Crypto payments firm Ripple has bought Swiss custody firm Metaco for $250 million as Swiss citizens vote to imbue cash with greater constitutional heft.

Metaco helps institutions store, trade, and manage digital currencies.

Ripple Wants to End Crypto Winter With Swiss Purchase

Ripple purchased Metaco with $250 million from its balance sheet to potentially trigger a departure from the crypto winter, Ripple CEO Brad Garlinghouse said. The payments firm is now the only shareholder.

Metaco CEO Adrien Treccani said,

“This deal will enable Metaco to leverage Ripple’s scale and market strength to reach our goals and deliver value to our clients at a faster pace. We look forward to continuing to serve unprecedented levels of institutional demand with the utmost excellence in delivery, as our clients have come to expect.”

Notable Metaco clients include UnionBank of the Philippines, DBS, and VP Bank.

Keeping institutional assets separate from customer assets became an industry imperative after the collapse of FTX.

Ripple expects its case with the U.S. Securities and Exchange Commission (SEC) to end by October. The agency sued Garlinghouse and co-founder Chris Larsen for pocketing millions from unregistered securities sales.

Swiss National Bank Debunks Retail CBDC

The Ripple deal comes amid central bank and broader national hostility to retail digital currency payments.

Campaigners from the Swiss Freedom Movement triggered a plebiscite that today prompted the Swiss Federal Council to consider elevating cash’s importance to the constitutional level.

Roughly 157,000 campaigners voted to trigger the plebiscite, exceeding the minimum 100,000 threshold.

The finance and justice ministries will present a draft referendum in three months.

The Swiss National Bank is investigating a wholesale digital currency, but senior employees have rejected a retail franc. SNB vice-president Martin Schlegel argued that one of the bank’s primary responsibilities is managing national cash flow.

Swiss citizens hold the largest cash per capita at $11,824, with most of the money kept in 1,000 Swiss franc notes. Last year, they settled 29% of transactions in cash.

The Swiss franc experienced 3% annual inflation in February, appreciating 13% against the euro since 2021. Comparatively, U.S. inflation was 4.9% in April, still above the Federal Reserve’s 2% target.

The move towards cash bucks global trends toward a unified digital currency policy G7 leaders will likely discuss this week. The International Monetary Fund and the World Bank Group will release a CBDC handbook later this year.

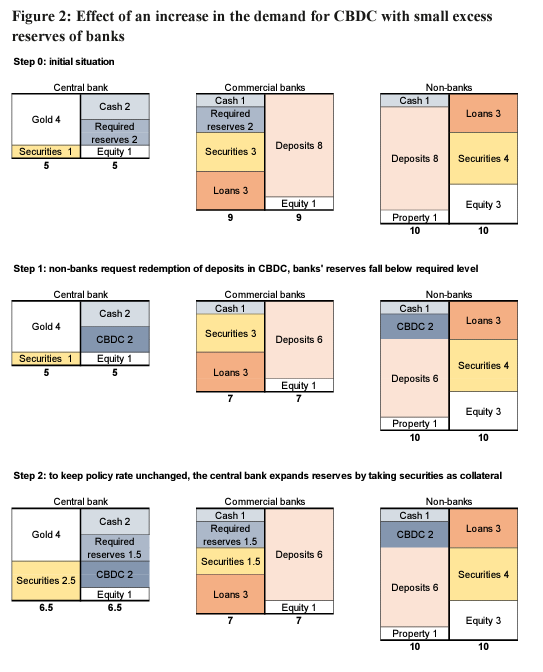

The SNB previously argued that lowering risk transfer from commercial banks to central banks is a challenge that negates some of a CBDC’s benefits.

It showed that higher demand for a CBDC could see the central bank take on more risk by increasing its reserves.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.