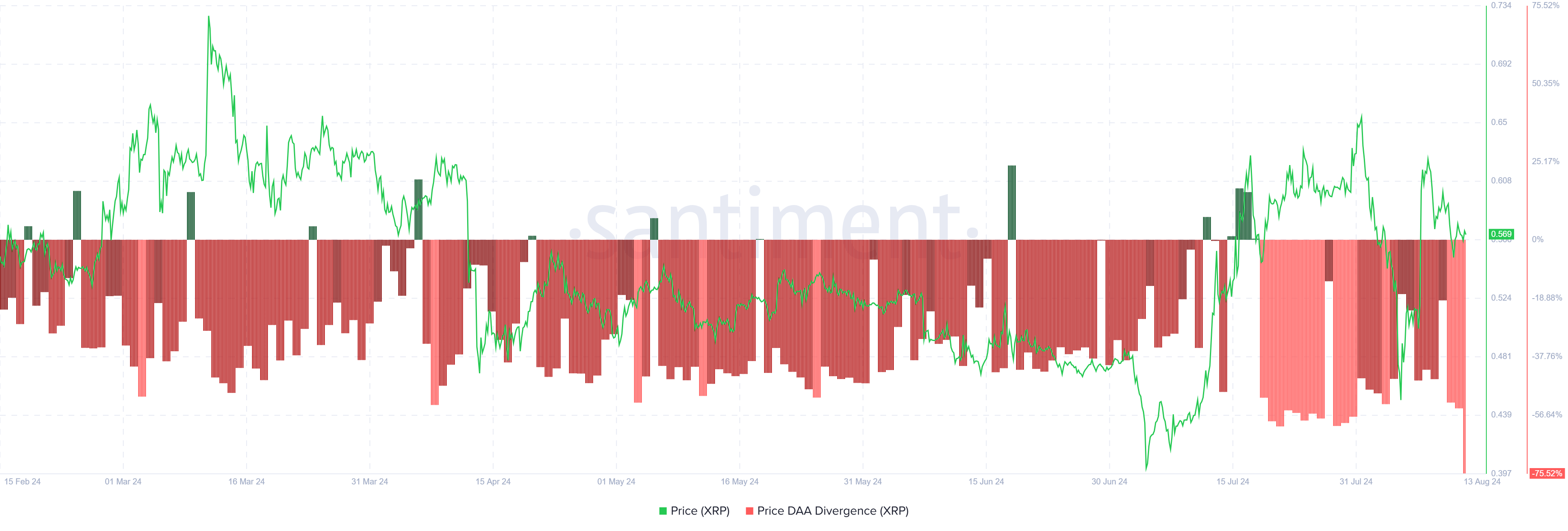

The price daily active address (DAA) divergence is also revealing sell signals, which could lead to increased participation in selling activities. This divergence highlights a weakening in buying interest relative to selling pressure.

A sell signal is often observed when participation and price action both decline. This shows rising pessimism among investors reacting to the shift in market sentiment.

Thus, the current market indicators suggest a bearish trend for XRP, driven by substantial investor withdrawals and increased selling pressure. As a result, XRP price action could further experience a decline.

XRP Price Prediction: Reclaiming Key Support

XRP price has failed to hold above the 38.2% Fibonacci Retracement line at $0.58 twice in the last four weeks. This is a sign of weak conviction in the investors and the market. While the altcoin recovered from the previous drawdown, the situation is not seemingly similar this time.

If the aforementioned bearish cues further impact the price, it would not be surprising to see the token decline further. This could push the XRP price from $0.57 at the time of writing to test the support at $0.52, coinciding with the 23.5% Fib line.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

However, if the altcoin manages to reclaim $0.58 as a support floor, it could have a shot at breaching the resistance at $0.63. XRP has failed multiple times at this point, but a successful breach could invalidate the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.