PEPE price might fail to notice a rally as investors are creating a bearish atmosphere for the meme coin.

The biggest drivers of this potential failure are the whales, which are pulling back considerably.

PEPE Investors See No Growth

PEPE price trading at $0.00000785 was expected to note a breakout from the bullish descending wedge. However, this may not happen since the investors are not particularly optimistic in their behavior.

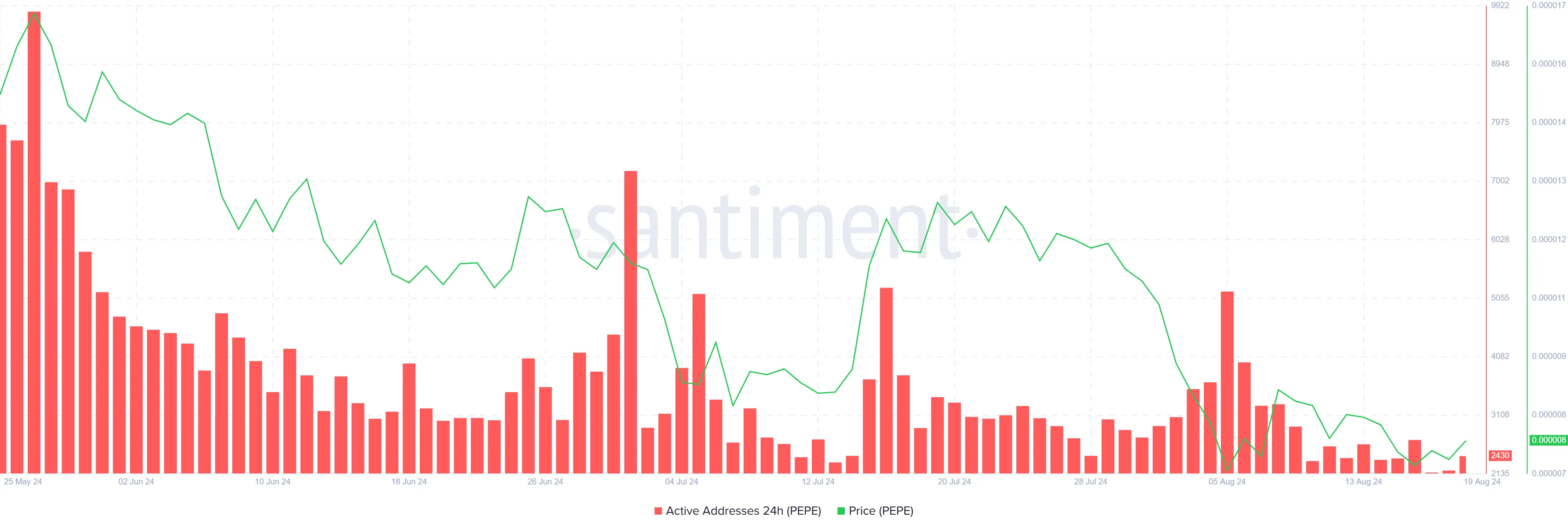

Participation across the network has taken a significant hit as investors continue to step back from conducting transactions. Active addresses are presently at a six-month due to the lack of recovery, giving investors no incentive to move their holdings around.

Read more: Pepe: A Comprehensive Guide to What It Is and How It Works

Moreover, the behavior of large wallet holders, often referred to as whales, is negatively affecting overall investor confidence. Their decision to step back from participating in the network is causing concern among market participants.

This pullback is particularly evident in the volume of high-value transactions, specifically those worth $100,000 or more. As these large holders reduce their activity, it signals a potential lack of conviction or interest in the current market conditions.

In just two weeks, the total daily transaction volume on average, has seen a decline of 60%, falling from $83 million to $33 million. This sharp decrease highlights the impact that whale activity can have on the broader market.

If the whales remain subdued and inactive, the price will have barely any room to note growth.

PEPE Price Prediction: Consolidation Ahead

The PEPE price is presently above the support of $0.00000775, and it is looking to bounce off this level to note a recovery. The descending wedge presents a potential 80% rise toward the all-time high of $0.00001725.

However, considering the aforementioned factors, a break out of this pattern is unlikely. Thus, the meme coin might struggle under $0.00001000 until stronger bullish cues pull the altcoin up.

Read more: Pepe (PEPE) Price Prediction 2024/2025/2030

On the other hand, if the investors’ tone changes, PEPE price could end up flipping $0.00001000 into support. This would enable further rise and a potential breakout, invalidating the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.