The Polygon (MATIC) price has fallen since an important horizontal resistance area rejected it. Then, the price broke down from a short-term parallel channel.

The weekly and daily timeframe readings are both bearish, suggesting that more downside is expected before the price eventually falls.

Polygon Price Gets Rejected by Crucial Resistance

The technical analysis of the weekly timeframe for MATIC gives a bearish outlook. This is mainly because of the rejection from the $0.80 resistance area and the creation of a long upper wick afterward.

The long upper wick was created way above the resistance area. This means that while buyers had the upper hand, sellers took over and took the price below the resistance area again. Therefore, it indicates that the trend is bearish.

The fact that the resistance area had previously provided support since July 2022 increases its legitimacy. So, the trend can be considered bearish as long as the price trades below it.

Additionally, the weekly Relative Strength Index (RSI) signals a bearish sentiment. The RSI, a momentum indicator utilized by traders to gauge if a market is either overbought or oversold, assists in making decisions about buying or selling an asset.

When the RSI reading is above 50 and exhibits an upward trend, it supports the bullish perspective, indicating a positive market sentiment. Conversely, when the reading drops below 50, it implies a bearish sentiment, with sellers gaining an advantage. The RSI is below 50 and declining, indicating a bearish trend.

Read More: Best Crypto Sign-Up Bonuses in 2023

Can MATIC Bounce After Breakdown?

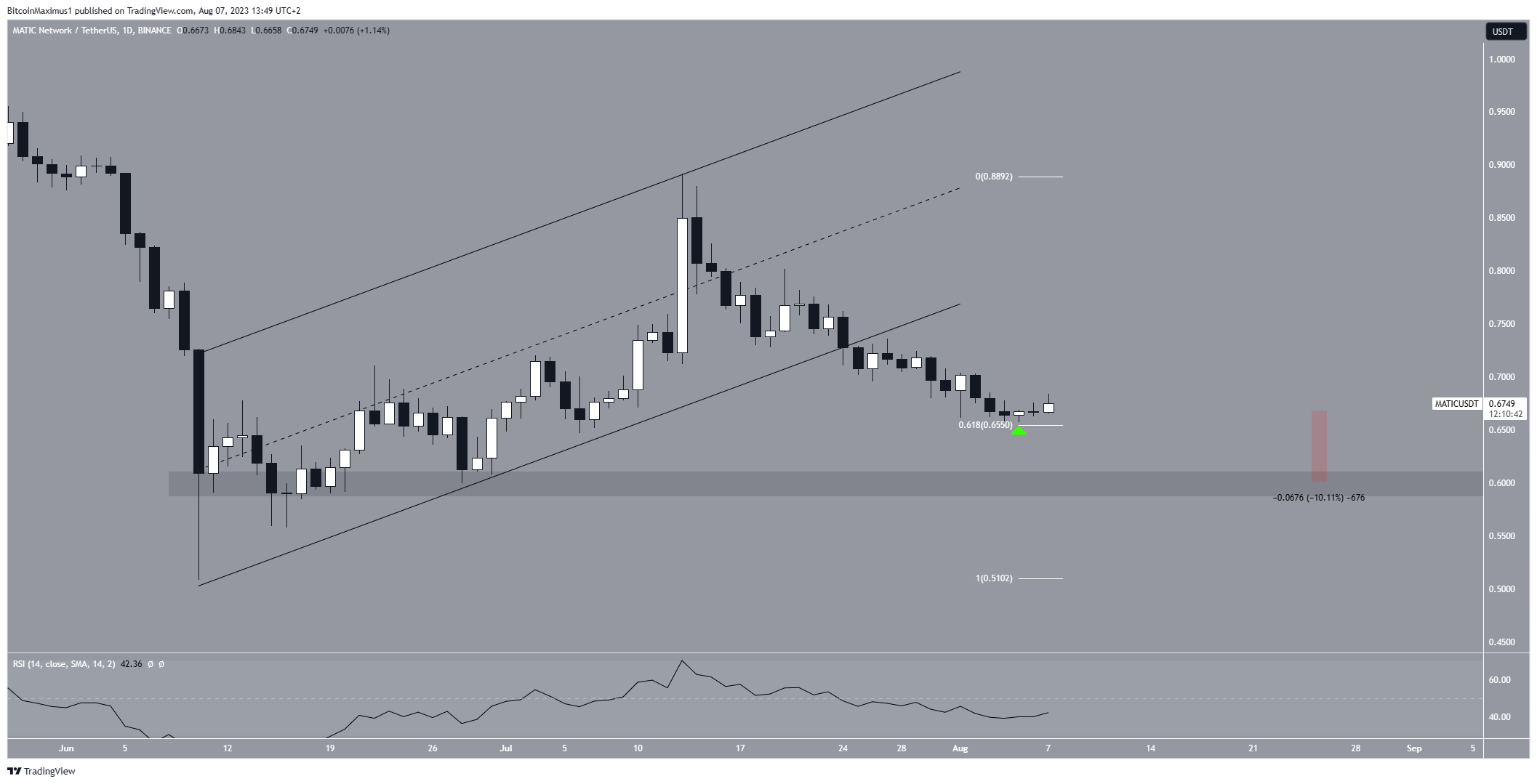

The daily analysis for MATIC also provides a bearish reading. This is mainly because the MATIC price broke down from an ascending parallel channel. Before the breakdown, the channel had been in place since June 10.

The RSI also supports the breakdown. At the same time, the price decreased below the channel’s support line, the RSI also fell below 50. Therefore, the RSI movement legitimizes the price action.

MATIC currently trades just above the 0.618 Fib retracement support level (green icon). The principle behind Fibonacci retracement levels suggests that after a considerable price movement in one direction, the price will return partially to a previous price level. If the decrease is corrective, the 0.618 Fib level most often acts as the bottom.

So, it is possible that a bounce will ensue. This is also supported by the fact that the Polygon NFT volume is increasing. If that occurs, the channel’s support line at $0.80 will be expected to provide resistance.

The next closest support is at $0.60, a 10% drop from the current price.

Despite this bearish MATIC price prediction, a movement above the channel’s support line will mean that the breakdown was illegitimate.

Since the line is at $0.80, this would also cause a reclaim of the $0.80 horizontal resistance area. Thus, it could trigger a sharp increase to $1.