On Jan 3, 2009, Bitcoin launched its Genesis Block — and, over the last ten years, much has changed.

Today, there are three generations of blockchain technology, new consensus algorithms, amendments to the Nakamoto Theory of Decentralization, and much more.

On Bitcoin’s tenth birthday, it is a time to look back at what this last decade meant for Bitcoin, cryptocurrency, and other crypto assets.

Major Moments During the First Five Years

Year One

Six days after the Genesis Block was mined, Bitcoin introduced the first version of its software. Three days later, the first BTC transaction took place when 10 BTC were transferred from the pseudonymous creator of Bitcoin Satoshi Nakamoto to Hal Finney, a computer developer. In Oct 2009, the exchange rate between BTC and the USD($) was first published by the New Liberty Standard. 1,309.03 BTC was then equal to $1. Two months later, the second version of the Bitcoin software was released.First newspaper I've bought in 18 years. Hopefully some high enough resolution images here that everyone can read the content. pic.twitter.com/zCCjT0ygGp

— Matthew Haywood (@wintercooled) January 3, 2019

2010: Early Adoption and Controversy

2010 saw the growth of adoption for Bitcoin. The first two Bitcoin exchanges appeared in Feb and July with Bitcoin Market and Mt. Gox respectively. Furthermore, the first BTC mining pool called “Slush” began mining Bitcoin successfully in June. As well, in May, Laszlo Hanyecz completed the first indirect purchase with BTC. He spent 10,000 BTC, then valued at around $25, for two pizzas. The BTC was transferred to another individual in London who then bought the pizza and sent it to Hanyecz, a Florida resident. Two months later, the value of one bitcoin rose from $0.008 to $0.08. In Oct, however, a vulnerability was discovered and exploited which allowed an individual to generate 184 billion fraudulent BTC. After this incident, the transaction was erased from the blockchain, and the vulnerability was fixed. This was the only major vulnerability exploited during BTC’s lifespan.2011-2014: Adoption and Value Increases

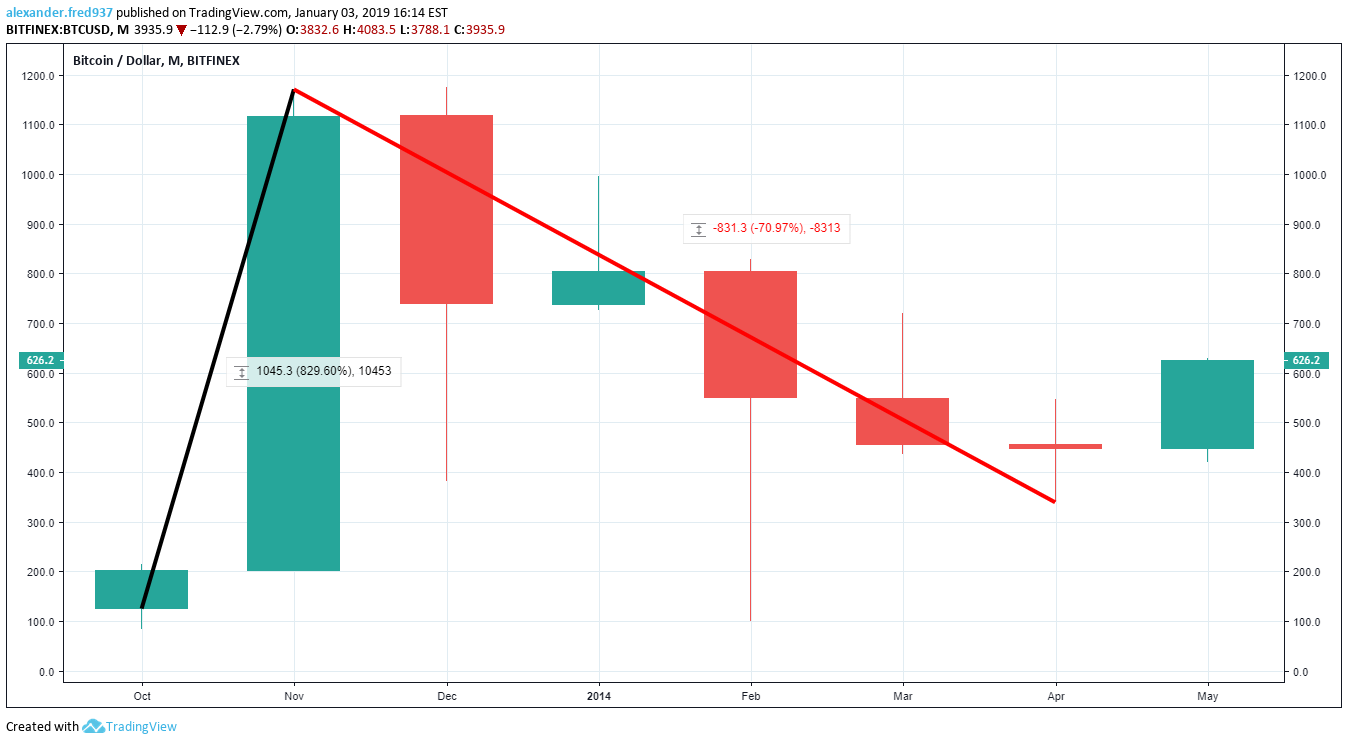

By 2011, Bitcoin was already being discussed in the media — with both TIME Magazine and Gawker writing about it. During the year, BTC value fluctuating between $10 and $30. New cryptocurrencies, including Litecoin, began to appear. The adoption of cryptocurrency had begun. Despite a security breach at Mt. Gox in June 2011 which compromised thousands of user accounts, Bitcoin rose to above $100 for the first time in Apr 2012. In Nov 2013, BTC price exceeded $1,000, increasing over 800 percent in value from the month prior. Nonetheless, BTC experienced steady losses over the next few months dropping to a low of $340 in Apr 2014. Five Years of Rising Value

Five Years of Rising Value

Since the first five years, Bitcoin has seen a steady increase in value. Periods of volatility occurred over the next several years. After the monthly high reached in Nov 2013 of $1,171.30, BTC did not exceed $1,000 until Jan 2017 when it reached $1,166.

In 2017, BTC value increased, reaching its all-time high of $19,891 on Bitfinex in Dec. A correction occurred throughout 2018 which saw BTC crash to a yearly low of $3,215.20. Despite this loss of value over the one-year period between Dec 2017 and Dec 2018, the period between April 2013‘s open and Dec 2018’s close saw BTC rise over 4,000 percent in value.

Ten-Years of Innovation

The introduction of Bitcoin into general society also marked the birth of practically usable blockchain technology. After a series of altcoins similar to Bitcoin emerged in and after 2011, there emerged second and third-generation crypto assets. New consensus algorithms emerged as an alternative to Bitcoin’s Proof-of-Work (POW).Second-Generation Smart Contracts

While Bitcoin was designed to serve as a virtual currency, second-generation blockchain technology was innovated with a different purpose. These platforms integrated smart contracts for the development of new ‘cryptoassets.’ The first second-generation cryptoasset was Ethereum, which was introduced in 2013. In the time that has passed many similar cryptoassets have emerged including EOS, Waves, and NEO.Third-Generation DApps

Using smart contracts, third generation tokens were subsequently created. New purposes for blockchain technology beyond currency emerged. From healthcare to virtual reality gaming to identify verification platforms, distributed applications (DApps) using third-generation tokens have been introduced. Though none have attained mass adoption, they have opened the door to a world in which blockchain technology can be used throughout all of society. It seems as if social integration is all but inevitable.Beyond Proof-of-Work

Bitcoin was designed to use POW to confirm transactions and hash them onto the blockchain. However, POW has faced many problems. First, there is the problem of centralization by multiple entities. There are the miners, without whom the transactions could not be confirmed, and the ASIC manufacturers who provide large-scale mining rigs with the equipment needed to mine BTC transactions. As well, though not directly related to POW, cryptocurrency exchanges like Coinbase have received funding from financial institutions increasing their influence within the cryptocurrency market. In addition, the mining process is incredibly energy inefficient. For these and other reasons, cryptocurrencies other than BTC have introduced different consensus algorithms. Ethereum, which currently uses POW, plans to switch over to Proof of Stake. The POA Network uses an amended form of Proof of Stake called Proof of Authority. Furthermore, Sia Coin has implemented Proof of Storage while NEM uses Proof of Importance, and this is just a preliminary list. There are many other consensus algorithms currently implemented within other cryptoassets as well as those currently being developed or yet to be released.

Amending the Nakamoto Theory of Decentralization

In the Bitcoin white paper, Satoshi Nakamoto introduced the “Nakamoto Theory of Decentralization.” This theory, in its original form, holds that the use of blockchain technology integrated with the Proof-of-Work consensus algorithm would allow peer-to-peer transactions to take place without the need of a centralized third-party financial institution acting as an intermediary. Given the now realized weaknesses of POW, the Nakamoto Theory has been amended to include other consensus algorithms. Furthermore, other centralized third-party entities like corporations and investment firms are included with financial institutions as authorities and influences to be resisted against with the usage of decentralized cryptocurrencies. In short, the Nakamoto Theory of Decentralization in its amended version holds that the use of decentralized cryptocurrencies can permit peer-to-peer transactions without any third-party acting as an authority, influence, or intermediary.

Conclusion

Following the emergence of the BTC Genesis Block on Jan 3, 2009, much has occurred. Bitcoin has been adopted within society, in part — yet full mass adoption and social integration are still unrealized. Nonetheless, with the birth of second-generation smart contract blockchain technology and third-generation DApps and tokens, cryptocurrency has become just the first of many types of crypto assets. Furthermore, the weaknesses of BTC’s POW consensus algorithm coupled with the continued creation of new crypto assets has forced amendments to the Nakamoto Theory of Decentralization. [bctt tweet=”With ten-years of evolution, innovation, and increasing social integration, the next decade for Bitcoin, cryptocurrencies, and other crypto assets is bound to be exciting.” username=”beincrypto”] What do you think the next ten years hold for Bitcoin? Let us know in the comments below!Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Alexander Fred

Global AI, Data Science, and Blockchain expert. Alexander writes for BeInCrypto where he completes technical analyses of various alt-coins and qualitative commentary and analysis about various cryptoassets and their potential for social integration.

Global AI, Data Science, and Blockchain expert. Alexander writes for BeInCrypto where he completes technical analyses of various alt-coins and qualitative commentary and analysis about various cryptoassets and their potential for social integration.

READ FULL BIO

Sponsored

Sponsored

Five Years of Rising Value

Five Years of Rising Value