Her Majesty’s Treasury has published a document wherein it proposes that the Financial Conduct Authority (FCA) regulates cryptocurrency adverts.

It states that this is a key consumer protection issue, and invites comments from relevant parties regarding the recommendations.

The UK government has proposed that cryptocurrency promotions, including advertisements, fall under the purview of the country’s financial regulator, the Financial Conduct Authority (FCA). The Treasury published a document titled ‘Cryptoasset promotions’ on July 16.

It considers bringing “certain types of cryptoassets within the scope of financial promotions regulation.” The proposal is categorized under consumer protection, market integrity, and financial crime.

The government assesses that “unregulated cryptoassets expose consumers to unacceptable levels of risk.” It goes on to single out advertising as a key consumer protection issue. It refers to a 2018 report which describes the issue as follows:

“Adverts often overstate benefits and rarely warn of volatility risks, the fact consumers can both grow and lose their investment, and the lack of regulation. There are also examples of regulated firms marketing cryptoasset products without clarifying that this part of their business is not regulated.”As a result, it wishes to regulate advertisements to prevent misleading and inadequate promotions. Regulated firms will also be required to go through the FCA for promotions.

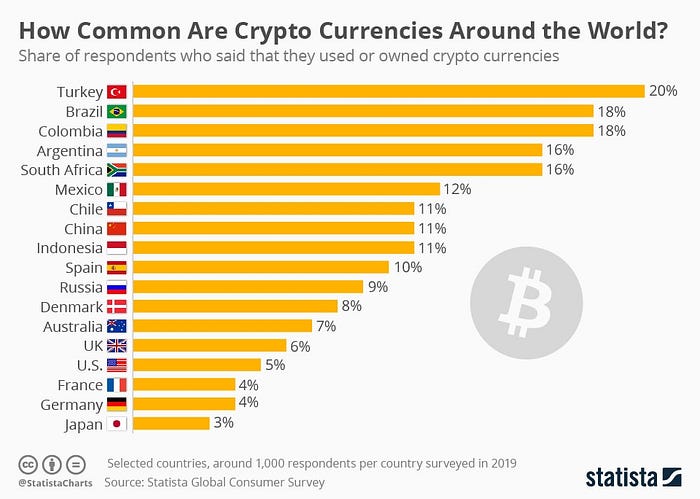

The UK Cryptocurrency Market is Growing

U.K. Government Trying to Balance Innovation and Consumer Protection

On an encouraging note, the document does say that it seeks to promote financial innovation. The government’s agencies — the FCA among them — have already taken steps towards regulation, which it outlines in the document. Governors of the country’s central bank, the Bank of England, have spoken on digital currencies as well. Former governor Mark Carney, has said that the bank was examining the idea of a CBDC. And it was designed on a strict set of requirements. However, current governor Andrew Bailey does not have a good view of Bitcoin, having said that people should be prepared to lose their money.

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored