Polygon (MATIC) price reclaimed the $0.90 territory on Nov. 14, bringing its monthly gains to 15%. On-chain and derivatives data analytics identify the critical bullish indicators that could shape MATIC’s next major price move.

MATIC has held onto its position as one of the biggest gainers in November’s top 20 crypto market gainers charts. Here’s how the Polygon community’s positive reaction to the recent collaboration with OKX could further propel MATIC’s price.

Polygon Partnership with OKX Exchange Could Spur Further Gains

On November 14, OKX announced the launch of X1, a New zKEVM layer-2 network built with Polygon CDK. Although the project is still only in testnet, MATIC holders sprung into action to front-run the possible gains from expanded scalability and increased adoption.

An OKX statement noted:

“As part of the collaboration between OKX and Polygon Labs, OKX will become a core contributor to Polygon CDK, and will invest substantial engineering resources to enhance the technology stack for Ethereum scaling solutions.”

Shortly after the announcement. MATIC market price broke above $1 for the first time in nearly four months. However, following further inquest, on-chain data shows that the recent MATIC price rally could be attributed to the increase in network usage.

Indicatively, the Cryptoquant chart below reveals that the Polygon network transaction count is currently trending at its highest level since September 28.

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

The chart below vividly illustrates that the Daily Transaction Count on the Polygon network has been steadily increasing this month. On November 14, Polygon recorded 7,819 transactions, 25% higher than last month’s peak of 6,229.

The transaction count metric represents the total number of confirmed transactions involving a particular cryptocurrency on a given day. Typically, a steady increase in transaction count, as observed above, implies growing investor interest.

The timing of the uptick also suggests that the OKX partnership spurred organic growth in Polygon network usage this week. Unsurprisingly, the continuous increase in Polygon transactional activity has triggered a 75% price gain over the last 30 days.

Futures Traders Have Doubled Their November Bets

Bullish trading activity among Polygon derivatives traders is another pivotal factor driving up MATIC prices. According to the crypto-trading analytics tracker Coinalyze, the total capital stock in the MATIC futures markets nearly doubled in November.

Read more: How To Buy Polygon (MATIC) and Everything You Need To Know

The chart below illustrates that MATIC’s open interest hit a low of $115 million on October 31. But mid-way through November, that figure has skyrocketed above $240 million. This highlights that the total value of outstanding MATIC futures contracts has increased by more than $125 million within the first 15 days of November.

In the context of derivatives trading, open interest represents the total value of active futures contracts for a particular asset. Typically, when open interest increases significantly higher during a rally, it suggests that many bullish derivates traders are doubling down on their long positions.

In summary, the rising network usage and the 109% increase in Open Interest this month emphasize investors’ confidence in the ongoing price uptrend. If these trends persist, MATIC holders could potentially see more gains in the coming days.

MATIC Price Prediction: Road to Reclaim $1.50?

From an on-chain standpoint, the rising network activity and increasing capital inflows from derivatives market traders are vital bullish indicators. With both metrics still trending upward, it puts MATIC’s price in a prime position to make another leg-up.

Read more: 14 Best Polygon (MATIC) Wallets in 2023

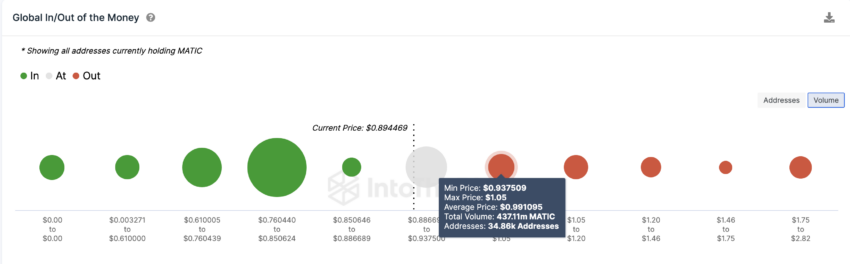

The Global In/Out of the Money (GIOM) data, which groups the current MATIC holders according to their entry prices, also confirms this bullish forecast.

However, it shows that the bulls must first scale the initial resistance at $0.10 for the bulls to be confident of reclaiming $1.50. As shown below, 34,860 holders had bought 437.11 million MATIC at an average price of $0.99. If those holders exit early, they could derail the MATIC price rally.

But if the bulls can scale that resistance sell-wall, MATIC price will likely reclaim $1.50 as predicted.

Still, the bears could negate the bullish prediction if the MATIC price dips below $0.80. But, in that case, the 62,490 MATIC holders that bought 4.64 billion MATIC at the minimum price of $0.805 could mount a support wall. If those investors can HODL firmly, Polygon will likely avoid a significant price reversal.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.