As market jitters rise and whispers of a looming recession grow louder, a clutch of financial experts continues to debate whether the storm will truly break or if the economy is setting the stage for another expansion. Such uncertainty calls to mind the adage, “economists have predicted nine of the last five recessions.”

This time, it is an intertwined narrative of skepticism, expansion optimism, and widespread recession anticipation.

The US Economy May Have Entered an “Expansion Phase”

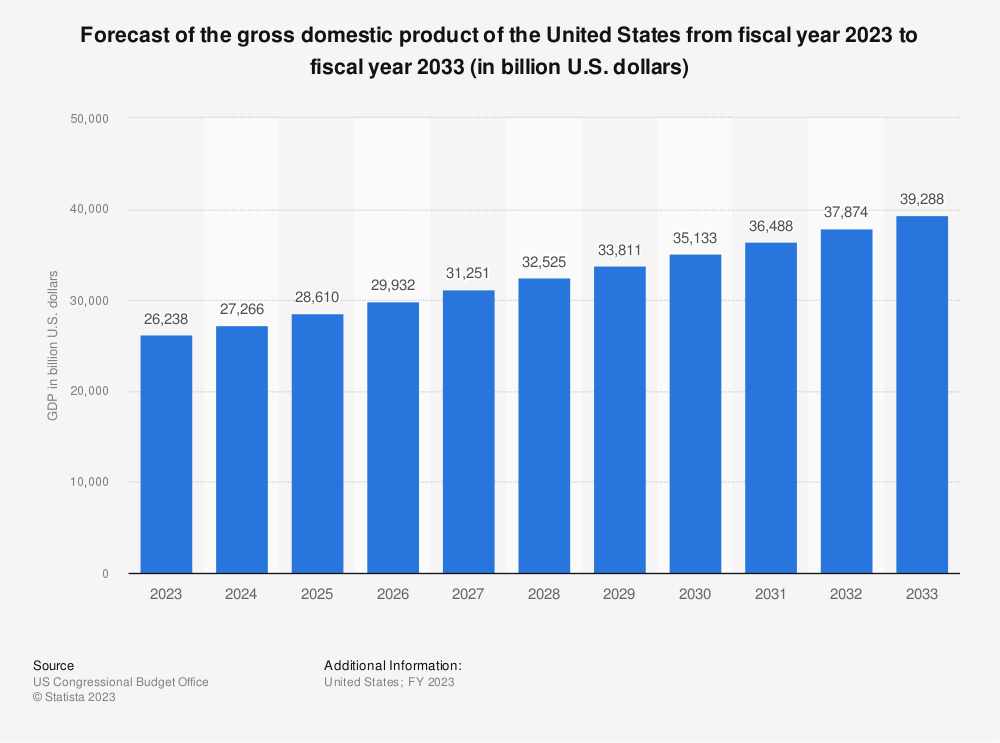

Wall Street’s most bullish analyst, Tom Lee of Fundstrat Global Advisors, stands firm in his conviction. He argues the economy is not sliding into recession but, rather, slipping into an expansion phase.

Lee’s arguments pivot on a cocktail of factors – falling commodity prices, a recovering supply chain, and an invincible labor market.

“I think these are conditions for profits to actually outperform, and at a time when investors’ positioning has been so offsides. I do not think stocks are overextended. I think the FANGs did the heavy lifting [in this year’s rally]. And if we are slipping into an expansion, a lot of other names are going to participate,” said Lee.

His contention aligns with Jay Hatfield of Infrastructure Capital Management, who predicts a future drop in inflation that would enable the Federal Reserve to end its rate-hiking spree. Although the Fed recently opted to maintain the current interest rates, fresh projections indicated that a hike in borrowing costs of up to half a percentage point might be necessary before the year concludes.

As Hatfield sees it, falling inflation and the AI boom could keep the stock market humming and boost economic activity.

“We believe that the Fed will be forced to capitulate on their ‘entrenched’ theory of inflation, just as they capitulated on their ‘transitory’ theory, as the year-over-year data confirm that inflation is plunging,” said Hatfield.

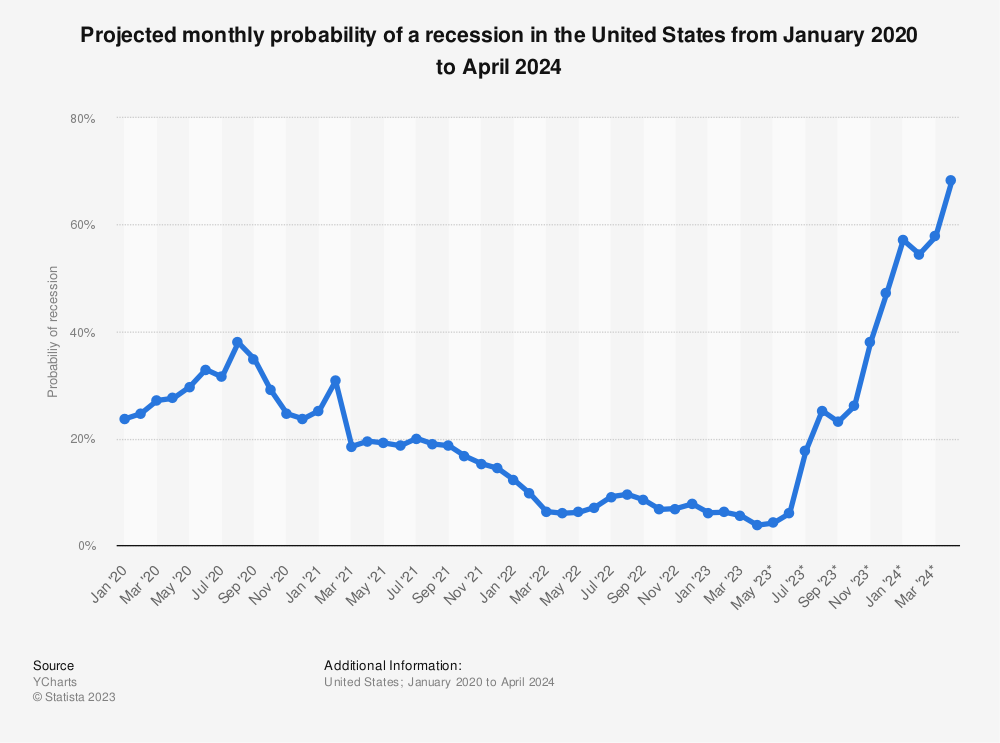

But in contrast, bond traders and a large segment of financial experts believe that the Federal Reserve’s aggressive stance on interest rates might ultimately steer the economy into a recession. This cohort believes that the Federal Reserve’s heightened focus on inflation control might end up stifling the economy.

The Risk of Recession in 2023 Is Real and CEOs Are Ready

A recent poll encapsulates the sentiment that a recession is near. Most of the respondents are convinced that the Fed’s tighter monetary policy might trigger a recession next year.

This school of thought suggests that the central bank’s emphasis on inflation containment could yield undesired consequences – an economic recession.

“The Fed was clearly trying to send a hawkish message that they are not quite done yet and do not think they have made enough progress on inflation. You see curve flattening and rates not pricing in the full extent of hikes, so the thinking is that these hikes may bite and the Fed is closer to the end,” said Michael Cudzil, Portfolio Manager at Pacific Investment Management Co.

Adding to the narrative of caution is market guru Jeremy Siegel. He warns of an imminent stock-market rally slowdown and a potential mild recession.

Siegel’s assessment of the Fed’s future actions is also worth noting. Consequently, suggesting that political pressure to prevent a deep recession could stall further rate hikes.

“This recent bull market move is no guarantee we are out of the woods from the downturn. With that caveat, my feeling is that the October low will hold, but I remain cautious and do not think we have the start of a major up move here,” said Siegel.

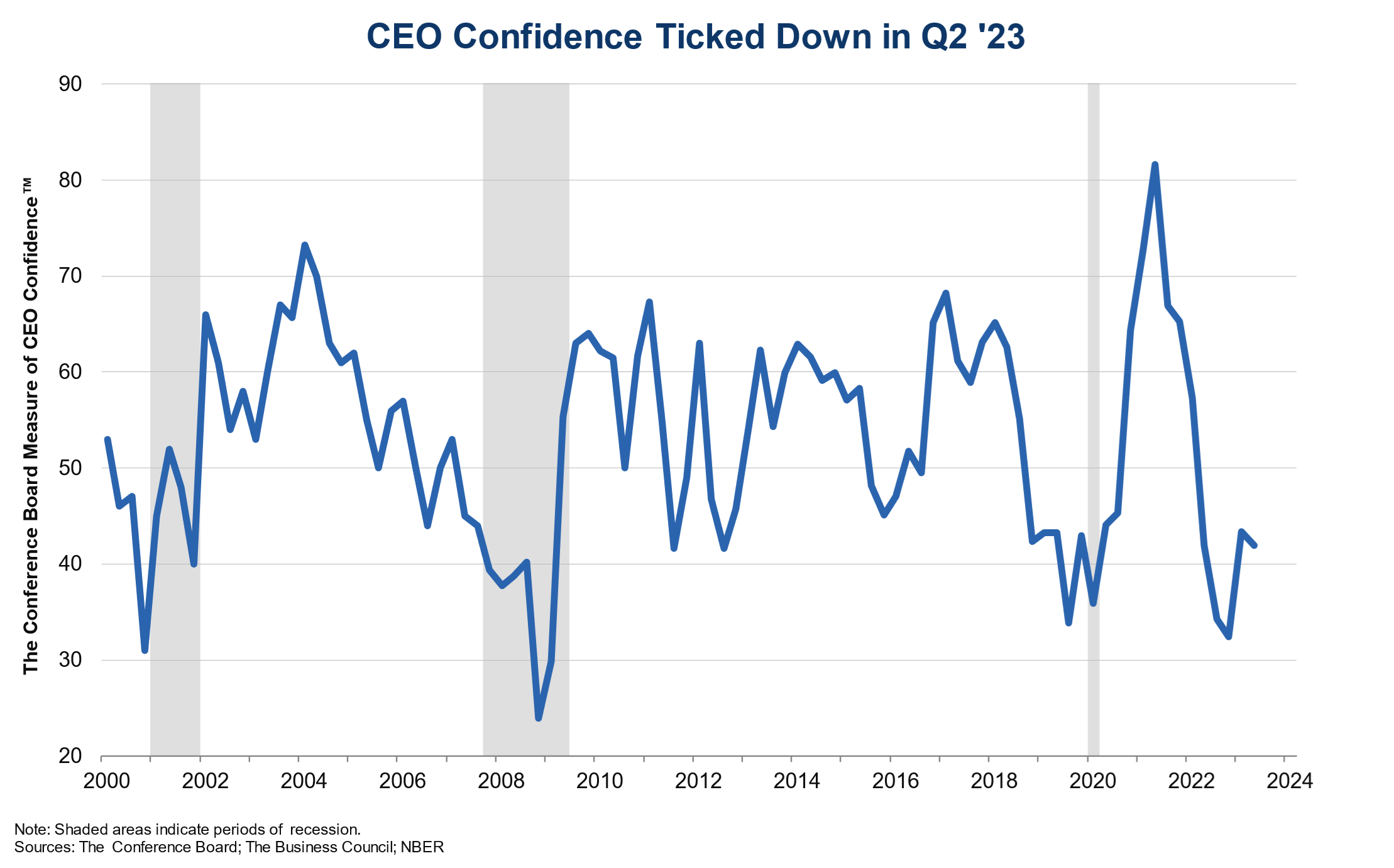

However, the economy currently presents a paradox. Despite fears of a recession, which have led 93% of CEOs to prepare for a potential downturn, the economy could still see robust consumer spending, low unemployment, and a rising stock market.

“To say that this is a unique cycle is stating the obvious, but in terms of the nature of where we are in the cycle, there really is no historical comparison,” said Liz Ann Sonders, Chief Investment Strategist at Charles Schwab.

Economists explain this anomaly as “rolling recessions” – a concept where certain sectors experience a downturn while others thrive. But Ed Yardeni, President of Yardeni Research, makes a compelling point.

According to him, “if we do have a recession, it will be the most widely anticipated recession of all time,” hinting at the exceptional preparedness of businesses for an economic downturn.

“Usually, recessions kind of surprise everybody, and everybody is stuck with a lot of business that was built on the assumption of growth for the foreseeable future. And then suddenly the floor falls out from under them,” said Yardeni.

Recession or No Recession? What to Do?

For investors, the scenario presents a quandary. Although market indices are buoyant, a substantial chunk of this performance is attributed to a handful of large-cap companies. This skewed market performance and investors’ assumptions about future Fed interest rate adjustments hint at potential volatility.

Experts advise investors to maintain a long-term perspective, favor high-quality stocks with strong balance sheets, and focus on bonds with high credit ratings. The key is to stay invested while positioning portfolios to withstand potential volatility. And as for cryptos, financial experts believe these assets will not serve as a hedge.

“The last year has busted the convenient myth that cryptocurrencies are a hedge against recession. The truth is that crypto prices have proven to be impacted by the same directional sentiment that impacts retail stock investors,” said Dan Raju, CEO of Tradier.

In the face of differing expert opinions and an unprecedented economic climate, it seems prudent to navigate cautiously, remaining nimble and ready for all possibilities.

Whether the pendulum swings towards a recession or an expansion, the current economic narrative reaffirms the age-old wisdom – “fortune favors the prepared mind.”