The Polygon (MATIC) price is trading at a crucial level. The reaction to it could determine if the future long-term trend is bullish or bearish.

The Polygon network is a Layer 2 scaling solution for the Ethereum blockchain. Its native token is MATIC. The MATIC price has increased since creating a bullish hammer candlestick on March 10.

The increase led to a reclaim of the 0.618 Fib retracement support level of $1.07 and a high of $1.25 on March 18. While the price has fallen to the $1.07 support area again, the decrease may be just a retest of the area after the breakout.

The daily RSI is at 50, providing a neutral trend. Therefore, whether the price bounces in the area, creating a higher low or breaks down could determine the future trend’s direction. A breakdown would likely catalyze a fall to $0.93, while the creation of a higher low would mean that the rally is likely to continue toward the $1.57 yearly high.

Is Polygon (MATIC) Price Relief Rally Over?

The technical analysis from the daily time frame shows that the entire 394% MATIC token price increase since June 2022 was contained inside an ascending parallel channel. Since channels usually contain corrective structure, the entire increase may have been an A-B-C corrective structure (black).

Moreover, the channel’s support line coincides with the March 10 low (red line). Therefore, a breakdown from the channel would definitively invalidate the bullish structure.

In that case, the price would be expected to fall to its 2022 low of $0.31.

On the other hand, creating a higher low as outlined above and moving above the channel’s midline would invalidate this bearish forecast. In that case, an increase toward the channel’s resistance line at $1.70 could occur.

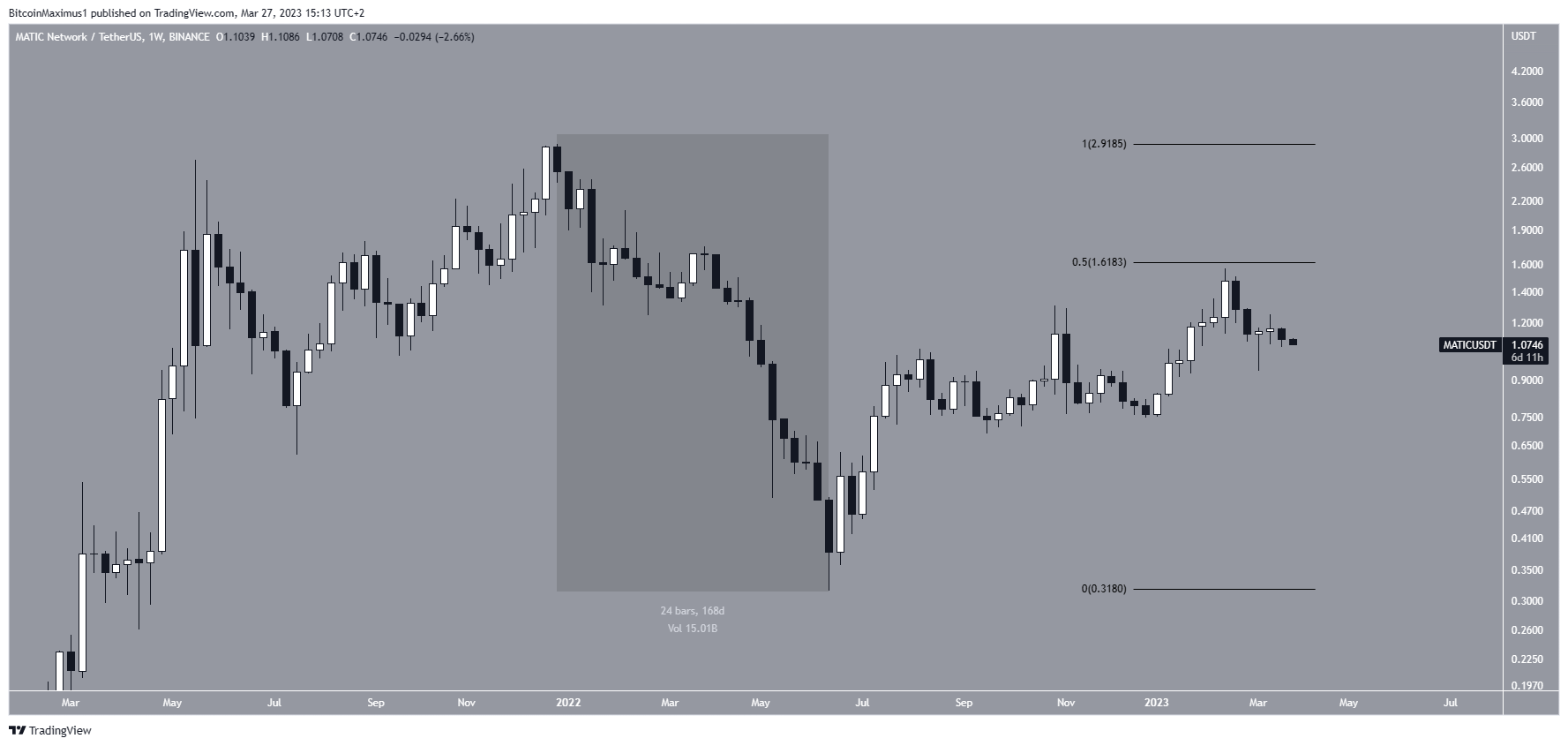

The possibility that the increase was part of a relief rally makes sense when looking at the weekly time frame. In that case, the increase occurred as a correction relative to the previous downward movement (highlighted) that began after the MATIC price’s all-time high. The rally validated the long-term 0.5 Fib retracement support level, and a new downward movement will follow soon.

To conclude, whether the Polygon price creates a higher low or breaks down below its March 10 low will determine the future trend’s direction. A breakdown could lead to lows near $0.30, while a higher low could cause an increase toward at least $1.61.

For BeInCrypto’s latest crypto market analysis, click here.