One of the many nations formed in the aftermath of the USSR’s collapse, Ukraine is uniquely straddled between European influence and Russian heritage.

Over the past three decades, it has transformed into a prominent economic and cultural powerhouse in Eastern Europe. In 2016, the Ukrainian central bank made cryptocurrency history. It announced a foray into blockchain with its own Central Bank Digital Currency (CBDC).

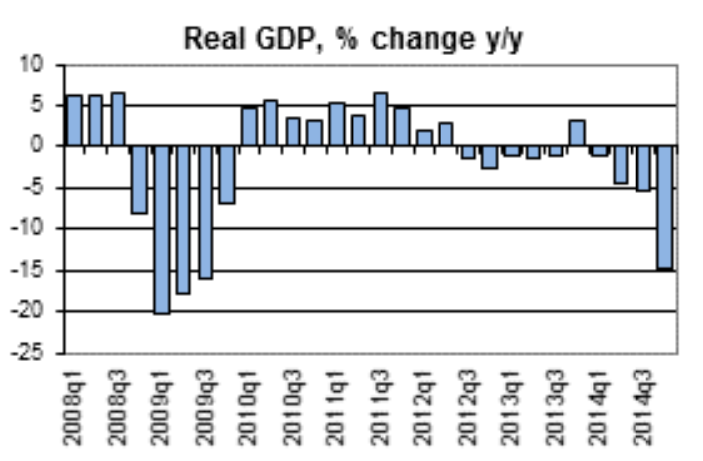

The country’s economic performance over the past few years has been turbulent due to the ongoing territorial dispute with Russia. At one point in 2013, Moody’s downgraded the country’s credit rating to Caa1 (poor quality and very high credit risk).

The Birth of E-Hryvnia: Ukraine’s National Cryptocurrency

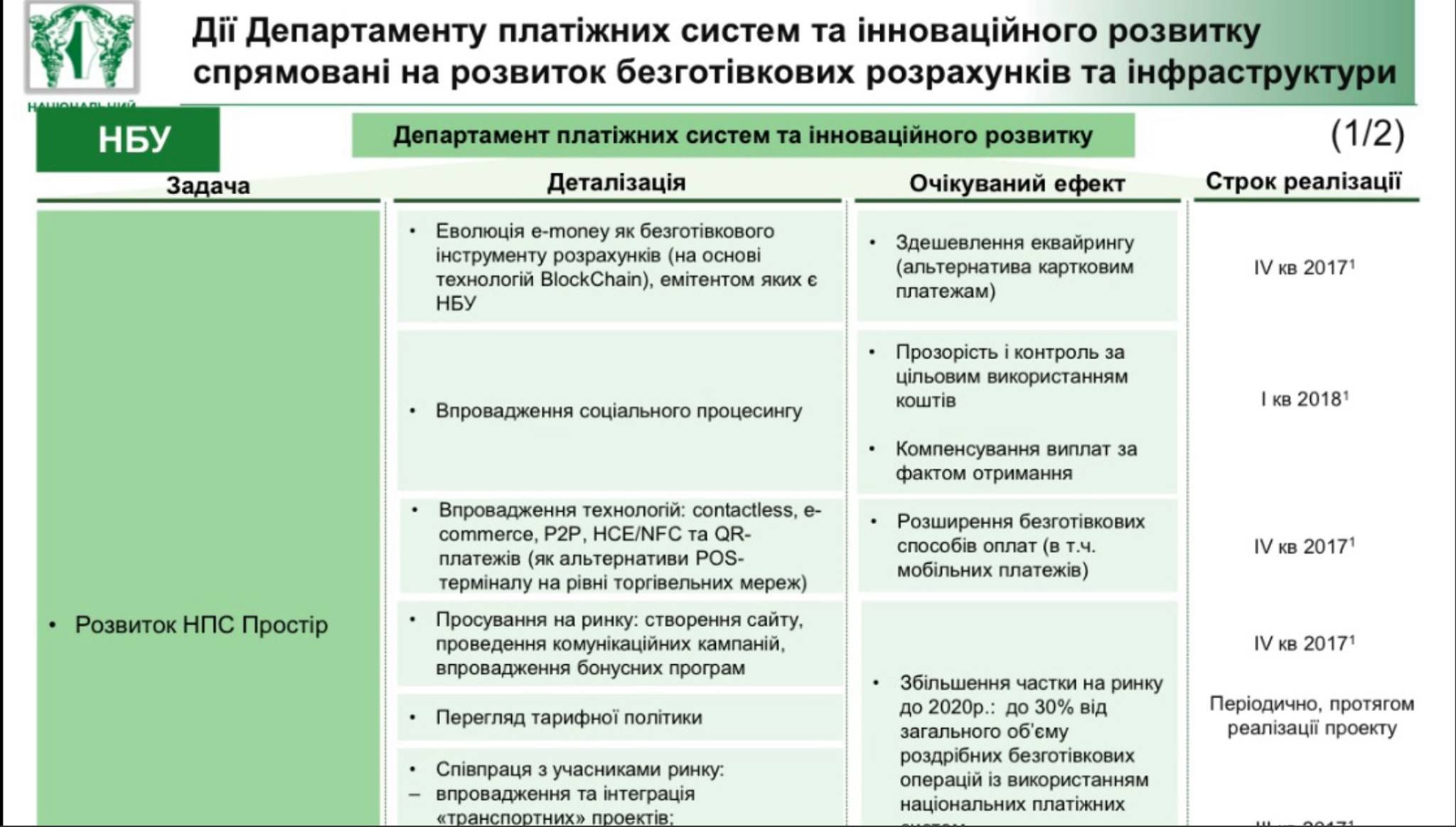

The NBU first revealed its intentions to issue a CBDC back in November 2016 during the Cashless Ukraine Summit 2016 in Kiev. At the time, the plan was to integrate blockchain technology into the country’s existing e-money systems as part of the central bank’s broader push for cashless transactions.

“The implementation of cashless payments we have identified as our own priority task,”she said.

“We also consider this one of the main strategic directions of the development of the banking system of Ukraine.”From the outset, it was clear that Ukraine’s CBDC, officially dubbed the E-Hryvnia, was meant to be a drop-in replacement to the country’s fiat currency. Citizens would be able to exchange cash for blockchain-based tokens at a 1:1 ratio. Furthermore, the central bank clarified that the E-Hryvnia would only serve as a medium of exchange and not as a yield-bearing instrument or store-of-value asset like gold. The pilot program wasn’t introduced until February 2018. In 2017, however, it expanded its blockchain team and enlisted the help of Distributed Lab, a Ukrainian advisory firm. Notably, the central bank disclosed little to no information about the E-Hryvnia’s technical workings, except that it had been implemented by the NBU’s internal human resources and IT infrastructure group.

How the E-Hryvnia Pilot Program Worked

Between September and December 2018, the NBU invited a small group of individuals to participate in the E-Hryvnia’s debut trial. During this time, it issued a small number of tokens – equivalent to 5,443 UAH or 200 USD – on a temporary blockchain and made it available to participants. Getting the tokens, however, was not a straightforward process. Individuals first had to download a mobile application and then refill their wallets through Ukraine’s cashless payment card called PROSTIR. While this approach is somewhat acceptable for a pilot program, it also meant it was inaccessible to the underprivileged and unbanked. Furthermore, while the E-Hryvnia token did not involve any transaction fees, the central bank clarified that the zero-fee rate policy was subject to change. This contrasts heavily with other central banks, which claim that digital currencies will incur lower fees compared with traditional mediums.

Surprisingly, the NBU did acknowledge the possibility of a decentralized E-Hryvnia, based on blockchain technology. However, it later rejected that idea because a decentralized token would no longer give the bank exclusive control over the money supply.

It also claimed that a centralized approach would be more “comprehensible and transparent” from a legal standpoint.

Furthermore, while the E-Hryvnia token did not involve any transaction fees, the central bank clarified that the zero-fee rate policy was subject to change. This contrasts heavily with other central banks, which claim that digital currencies will incur lower fees compared with traditional mediums.

Surprisingly, the NBU did acknowledge the possibility of a decentralized E-Hryvnia, based on blockchain technology. However, it later rejected that idea because a decentralized token would no longer give the bank exclusive control over the money supply.

It also claimed that a centralized approach would be more “comprehensible and transparent” from a legal standpoint.

The Pilot Outcome

CBDCs are basically centralized in every way, from issuance to circulation. While certain countries like China have partnered up to aid in distribution, the final policy-making authority almost always lies with the central bank. This allows the government to dictate terms on transaction limits and wallet ownership, aspects completely absent in traditional cryptocurrencies like Bitcoin. On conclusion of the pilot, the NBU released a 40-page analytical report detailing the implementation. It also outlined the central bank’s thoughts on the future of the E-Hryvnia. Among other findings, it concluded that the token showed promising results and could become a tool for instant retail payments. However, the NBU also acknowledged that its limited tests did not cover all potential transaction types and user groups. This led to an incomplete understanding of the currency’s attractiveness at a national level. It built the trial payment network on top of the Stellar blockchain. The NBU clarified, however, that a public release would involve a proprietary system, designed with “modern blockchain protocols” in mind. The Ukrainian government also confirmed that it would be adding user identification processes to any future CBDC released by the NBU. This is reportedly to ensure compliance with the country’s KYC and anti-money laundering laws. Similar to most crypto exchanges, users complying with this identification step would be given higher transaction limits.Was the E-Hryvnia a Failed Experiment?

Overall, the pilot program’s low issuance, user participation, and transaction types meant that it offered little useful information on its viability. Regardless, the project’s developers did isolate a few technical shortcomings, which will likely play a vital role in E-Hryvnia’s public release. Identifying these technical hurdles is important for any government experimenting with disruptive blockchain tech. What’s surprising is that the NBU publicly disclosed two major flaws with its blockchain. Most other CBDC developers have been rather opaque in their findings. The first issue involved a partial system slowdown in the underlying Stellar code. It couldn’t be resolved even after Stellar’s developers fixed it. The second issue was a potential “system-level emergency”. According to a report, this issue became evident whenever the block validation process was halted, and a user attempted to initiate a transaction. The system would present the user with an error message, however, the transaction would complete successfully as soon as block production resumed. Since blockchain transactions are immutable, victims usually have no recourse. This reason alone causes central banks to take measured steps toward issuing a public CBDC.The Ukrainian CBDC in 2020

Since the publishing of the 2019 pilot, little of the project has come to light, with a couple of exceptions. On February 21, 2020, the NBU held an international conference where it discussed CBDC’s and how they could interact with the existing payment infrastructure. Its main concern was how it would function alongside the traditional banking system. Furthermore, a widespread shift to digital currencies would likely affect financial stability and monetary policy to a greater extent than what is manageable by a central bank.CBDCs vs Fiat

CBDCs mostly eliminate the need for people to own a bank account. In the traditional financial system, financial institutions form the bedrock of any country’s economy. A digital currency almost entirely subverts the role of bank accounts, reducing the relevance of these institutions to potential obscurity. In the NBU’s own words,“For people, it [owning a CBDC] is actually like having an account directly with a central bank”.An advantage of replacing fiat currencies with crypto is that the central banks will have easier access to control monetary policy. Programmable money means that central banks can meet inflation targets, as long as the central bank is competent. Good monetary policy will achieve positive results quickly. Bad policies could, of course, just plunge the country into hyperinflation. Venezuela is a good example of this. NBU’s current Governor, Yakiv Smolii, agrees:

“We continue to look into the chance of issuing the E-Hryvnia, and we will be ready to return to this matter when we are convinced that not only can it be technologically feasible, but also that it will not interfere with the pursuit of our mandate as a central bank, which is to ensure price and financial stability.”

Future Scope

According to a report by the Bank of International Settlements (BIS), approximately 80% of the world’s central banks are currently working on their own state-backed digital currencies. Ukraine’s E-Hryvnia project is one of the earliest adopters of blockchain technology in the form of Stellar. It’s one of the very few CBDCs that shares its fundamentals with traditional digital currencies. Having said that, several years of NBU radio silence proves that most central banks are waiting on others to take the first step. The clock is ticking and smaller nations risk losing public confidence to private competition from the likes of Facebook and multinational banks.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored